- The CRV has seen a massive 24 -hour increase after Trump’s new legislative ordinance which grants the active independence to DEFI

- Investors of the cash market continued to increase their exposure to the assets

In the past 24 hours, CURVE DAO (CRV) has experienced a major rally following the last legislative order of Trump, which protects decentralized finances (DEFI) and related assets.

The feeling of purchase has since continued to strengthen, the ad hoc markets accumulating a significant amount. However, there is probably an incoming drop before a rally supported upwards.

How does President Trump’s bill affect CRV?

On April 10, the President of the United States, Donald Trump, signed the very first Crypto bill, protecting DEFI.

This new law should prevent the rule of sales and digital exchanges of digital assets of internal income (IRS). This bill, also known as the DEFI broker rule, was provided to apply the Guardian and Non -Guardian services to submit reports to the IRS at intervals.

Representative Mike Carey of the Chamber’s Ways and Meaning Committee said,

“The Defi Courtier rule unnecessarily hampered American innovation, breaks the privacy of everyday Americans, and was about to overwhelm the IRS with an overflow of new documents that it does not have the infrastructure to manage during the tax season.”

After the news, Defi Tokens reacted positively. The CRV, the native curve token, led the charge. He jumped 19% and pushed his monthly earnings to 48%.

Therefore, Ambcrypto analyzed the market to determine how participants could react and whether the rally could be maintained or not.

Merchants accumulate CRV, looking at a rally of almost $ 2

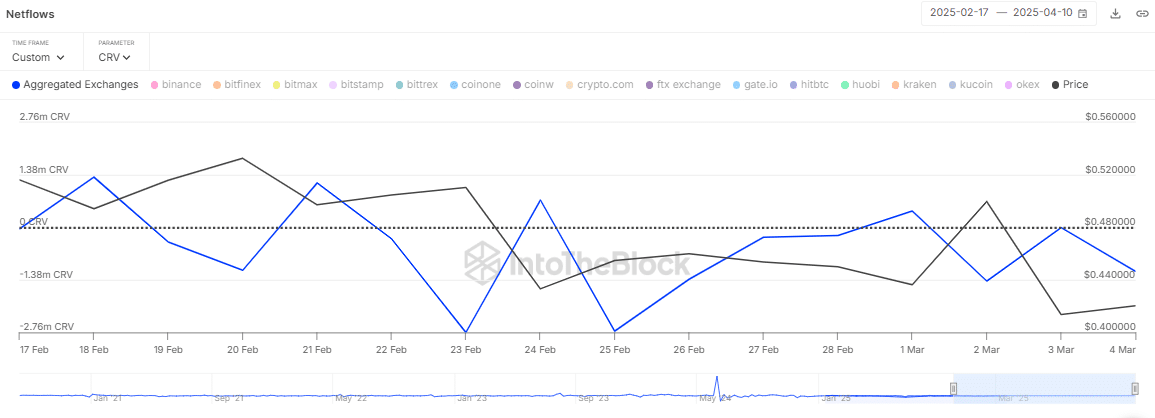

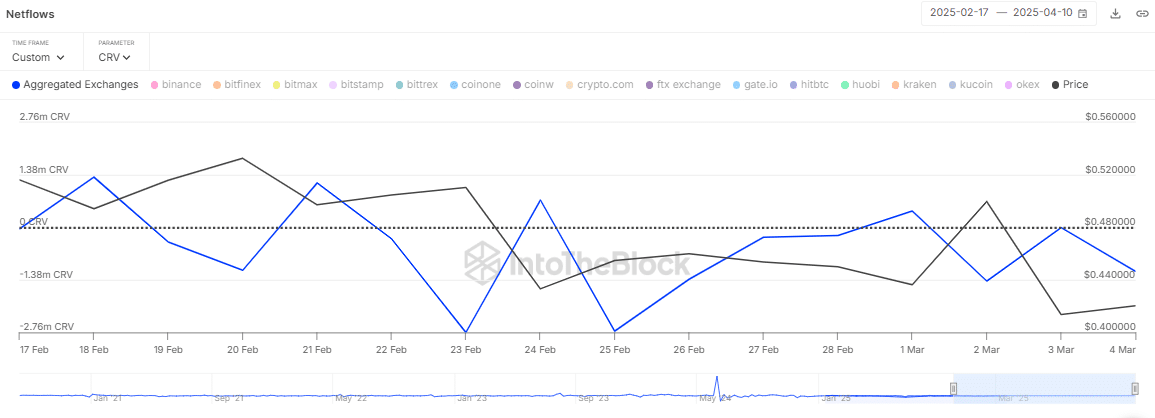

After the update, traders on the cash market have accumulated 1.15 million CRV, worth $ 667,000, as the Netflows scholarship indicates.

