Key notes

- TRX leads the main performances of the Altcoin with a minimum of loss of 1% while the main competitors are faced with two figures greater than 10%.

- Tron’s market capitalization reaches $ 29.3 billion, officially exceeding Cardano’s evaluation for the first time this quarter.

- The data on the chain reveal stable stable deposits at $ 82 billion, indicating the rotation of the funds rather than the mass cryptography outputs.

Tron

Trx

$ 0.31

24h volatility:

1.5%

COURTIC CAPESSION:

$ 29.27 B

Flight. 24 hours:

$ 4.88 B

Exchanged at $ 0.306 on Monday, slipped 1% intraday, but still displayed the best performance among the 10 best altcoins. On the other hand, Ripple

Xrp

$ 3.17

24h volatility:

10.4%

COURTIC CAPESSION:

$ 187.22 B

Flight. 24 hours:

$ 12.64 B

and cardano

ADA

$ 0.81

24h volatility:

9.1%

COURTIC CAPESSION:

$ 29.42 B

Flight. 24 hours:

$ 1.91 B

Prices have experienced intra-day losses over 10%, which has stopped recent rallies.

Tron’s market capitalization is now $ 29.3 billion, exceeding Cardano’s evaluation for the first time this quarter.

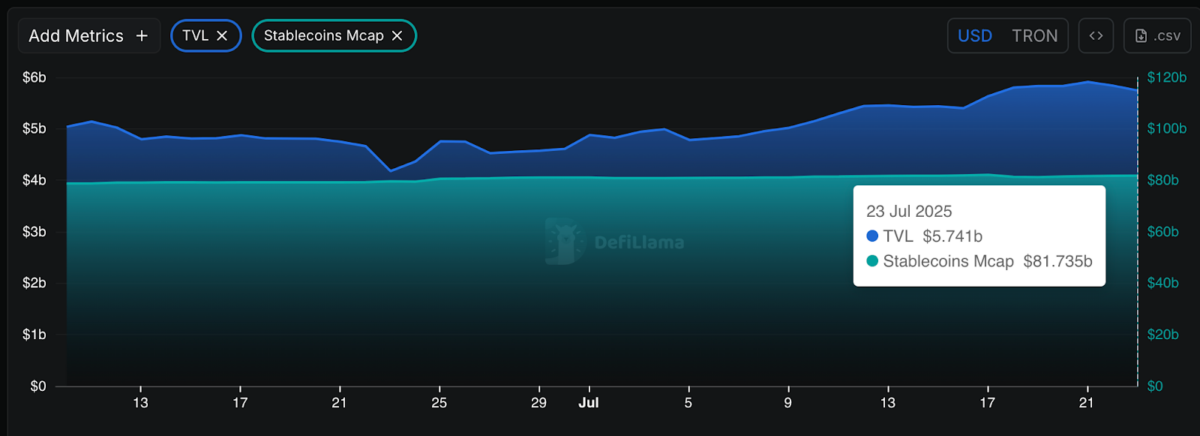

Based on the latest Defillama chain information, Tron’s resilient performances suggest that market correction on Wednesday is linked to the consolidation of investors rather than rapid withdrawal from the wider cryptography sector.

Stablecoin Tron Deposits VS Total Locked Value (TVL) | Source: Defillama

As illustrated above, Stablecoin’s market capitalization on Tron remains close to recent vertices at $ 82 billion while TVL also holds around $ 5.7 billion. Given that Tron dominates more than 70% of Stablecoin Crypto transactions, the figure indicates intradays minimum withdrawals despite the best classified assets like XRP and ADA faced with two -digit losses. Furthermore, this suggests that traders choose to run funds in various Altcoin markets, rather than transforming rotation into stablecoins.

TRX price prediction: the bulls hold $ 0.30 but the withdrawal of MacD signals

The TRX price closed on Monday at $ 0.306 after rejected the local summit of $ 0.33 last week. The Keltner Channel Mid-Band at $ 0.303 offers a nearby support, but the band less than $ 0.286 is the key level to look at if $ 0.30 breaks.

Tron price prediction | Trxusdt

MacD on the daily graphic shows the discolving impulse, with the Blue MacD line crossing the Orange signal line. This lowering crossover points to potential cooling in future sessions.

If the bulls defend $ 0.30, a rebound in Tron price to $ 0.32 could follow. However, non-compliance with this level could open up drop targets at $ 0.286 and $ 0.275, aligning with the bottom of the channel and can take care of.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn