The feeling of the cryptography market has improved this week, with several major cryptocurrencies, recording two-digit gains. The Bitcoin rally has exceeded the resistance of $ 95,000 is the highest point, with altcoins like the Trump official and Supporming most of the others.

The decoupling of the stock of the stock, the return of the digital gold account and the softening position of Trump on the prices supported this week’s earnings.

Bitcoin, Altcoin weekly performance

Bitcoin (BTC) currently oscillates less than $ 95,000, a key level for the most important cryptocurrency. At the last check on Saturday, the BTC dropped by 0.45%, trading at around $ 94,358.49.

The observers noted that he recovered from his last Flash accident, where the asset slipped to his lowest level in almost five months.

With Bitcoin above key support areas, traders watched the milestone of $ 100,000 and a re-test from the top of all time in the coming weeks. Crypto’s demand remains strong and the feeling becomes positive. For the first time in several weeks, traders are “gourmet”, as we can see on the Fear & Greed index in the alternative.

Altcoins followed the traces of Bitcoin and recovered the losses. Most cryptos displayed two -digit rallies this week, erasing the losses of the Flash BTC crash during the second week of April 2025.

Trump, supeperforma

The official Trump token (Trump) and Su (sui) are two tokens that have surpassed most other altcoins with their seven days, 79% and 70% gains respectively. The technical indicators for the two tokens show a probability for an extension of their gatherings in the coming weeks.

President Donald Trump’s price for memes play only jumped after announcing that the 220 best holders would be invited to a gala dinner with him next month, the top 25 assistant to a VIP reception and a visit to the White House.

The White House crypto office said that it was not associated with the event, and dinner could personally benefit the Trump family by increasing the value of the room.

Despite the rally, $ Trump remains well below its $ 75 summit compared to January.

However, as the risk appetite increases among traders, Trump and Suit holders had to win and see profit opportunities if the momentum to increase the two tokens is maintained.

Bitcoin and Altcoins should close a strong week while Trump softens his position on the prices and maintains the support of the president of the American federal reserve Jerome Powell. The story of digital gold makes a return while the discopes Bitcoin of technological actions and portfolios of traders could benefit from the addition of an active ingredient structurally different from actions.

Institutional demand is increasing

While altcoins fly the spotlight with two -digit rallies, institutional investors have warmed up to Bitcoin and the funds negotiated in exchange for American points recorded the strongest week in 2025.

Institutional customers pour capital into the FNB Bitcoin Spot and were preparing for the imminent approval of ETF Altcoin, with a dry Pro-Crypto and a President Paul Atkins in office.

While American-Chinese tensions are cooling, institutions quietly stimulate BTC demand, citing two key properties of the active, “resistance to inflation” and its “rarity”.

Sovereign funds, banks and asset managers are interested in Bitcoin, while institutions like Semler Scientific follow the traces of Michael Saylor’s strategy in 2025.

