Key dishes to remember

- President Trump urges the federal reserve to reduce interest rates despite solid data on employment.

- It is unlikely that the federal reserve will lower rates in June due to the stable job activity.

Share this article

Friday, President Trump renewed the pressure on the Fed to reduce interest rates, but the robust employment data in April which followed the chances of a rate drop in June, according to Nick Timiraos, often called “Fed oral tip” at the Wall Street Journal.

The next Fed political meeting is scheduled for May 6 to 7, 2025. Economists expect the central bank to retain the rate of federal funds unchanged in its current range of 4.25% to 4.5% during this meeting.

This means that attention goes to the next meeting on June 18. According to Timiraos, a single job report will be published before this meeting, leaving a time limited to economic conditions to deteriorate enough to justify a drop in rate.

The Fed is based on monthly work data to assess whether the economy is weakening. Since the April report was stronger than expected, it reduces the urgency of an immediate relaxation of monetary policy.

According to the US Bureau of Labor Statistics, the non -agricultural payroll increased by 177,000 in April, beating market expectations. The unemployment rate remained stable at 4.2%, continuing a close beach in place since May 2024.

Employment gains were the most notable in sectors such as health care, transport and storage, financial activities and social assistance, while the employment of the federal government has decreased.

FED officials have stressed that a decision to reduce interest rates would likely require clear evidence of unemployment or weakening the demand for labor.

Until now, the new data have shown few signs of decreasing hiring activity, giving the justification of the central bank to maintain its waiting position, despite the uncertainties, including the potential economic effects of recently reimposed prices.

