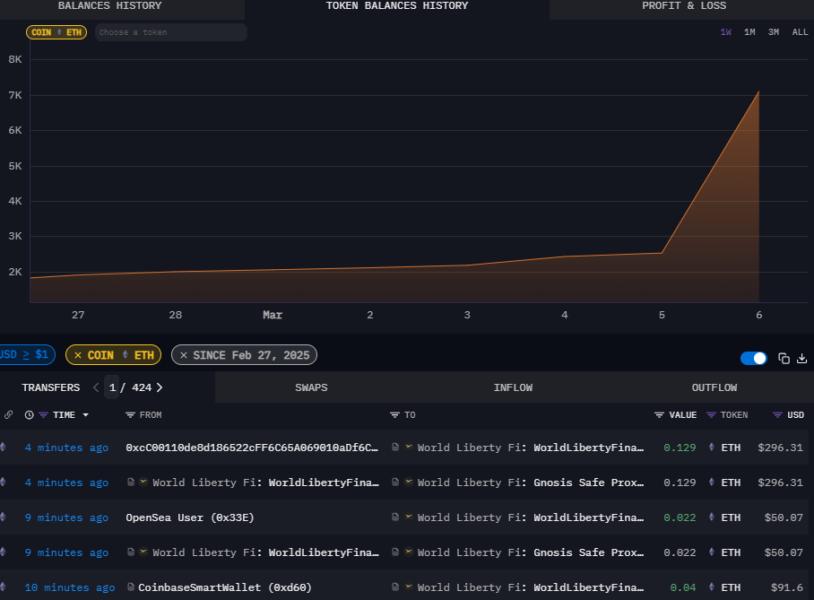

The decentralized financial platform (DEFI) linked to the American president Donald Trump considerably increased his assets during last week while the price of the cryptocurrency briefly fell below $ 2,000.

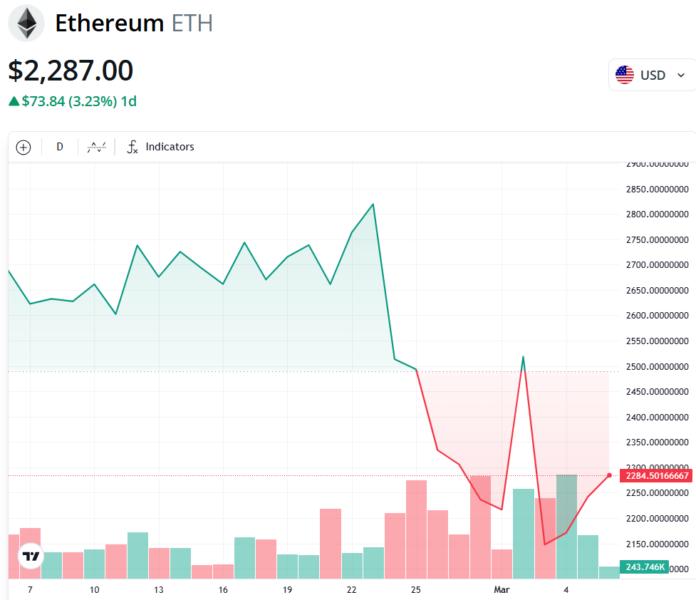

Trump’s World Liberty Financial (WLFI) platform has tripled his ether Ethusd Assets in the last seven days while the ETH fell below the psychological brand of $ 2,000, reversing $ 1,991 on March 4, according to Cointelegraph Markets Pro.

The data provided by Arkham Intelligence shows that WLFI now contains about $ 10 million more in ether than a week earlier. Its latest acquisitions also include an additional $ 10 million in Bitcoin tokens (WBTC) wrapped up and $ 1.5 million in Movement Network tokens (MOVE).