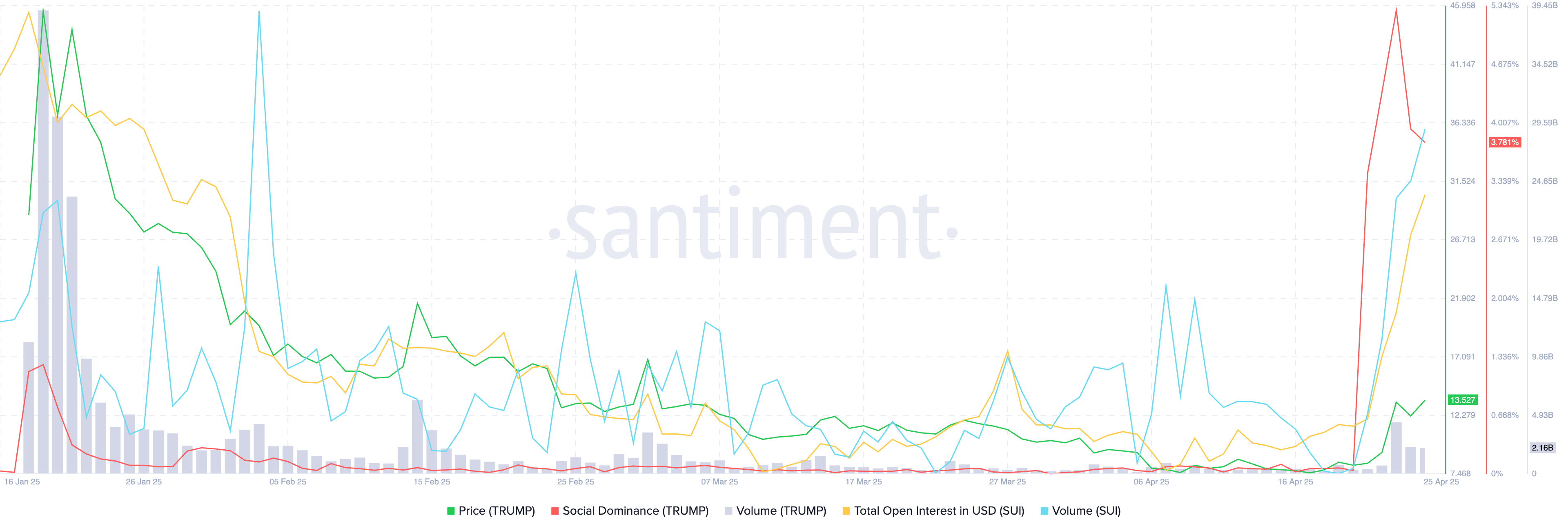

Santiment shows …

The data on the chain of health show that Trump has noted a great peak of social domination and an increase in commercial volume – probably due to the invitation of the gala.

For SUD, there has been a significant increase in open interest as a total value of open positions in the following exchanges through derivatives and an increase in volume.

Channel indicators support Trump and Sui gains and suggest a priced price rally in the coming weeks.

Trump joined about 16% in the last 24 hours; SUP is down approximately 8.35% in the last 24 hours.