This purchase is probably in the long term, especially since this cohort of traders has moved CRV in private wallets for detention.

Source: intotheblock

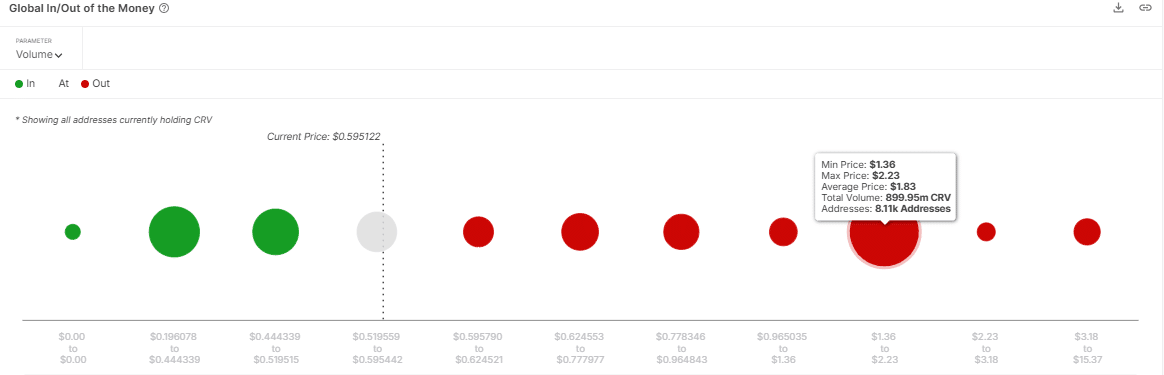

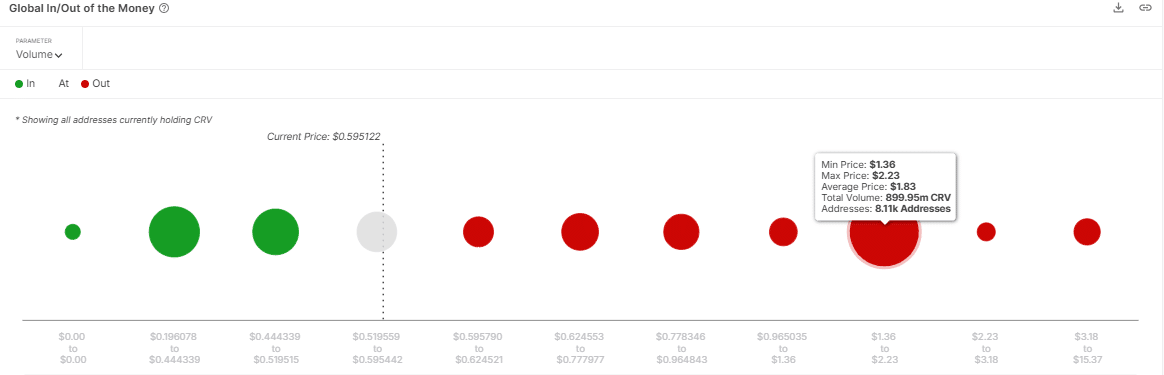

The in / out of the Money Around Price (IOMAP) indicator has revealed to come minimum resistance, referring to more space for growth.

At the time of writing the editorial staff, the IOMAP has not highlighted any strong resistance up to $ 1.83. At this level, around 899.95 million CRV sales orders may exist.

If the purchase of pressure persists, the CRV could climb to this area of resistance.

This means that if the purchase of feeling on the market continues to climb, the CRV could record a price period at $ 1.83.

