According to crypto tracker Lookonchain, two Ethereum (ETH)-based decentralized finance (DeFi) altcoins are surging after whales scooped up large amounts of the projects’ tokens.

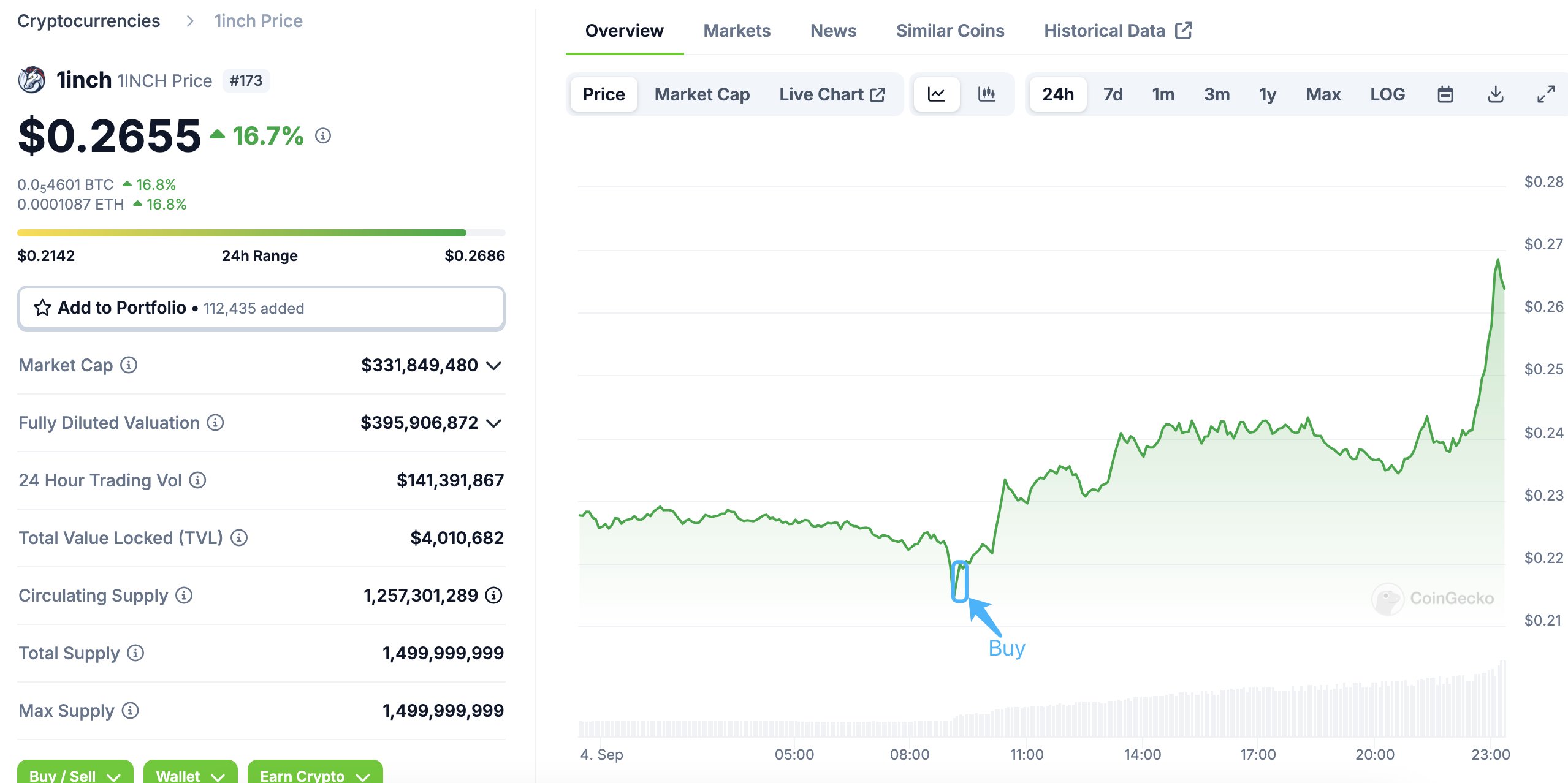

Lookonchain reports that decentralized exchange (DEX) aggregator 1inch’s governance token (1INCH) is up double-digits after a significant buy.

According to Lookonchain, a wallet associated with the investment fund behind the 1inch DEX has just purchased 7.96 million 1INCH worth $1.75 million. Since July 5, the wallet has purchased a total of 22.4 million 1INCH worth $5.49 million at an average price of $0.25.

At the time of writing, 1INCH is trading at $0.28, up over 26% in the last 24 hours. Its market cap is over $358.9 million.

