Arrest of two suspected Polymarket interns in Israel: Prosecutors have charged an IDF reservist and a civilian for allegedly using classified military information to profit from crypto prediction.

In a joint statement from the Israel Police, Shin Bet and Defense Ministry, the reservist accessed non-public operational intelligence as part of his military role and shared it with the civilian. The civilian then allegedly carried out transactions on the Polymarket markets linked to Israeli military actions.

Authorities say the activity generated about $150,000 in profits. The exact deals have not been fully disclosed, but local media suggest they were linked to the timing of Israeli military operations during the attack on Iran in June 2025.

There is a significant chance that Israel made these very public arrests because they got the green light from Trump yesterday and they don’t want these idiots tipping off Iran with their bets 😭😭😭

-Mel (@Villgecrazylady) February 12, 2026

DISCOVER: Best Solana Meme Coins by Market Cap 2026

Insider Trading in Prediction Markets

This case highlights growing tension in crypto markets. Prediction platforms are decentralized and operate on a global scale, but traders remain subject to local laws, especially when national security is at stake.

Geopolitical markets have become among the most liquid categories on Polymarket. They often move faster than traditional media because traders evaluate their expectations in real time. But that same speed creates risks if insiders exploit sensitive data.

Platforms like Polymarket have grown in popularity, recently integrating native USDC support to streamline betting infrastructure.

While prediction markets are often used for sports or crypto, for example when

BTC

$68,857

24h volatility:

5.0%

Market capitalization:

$1.38T

Flight. 24h:

$44.84 billion

price quotes have increased significantly, contracts related to sovereign military actions present unique legal and ethical challenges. In this case, the ability to bet on specific dates for military action created a direct financial incentive for the misuse of state secrets.

EXPLORE: What is the next crypto to explode in 2026?

Role of Lahav 433 and the Shin Bet in the arrest of the two Polymarket insiders

The investigation was led by the Israel Defense Forces (IDF), the Shin Bet internal security agency and the Lahav 433 unit of the Israel Police. According to a joint statement, the reservist accessed classified documents to inform the civilian co-conspirator, who then executed the exchanges.

Reports indicate that the betting account in question may have wagered tens of thousands of dollars on markets like “Israeli Strike on Iran,” generating more than $150,000 in profits. Local prosecutors plan to file indictments for aggravated espionage, bribery and obstruction of justice.

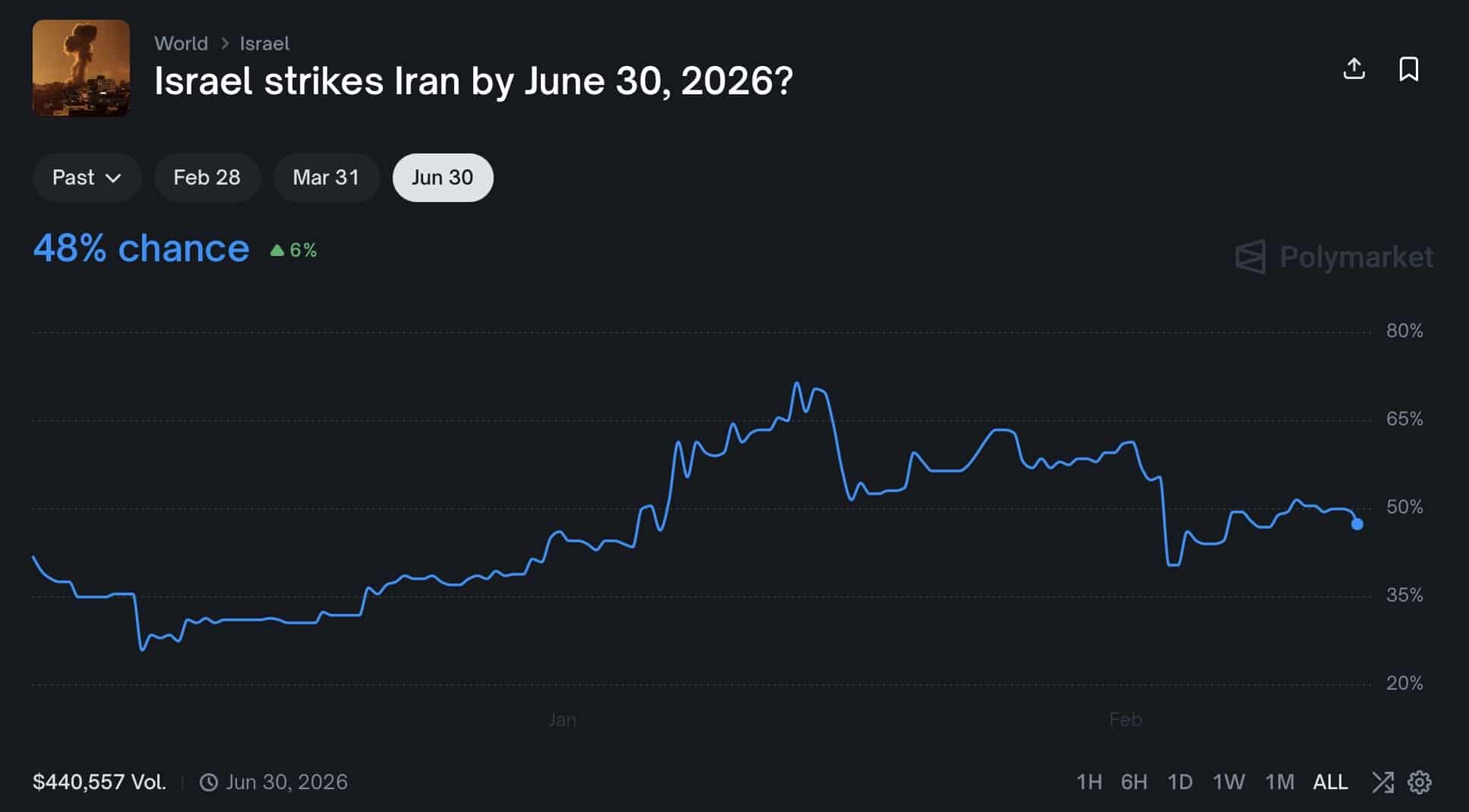

Investigators say the suspected bets were not isolated: Traders placed multiple bets on the outcomes of contracts regarding when Israel would strike Iran. People are clearly still betting on a possible next attack, like this, between now and June 30, 2026.

Israel strikes Iran by June 30, 2026? Source: PolyMarket

The Ministry of Defense highlighted the seriousness of the violation in a statement:

“The use of classified information for financial purposes poses a real risk to the security of IDF operations and national security. »

DISCOVER: 10 new Binance announcements to watch out for in February 2026

Crypto legal precedents

This case sets a precedent for crypto law enforcement regarding decentralized ledgers and state jurisdiction. Even though the protocol itself is decentralized, actors remain subject to local laws regarding espionage and financial fraud. This increased scrutiny comes as prediction markets engage in regulatory battles globally, with Polymarket currently filing a lawsuit to block a ban on sports predictions in Massachusetts.

These appear to be the first arrests related to insider trading on Polymarket. A user made $150,000 last year from Polymarket trading on the war between Israel and Iran. pic.twitter.com/fIVGhVHNI2

– Nick Cleveland-Stout (@nick_clevelands) February 12, 2026

The incident reinforces arguments by global lawmakers that prediction markets could encourage corruption or intelligence leaks. Despite these obstacles, the sector is growing, with competing platforms like Hyperliquid supporting outcomes contracts, suggesting that the industry will continue to grow even as it faces stricter forensic monitoring from state authorities.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

Daniel Frances is a technical writer and Web3 educator specializing in macroeconomics and DeFi mechanics. Hailing from crypto since 2017, Daniel leverages his experience in on-chain analytics to write evidence-based reports and in-depth guides. He holds certifications from the Blockchain Council and is dedicated to providing “insight gain” that overcomes market hype to find real utility for blockchain.