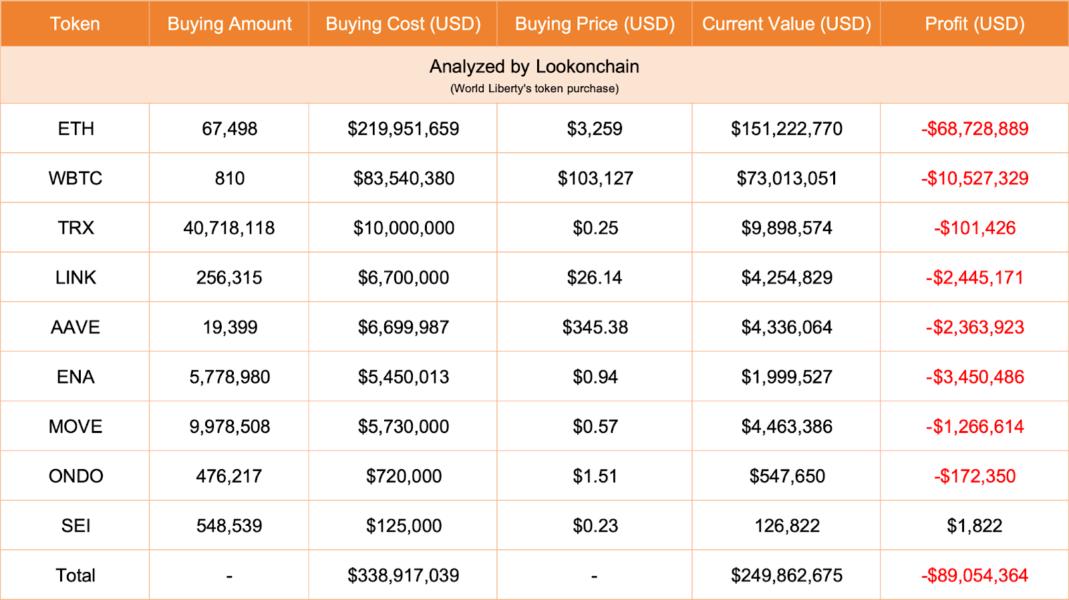

Trump’s DEFI platform is currently sitting on an unrealized total loss of more than $ 89 million on the nine tokens in which it has invested, according to Lookonchain data.

The purchase of DIP occurred during an increased volatility period on the market and investor concerns, drawn both by macroeconomic concerns and crypto-specific events, including the hacking of $ 1 billion on February 21, the greatest feat in cryptographic history.

The recent decrease also led to a “wider leak towards cryptographic markets”, which prompted investors to seek safer assets with more predictable yields, such as real active active ingredients (RWA), according to a research report on the Binance shared with Cointelegraph.

Trump’s WLFI launches the “Macro Strategy” fund for Bitcoin, Ether, Altcoins

The latest investments in the digital assets of WLFI took place almost a month after the platform unveiled the “Macro Strategy” fund for Bitcoin (BTC), ether and other cryptocurrencies “at the forefront of reviving global finance”.

According to an announcement of February 11, the fund aims to strengthen these projects and extend their role in the evolving financial ecosystem:

“Together, we build a heritage that fills the worlds of traditional and decentralized finance, establishing new standards for industry.”

The fund aims to “improve stability” by diversifying the assets of the platform through a “spectrum of tokenized assets” to ensure a “resilient financial system” and invest in “emerging opportunities in the DEFI landscape”.

The announcement occurred three weeks after generalized speculation on the Trump family which launches a “giant” company on Ethereum, according to Joseph Lubin, co-founder of Ethereum and founder of Consensys.

“Based on what I know, the Trump family will build one or more giant companies in Ethereum,” wrote Lubin. “The Trump administration will do what is good for the United States, and that will imply ETH.”

Lubin suggested that Trump administration could possibly integrate Ethereum technology into government activities, similar to its current use of Internet protocols.

Ether is currently the largest WLFI detention, followed by $ 14.9 million in WBTC and $ 13.2 million from the USDT stablecoin (USDT).