World Liberty Financial, a decentralized finance project linked to US President Donald Trump’s family, has entered the crypto lending market as its $1 stablecoin surpasses $3.5 billion in circulating supply.

The project launched its lending and borrowing product, World Liberty Markets, on Monday, as noted in the company’s announcement.

The new web application allows users to lend and borrow digital assets within a single on-chain marketplace built around $1, the platform’s US dollar-backed stablecoin, and its governance token, WLFI.

Users can post collateral including Ether, a tokenized version of Bitcoin, and major stablecoins such as USDC and USDT, with the underlying infrastructure powered by Dolomite.

On-chain lending rebounds as World Liberty Financial builds on USD 1 momentum

World Liberty Financial said this launch represents the second major product rollout for the project, following the introduction of USD1 last year.

The stablecoin has seen rapid growth, reaching a market capitalization of approximately $3.48 billion, with the entire issued supply already in circulation.

USD1 maintains a $1 peg and is deployed on multiple blockchains, with the largest share on BNB Smart Chain with around 1.92 billion tokens, followed by Ethereum with around 1.31 billion.

Smaller but growing allocations exist on Solana, Aptos, Plume, Tron, and several newer networks.

The launch of the loans comes as on-chain lending has regained momentum following the collapse of several centralized lenders during the previous cycle.

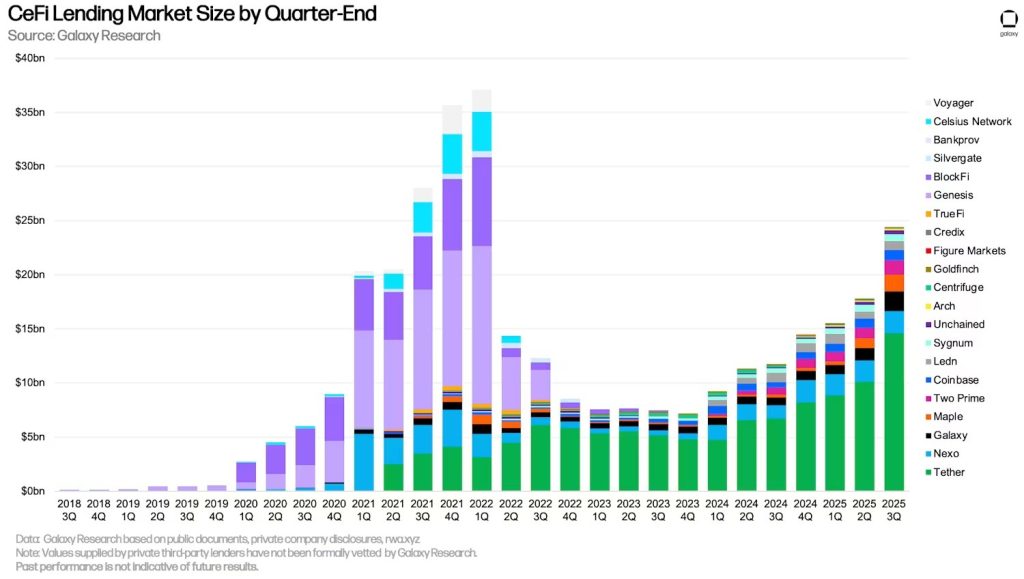

Galaxy Research reported that cryptocurrency-backed loans reached an all-time high of $73.59 billion at the end of the third quarter of 2025, surpassing the 2021 peak.