Trump, Support Prix Forecasts

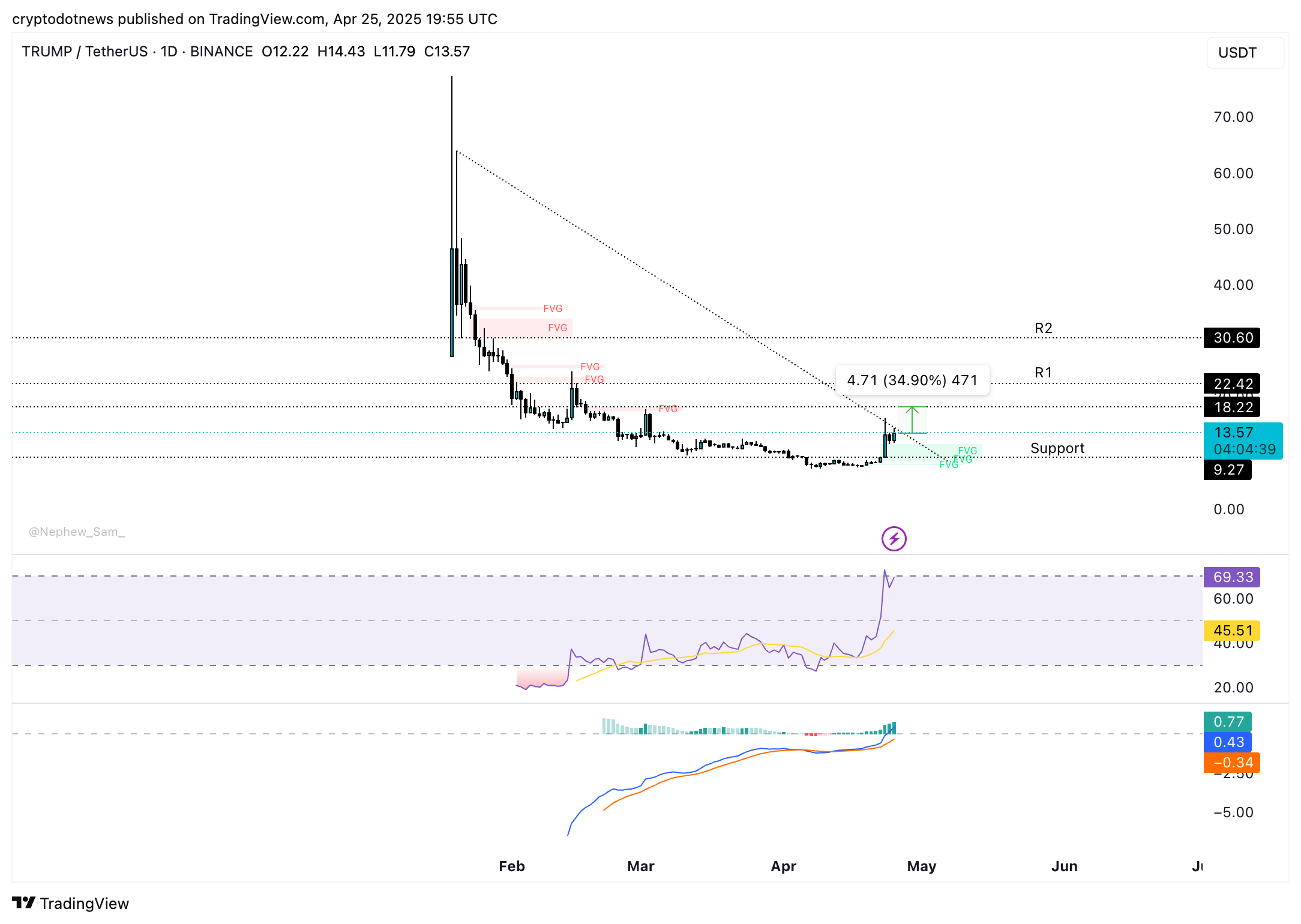

Trump is consolidated in resistance at $ 18.22 in the last month. Two key momentum indicators on the daily delay, RSI and MacD support gains in Trump. RSI bed 69, shy of the level “overvalued” or “Surbouillé” at 70 and MacD flashes green histogram bars consecutively higher above the neutral line.

If Trump’s positive impetus is maintained, the memes piece could return resistance to support and rally 34% to test $ 18.22, a sticky level for the token. Two key resistances on Trump’s path while it repercussions in a rally is $ 22.42 and $ 30.60.

SU is negotiated at $ 3.5791 at the time of the editorial staff. The DEFI token could prolong its rally by 12% and test resistance to $ 4.0105, for the first time since February 2025. The level of $ 3.8588, a lower limit of a fair value on the daily price table, is an obstacle to the upward trend of the token.

SUD could find support in the FVG between $ 2,7488 and $ 2,8950, in the event of a correction.

The MacD, one of the two key mandate indicators, supports gains in the token and implies an underlying positive momentum in the upward trend.

RSI is currently in the “Surbowed” area greater than 70, which generates a sales signal. However, unless other indicators point to a trend reversal, AS could prolong its price rally.

Why altcoins could soon rally

Recent Bitcoin gains and the return above $ 95,000 could be an ephemeral moment of the market cycle, because data on the chain show that BTC demand is still contracting, but not as fast as before.

Cryptoque data show that the momentum of new investors has dropped sharply and has reached its lowest level since October 2024.

Although the ETF flows have been stabilized for the moment, the growth in liquidity is lower than market expectations and it is not a recipe for a sustained price rally in Bitcoin.

A slowdown in bitcoin could lead the capital to altcoins, pave the way for a rally, earned gains in the same token and alternative cryptocurrencies until BTC demand increases.

Disclosure: This article does not represent investment advice. The content and equipment presented on this page are only for educational purposes.