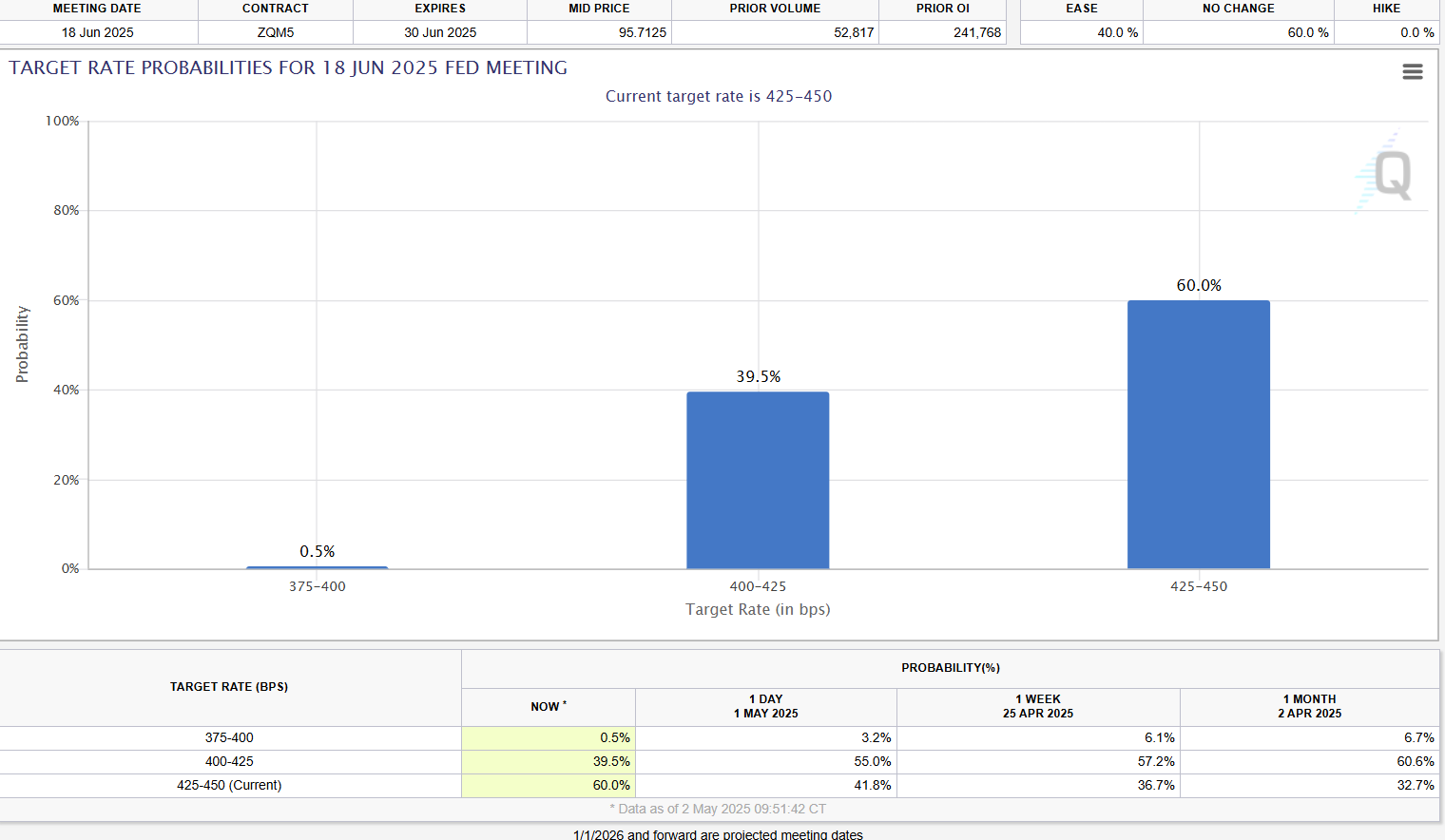

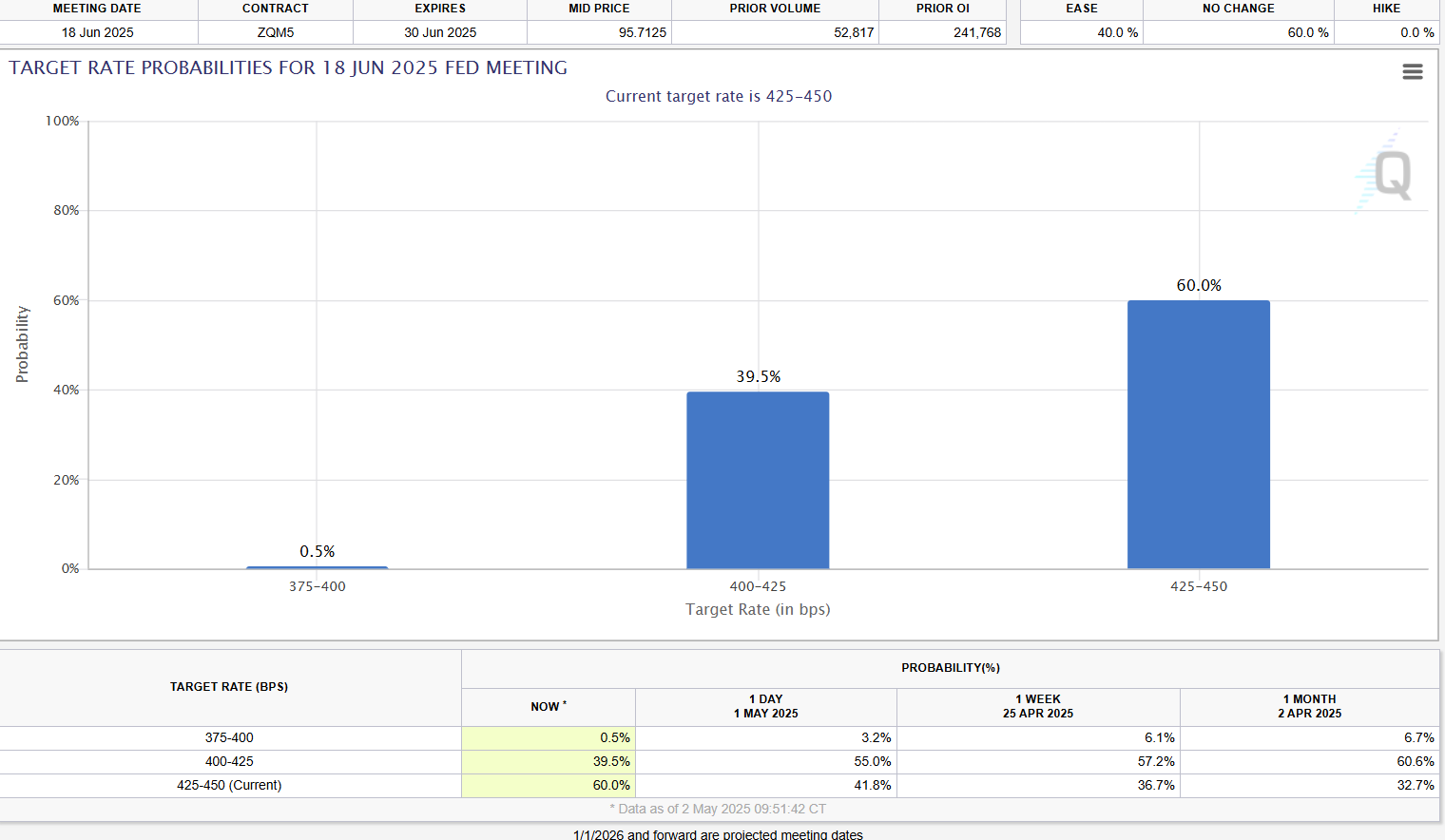

After the publication of the job report in April, market expectations for a rate drop in June increased from around 58% to 40%, according to daily quarters followed by the CME Fedwatch tool. Investors now see about 60% like the Fed holding stable rates in June.

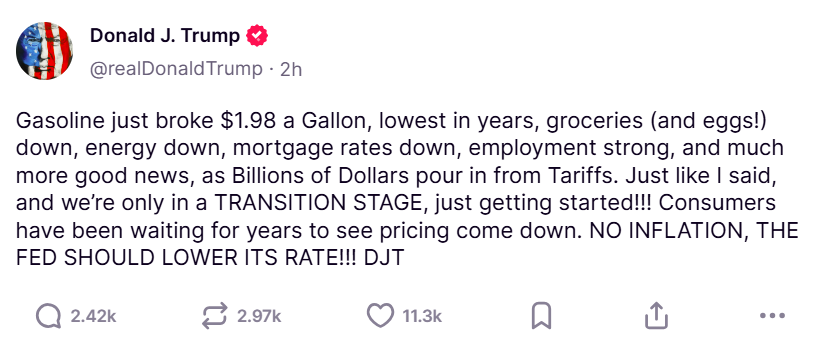

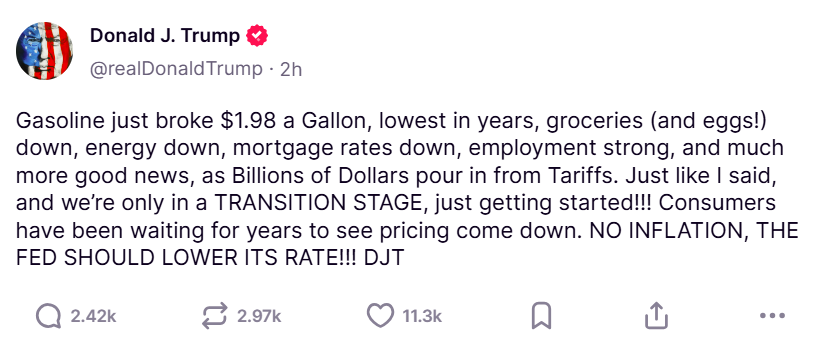

In her declaration urging the Fed to act, Trump said that there was “no inflation”, arguing that consumers finally experience the long -awaited price relief.

He underlined the drop in petrol prices, the drop in grocery costs and energy, the drop in mortgage rates and solid employment figures as a sign that the economy stabilizes.

Inflation is no longer a threat, the Trump insisted, the Fed should act quickly to reduce interest rates to support continuous economic growth.

Share this article