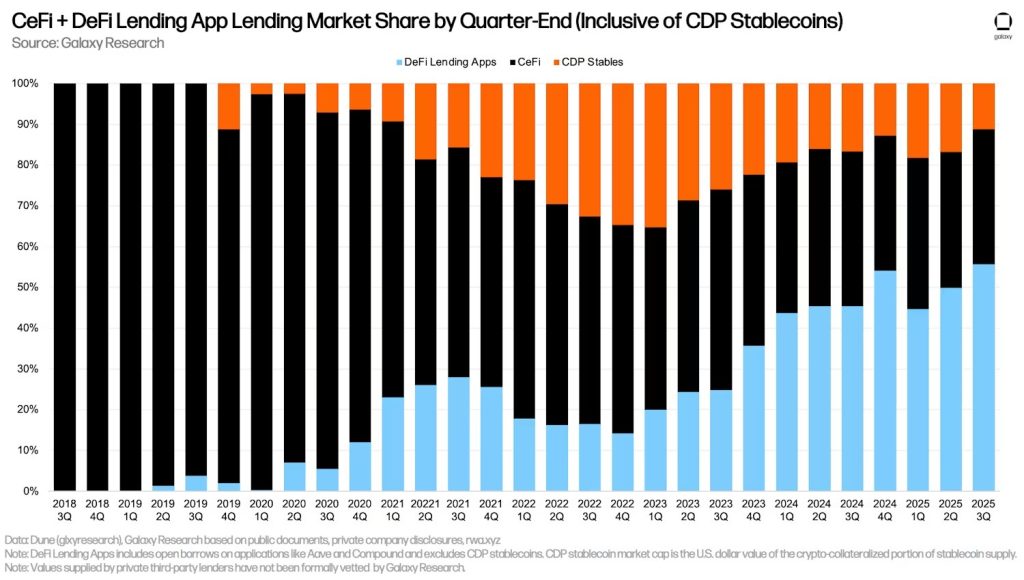

DeFi lending apps accounted for $40.99 billion of that total, capturing 55.7% of the entire lending market and growing nearly 55% quarter-over-quarter.

Unlike the previous cycle, growth was driven by fully collateralized loans, transparent liquidation mechanisms and on-chain risk management.

USD1’s role extends to banking and crypto markets

World Liberty Financial’s move places it squarely in this evolving sector, where demand for borrowing on digital assets is increasing as investors seek liquidity without selling their holdings.

The company said World Liberty Markets is designed to expand the utility of $1, allowing holders to deploy the stablecoin while accessing borrowing opportunities.

Users who provide $1 are eligible for the project’s existing points program, which distributes rewards under specific conditions.

The company also launched an early adopter rewards campaign, offering WLFI incentives for deposits of $1.

The timing of the launch aligns with the growing institutional and regulatory engagement around stablecoins.

Earlier this month, World Liberty Financial confirmed that its trust entity had filed an application for a U.S. national banking charter with the Office of the Comptroller of the Currency.

USD1 also gained visibility thanks to high-profile market activity. In December, Binance rolled out a limited-time “USD1 Boost Program,” offering enhanced returns of up to 20% APR on the stablecoin through its Simple Earn products.

The promotion coincided with a sharp increase in the market capitalization of USD1 and followed Binance’s decision to expand free USD1 trading pairs and replace BUSD with USD1 as the main collateral asset on the exchange.

Binance has positioned USD1 as an integral part of its collateralization framework, further integrating the token into the centralized trading infrastructure.

The broader credit market has continued to evolve alongside these developments.

Although centralized lenders still account for a significant portion of outstanding loans, data from Galaxy Research shows that blockchain platforms are now dominating the new growth.

CeFi lending reached $24.37 billion at the end of September, with Tether holding nearly 60% of the tracked market, but surviving centralized lenders have moved to fully collateralized models and public reporting.

The article Trump’s World Liberty Financial Launches Crypto Lending as Stablecoin USD1 Hits $3.5 Billion appeared first on Cryptonews.

World Liberty Financial has filed for a U.S. national banking charter, seeking OCC oversight to fully bring its dollar-backed stablecoin USD1 into regulatory scope.

World Liberty Financial has filed for a U.S. national banking charter, seeking OCC oversight to fully bring its dollar-backed stablecoin USD1 into regulatory scope.  Trump-linked stablecoin USD1 jumps $150 million after

Trump-linked stablecoin USD1 jumps $150 million after