On January 21, 2025, the new leadership of the Securities and Exchange Commission (SEC) announced a task force to develop a regulatory framework for crypto assets, one day after President Trump’s inauguration. The first major move by President Donald Trump’s new administration to repaint crypto policy.

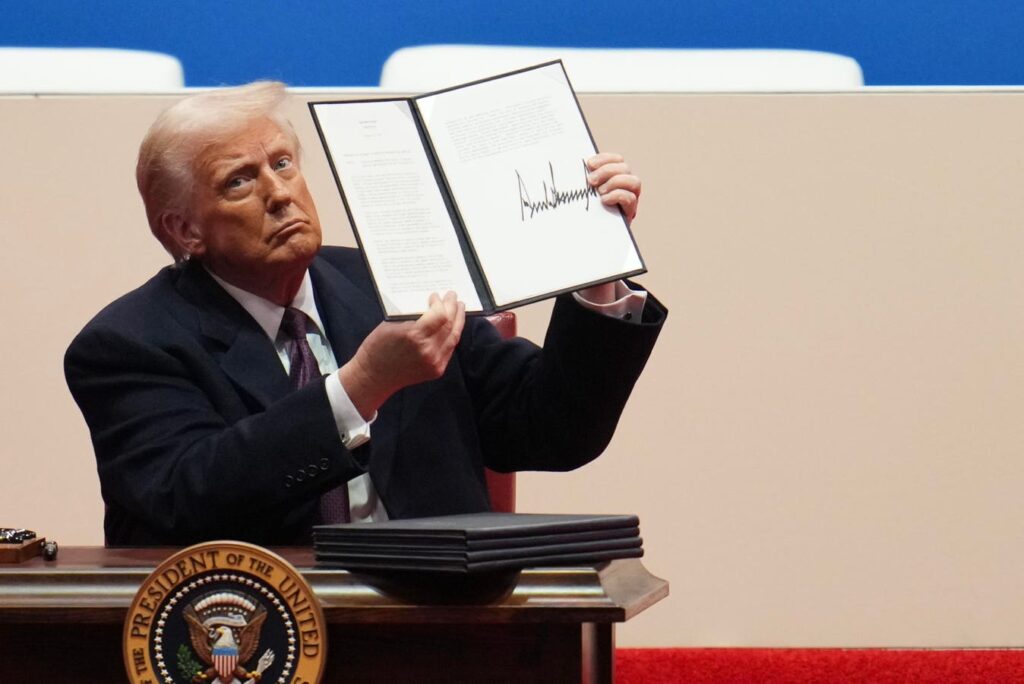

Washington, DC – January 20: US President Donald Trump holds an executive order after signing … (+)

Led by Acting SEC Chairman Mark Uyeda, this initiative represents a significant departure from previous regulatory approaches that relied heavily on enforcement actions and limited any new crypto-specific regulations.

Leadership and mandate of the working group

Led by Acting SEC Chairman Mark Uyeda and Commissioner Hester Peirce, Task Force Represents a Pivot from Law Enforcement-Oriented Oversight to a More Collaborative Approach. The main objectives of the working group include:

- Develop clear registration pathways for crypto assets.

- Crafting sensitive disclosure frameworks.

- Providing clarity on when crypto tokens are considered securities.

- Ensure judicious deployment of application resources.

Commissioner Peirce, ready to lead the task force, stressed public engagement as the cornerstone of the initiative. The SEC plans to host public hearings and consult with investors, industry participants, academics, and other regulators like the Commodity Futures Trading Commission (CFTC).

This change in the SEC’s approach to collaboration and public engagement is crucial to combating the long-standing tension between the crypto industry and regulators. For years, the lack of clear guidelines has stifled innovation, deterred institutional participation, and left market participants vulnerable to inconsistent enforcement.

By establishing clear pathways for registration and transparent disclosure frameworks, the SEC could achieve the design of a regulatory environment where companies can operate with confidence while ensuring investor protection. It will indeed be beneficial for all market players. Furthermore, the engagement of stakeholders such as industry leaders, academics and other regulatory bodies reflects a recognition that effective policy cannot be developed in isolation.

This inclusive approach not only encourages compliance, but also helps identify practical solutions that balance innovation with oversight. In doing so, the SEC signals its intention to move away from reactive enforcement strategies and toward a proactive regulatory model that can adapt to the rapid evolution of digital assets.

Industry response and regulatory independence

The market response to this regulatory change was undoubtedly positive, with bitcoin climbing 3.3% to $107,268.27 following the announcement. Industry leaders including Kraken and Coinbase have expressed support for the new direction, hailing it as the end of the “regulation by enforcement” era. Kraken’s global head of policy, Jonathan Jachym, welcomed the initiative, calling it “a significant first step towards real policy solutions.”

The Formation of the New SEC Task Force and Its Vision to Grow Clear regulatory frameworks for crypto assets represent a promising step forward for the industry and investors. For years, a lack of transparent guidelines has created uncertainty, stifled innovation, and limited institutional participation. A structured regulatory environment can provide businesses with the clarity they need to operate effectively while protecting investors through standardized practices. An approach, similar to that adopted in the EU with the MICA regulation.

However, the pursuit of clarity and innovation should not come at the expense of broader policy considerations or the enforcement of existing laws. Effective regulation requires more than forward-looking frameworks – it also requires a strong foundation of enforcement to maintain trust and integrity in the marketplace, but more than all that is trust in the SEC.

Relaxed enforcement measures, as proposed by the Trump administration, risk creating an environment where bad actors can flourish, ultimately undermining both investor protections and the broader goal of driving adoption of digital assets. Striking a balance between regulatory clarity, innovation and enforcement is essential for long-term market stability.

Despite the promise of this new direction, several concerns remain, particularly regarding the potential conflicts of interest. The timing of the task force’s announcement drew criticism, coinciding with the launch of the $Trump token. The Token’s extreme price volatility, concentrated ownership (80% owned by Trump-affiliated entities), and plans to increase supply from 200 million to 1 billion units raise further concerns regarding market integrity. Additionally, closed-door meetings between administration officials and major bitcoin miners ahead of these announcements further underscore the risk of Information asymmetrywhere privileged market participants could gain an unfair advantage.

If the new administration truly wants the United States to become the crypto capital of the world, it must consider long-term goals and eliminate any real or even potential conflicts of interest. The cryptographic working group must operate transparently and prioritize the public interest. Preserving the independence and credibility of the SEC is critical to the U.S. economy.

A new era for crypto regulation?

The Trump administration’s crypto stance represents a significant shift in US policy, with the potential to reshape the regulatory landscape. The SEC task force aims to resolve long-standing industry grievances by establishing clear rules, promoting public engagement and reducing enforcement-led oversight. However, the influence of industry insiders and the weakened potential for investor protection must be addressed without delay.

The results of this initiative will have far-reaching implications, not only for crypto market participants, but for broader questions about financial innovation, regulatory independence, and investor confidence in the digital age. The stakes are high and the world will watch as this new framework takes shape.