Source: intotheblock

A drop before a new push

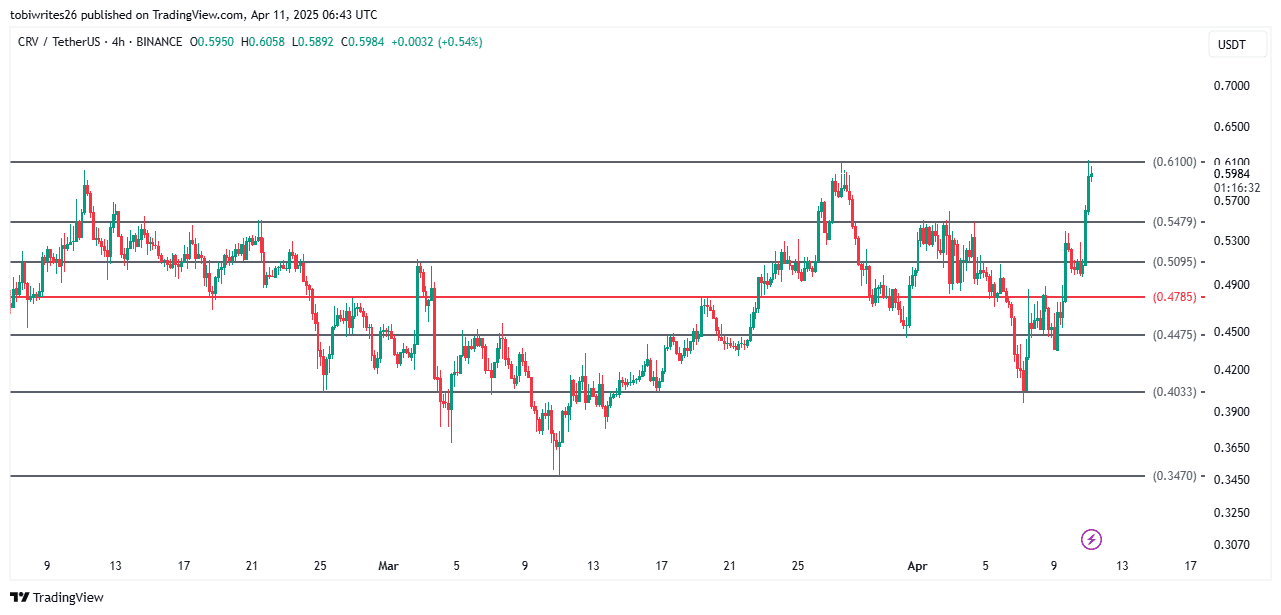

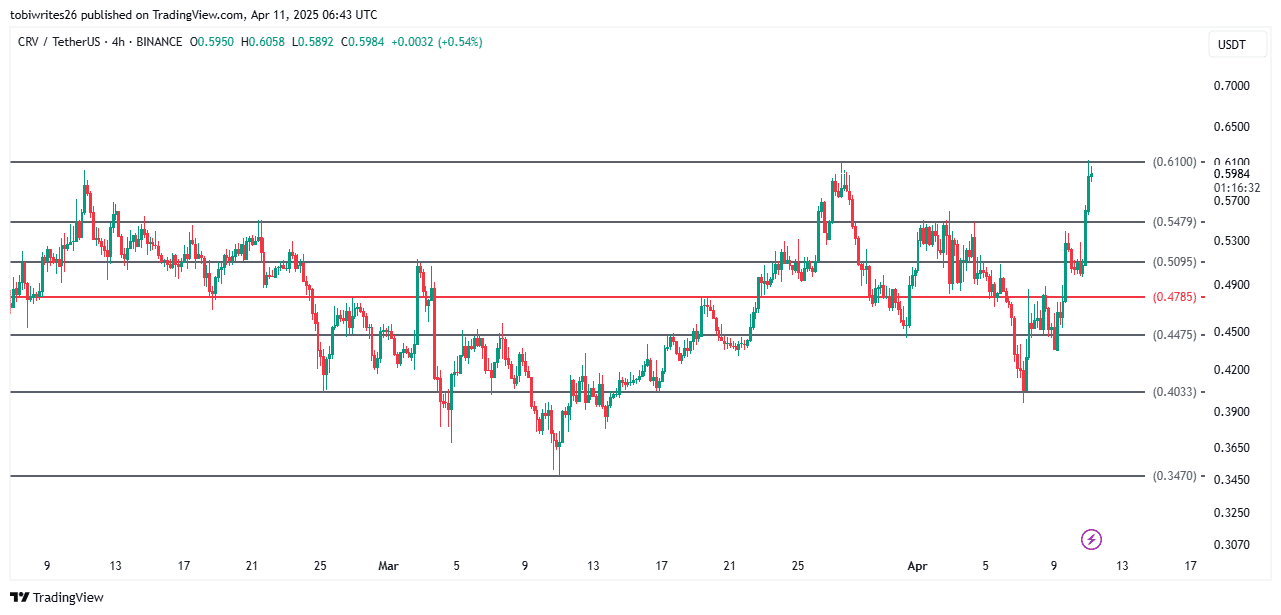

The CRV could attend a price charging time before a sustained market rally. At the time of writing the time of the editorial staff, he was negotiating in a level of key resistance at $ 0.61 – a level that previously forced the lower price the last time that the asset has reached this level.

It is unlikely that this decline is significant, in particular given the dominant bullish feeling. Three levels are expected to act as a support to push the assets even more – $ 0.549, $ 0.509 or $ 0.478, according to the momentum of the market.

Source: tradingView

On the derivative market, the sale of pressure also seemed to be built. The OI weighted financing rate has also reversed negative – a sign of a hike in a short activity.

The last RAGS rally reflected renewed confidence, in particular on the back of the regulatory clarity of the White House.

Although a brief decline can occur soon, a strong accumulation and a minimum resistance suggested that bulls can still have room to run.