Next, Lookonchain reports that a whale has just accumulated over $6 million worth of governance tokens for lending protocol Aave (AAVE). AAVE is trading at $137 at the time of writing, up 12.5% in the last 24 hours, and has a market cap of $2.05 billion.

“This whale bought 50,604 AAVE ($6.78 million) again (on September 4) and currently holds 125,605 AAVE ($16.9 million) with an average purchase price of $134.6 million.”

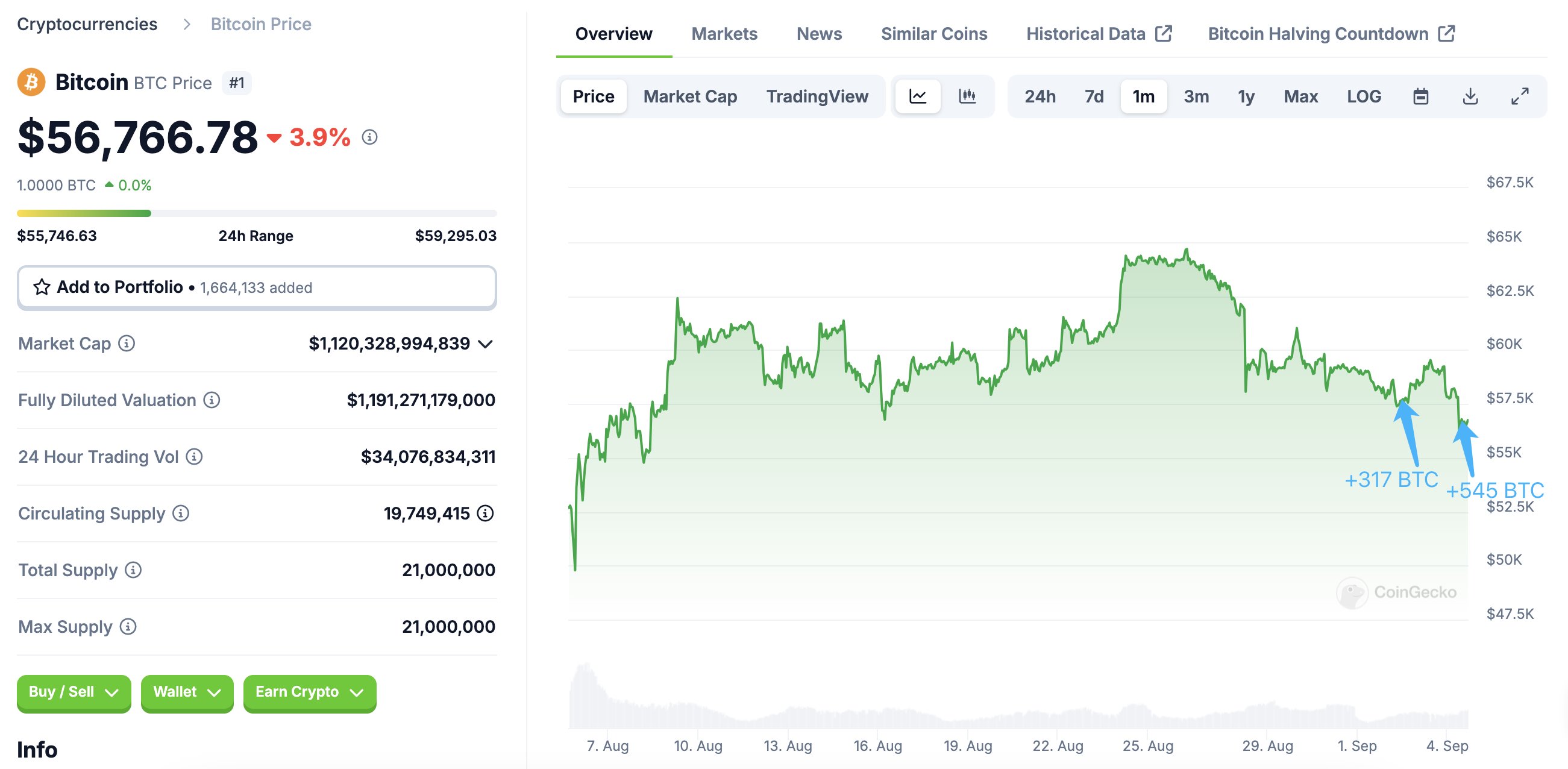

Lookonchain notices that another deep-pocketed investor purchased massive amounts of Bitcoin (BTC) between September 2 and September 4.

“A whale bought 545 BTC ($30.82 million) again after the BTC price crash! This whale bought 862 BTC ($49 million) from the bottom at an average price of $56,993 over the last three days.”

At the time of writing, Bitcoin is trading at $58,399.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check price

Follow us on XFacebook and Telegram

Surf the Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney