As President-elect Donald Trump prepares to take office on January 20, 2025.

The cryptocurrency industry is eagerly awaiting the rollout of its promised for a long time overhaul of the regulations.

According to Reuters, there are growing expectations of potential executive orders aimed at cementing the role of the United States as a global leader in digital assets. Industry insiders are pushing for Trump to take immediate action on his first day in office, fulfilling his campaign promise to create a friendlier regulatory environment for the crypto sector.

A strategic reserve of Bitcoin?

One of the most anticipated measures is Trump’s proposal to create a national Bitcoin reserve. During his campaign, Trump hinted at the idea of making Bitcoin a “strategic reserve asset.” This concept has already gained traction among some policymakers and crypto advocates. The Bitcoin Policy Institute, for example, has proposed an executive order under which the US government could invest up to $21 billion per year for five years to accumulate Bitcoin. This could significantly disrupt the cryptocurrency market by removing a significant percentage of Bitcoin from circulation.

Zack Shapiro, head of policy at the Bitcoin Policy Institute, said: “The United States should have a head start when it comes to acquiring Bitcoin. If we wait too long, other nations could dominate this space. Analysts debate whether this can be accomplished through executive action or whether legislation is necessary, but the Bitcoin Act of 2024, introduced by Senator Cynthia Lummis, suggests that the Federal Reserve and Treasury purchase 200,000 Bitcoins each year, with the possibility of acquiring it. up to 1 million Bitcoin by 2029.

Crypto-friendly regulations

The Trump administration is also expected to criticize the current regulatory climate, which many in the crypto industry see as a barrier to innovation. This comes from President Joe Biden’s administration’s tough approach to cryptocurrency, which has led to heavy-handed regulation that many believe has driven crypto companies overseas. But Trump promised change. “There have been efforts to stifle innovation, but President Trump will deliver on his promise to promote American leadership in crypto,” said Brian Hughes, a spokesperson for the Trump transition team.

Source: X

Trump’s choice to lead the SEC, Paul Atkins, has been seen as more lenient and pro-crypto, unlike the current head, Gary Gensler, who has led several high-profile enforcement actions against crypto companies. Atkins, who previously served as an SEC commissioner and previously had ties to the digital assets industry, expresses support for common-sense regulations that promote innovation but protect investors.

Crypto Industry Council and Banking Access

In addition to his bitcoin reserve plans, Trump is reportedly considering the creation of a “crypto industry council.” This council would advise the government on issues related to digital assets and is seen as a step toward formalizing the U.S. government’s relationship with the crypto industry.

Another key issue for crypto companies is the lack of access to banking services. Many digital asset companies have complained that they cannot secure their traditional banking relationships due to regulatory uncertainty. Trump has promised to stop banks from “stifling” crypto businesses and to ensure that financial institutions provide services to businesses that follow the law. An executive order addressing this issue could signal a new era of collaboration between banks and crypto companies, although the practical impact could be limited, given the independence of banking regulators.

Market implications: Bitcoin price surge?

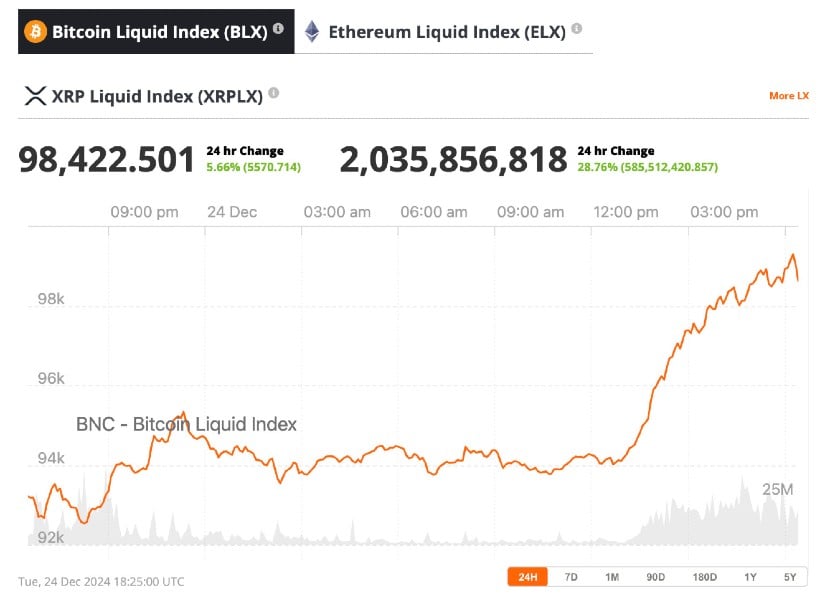

The mere prospect of these changes has already had a significant impact on the cryptocurrency market. Bitcoin recently hit an all-time high of $107,000, and although its price has since declined, the cryptocurrency community remains optimistic. Experts believe that if Trump succeeds in implementing his crypto-friendly policies, bitcoin could see even greater price appreciation. According to Perianne Boring, founder of The Digital Chamber, “There is no limit for Bitcoin because its supply is fixed while demand increases, causing its price to skyrocket if Trump’s policies bear fruit. »

Bitcoin (BTC) Price Chart. Source: Bitcoin Liquid Index (BLX) via Brave new piece

The much-cited stock-to-flow model places bitcoin’s potential price at over $800,000 towards the end of 2025, although there is a prospect that could propel its price as high as $1 million per unit. A push of this magnitude will be enough to not only reshape digital assets, but also eventually become integrated as an integral part of global financial systems.

Early Action: Can Trump keep his promises?

Although Trump’s transition team has made bold promises, it remains unclear whether these executive orders can be implemented on day one. Legal complexities surrounding bitcoin’s status as a reserve asset and challenges with regulating the crypto industry pose significant hurdles. However, the widely held view within the industry is that the president-elect’s actions could set the tone for his administration’s approach to digital assets.

As Rebecca Rettig, chief legal and policy officer at Polygon Labs, told Reuters, “it is imperative that its first set of executive orders provide a road map, setting clear priorities for the future of state crypto regulation.” -United”. 100 days will see concrete steps towards reforming the current regulatory framework and ushering in a new era of innovation and investment in digital assets.

In conclusion, while the details remain to be seen, the crypto industry is bracing for significant changes in the regulatory landscape under Trump’s leadership. His administration’s early moves could not only reshape the future of digital assets in the United States, but also influence global cryptocurrency adoption trends and market dynamics.