Key notes

- Donald Trump called Trump “the biggest of all”, via Truth Social.

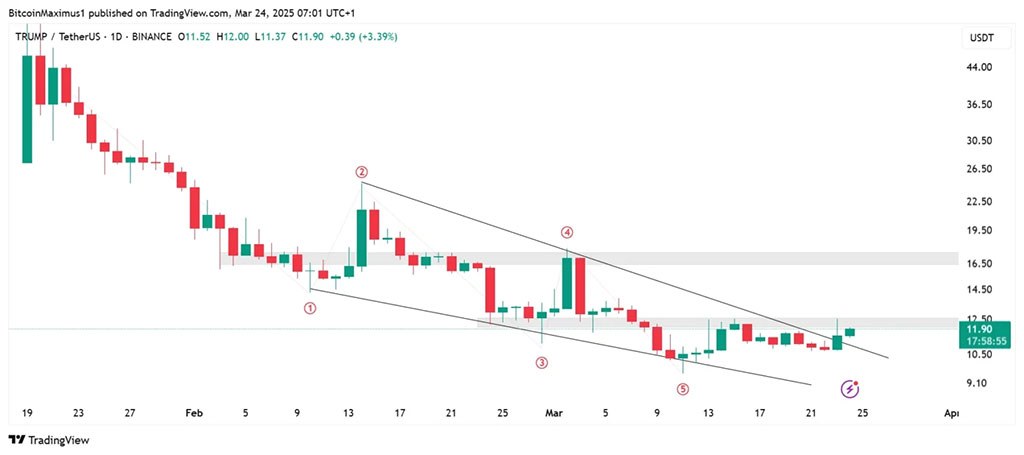

- If $ Trump breaks and maintains more than $ 12.50, the following target would be $ 17.

- The cryptocurrency left a corner model that falls on the 12-hour board.

The official asset

ASSET

$ 11.70

24h volatility:

2.0%

COURTIC CAPESSION:

$ 2.34 B

Flight. 24 hours:

$ 1.09 B

Even Coin once again attracted attention to the cryptography market following a promotional thrust by US President Donald Trump.

His recent article on Truth Social, where he described $ Trump as “the greatest of all”, triggered a price increase of 7% and an enthusiasm of revival investors, shows CoinmarketCap data.

Despite this price increase, $ Trump remains below the level of key resistance to an exponential mobile average of 20 days (EMA), because investors wonder if the same token will be able to support the sudden rally after Trump’s support.

$ Trump Targets

$ Trump was launched on January 18 and quickly increased to a market capitalization of more than $ 30 billion, guaranteeing a place in the first 50 cryptocurrencies.

However, its trajectory was extremely down, in a fall of 86% compared to its top of all time and reaching a new hollow of $ 9.52 on March 11.

After rebounded from this bottom, $ Trump tried to recover the level of support of $ 12.50 but failed, confirming it as a resistance on March 23 with a long upper wick – usually a lowering signal. The current price is around $ 12, negotiating near a long -term descending trend line.

On the 12 -hour table, Trump / USDT broke out of a falling corner model, training that often signals a trend reversal.

Source: tradingView

On the basis of the measured movement of the area, the escape target is around $ 17, which represents a potential gain of 40% if the momentum continues.

However, this will depend on the question of whether the price can be maintained above $ 12.50 and the EMA from 20 days to $ 11.67, which acts as a high level of resistance.

Trump indicators

The relative resistance index (RSI) on the 4 -hour graph is 57.95, suggesting neutral impulse to Haussier. If the RSI rises above 60, this could point out increased purchase pressure but the line gradient suggests a reduction in the purchase pressure.

Source: tradingView

Bollinger (BB) strips show that the price is currently near the upper strip, indicating over -rascal conditions. A rejection of this level can lead to a reward of $ 11.00 before another attempt to break.

Until $ Trump recovers the 20 -day EMA and transforms it into a level of support, the signs of a new summit of all time when a new neighborhood begins is low.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Cryptographic journalist with more than 5 years of experience in the industry, Parth has worked with the main media in the world of crypto and finance, the collection of experience and expertise in space after having survived bear markets and bulls over the years. STHTH is also an author of 4 self-published books.

Parth Dubey on LinkedIn