Why this turnaround is important for SUI

Source:

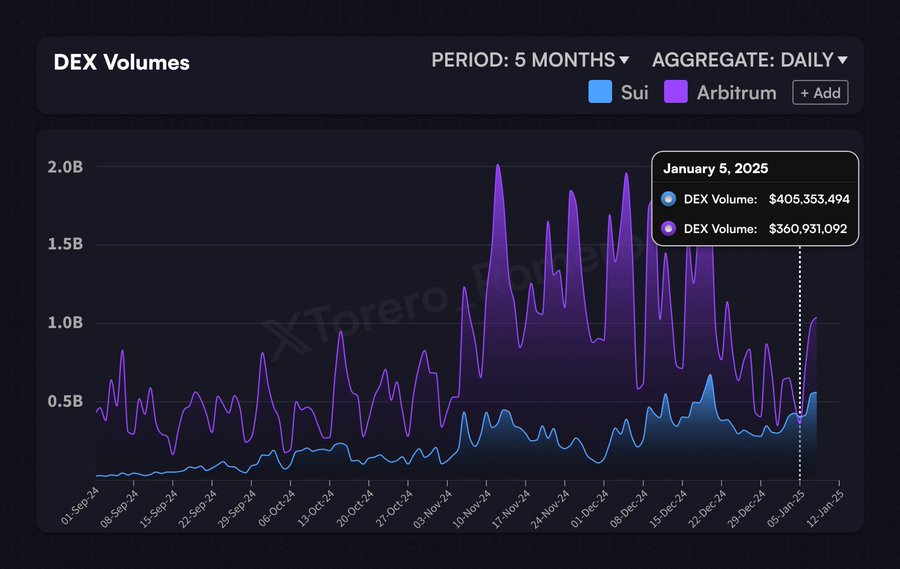

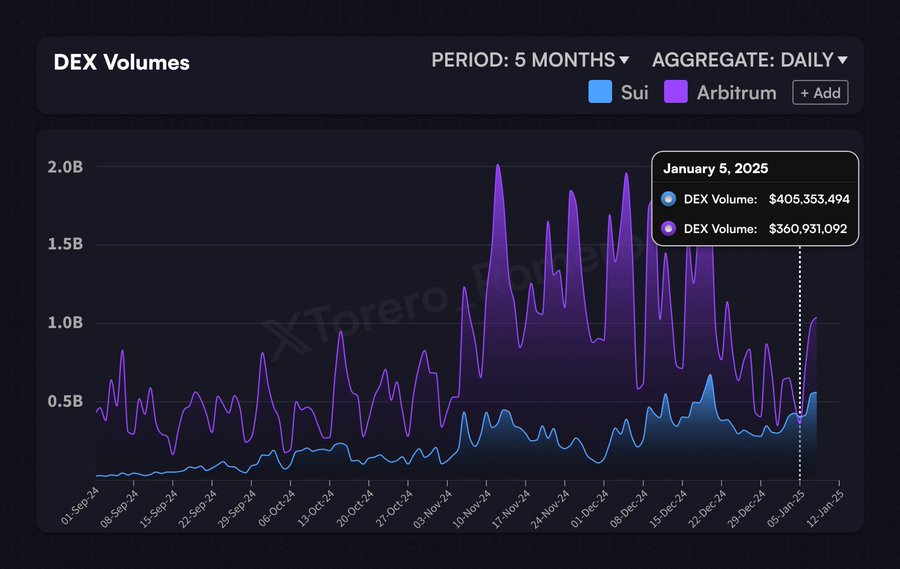

Surpassing Arbitrum in DEX volume marks a crucial achievement for SUI. DEX volume serves as a critical indicator of a network’s liquidity and user engagement, reflecting how participants actively use the protocol for trading and other financial activities.

This turnaround signifies SUI’s ability to challenge established players, potentially attracting more developers, liquidity providers and investors into its ecosystem. This milestone is also a sign of SUI’s scalability and utility, which could boost market confidence. In turn, this could lead to more sustained token adoption and demand.

SUI – The no-trade zone

According to Crypto analyst Ali Martinez, SUI price oscillates between $4.86 and $4.61, forming a no-trade zone that traders often avoid due to uncertain directional bias.

This area highlights market indecision, where buyers and sellers fail to dominate. A break above $4.86 could signal a bullish breakout, while a close below $4.61 could indicate further bearish momentum.

Source:

Traders are watching this range closely, as a sustained close outside of it could trigger significant volatility, potentially triggering a 10% move in either direction. This makes the $4.86 to $4.61 range critical in determining SUI’s next major trend. For now, patience is required as the market awaits a decisive decision to confirm its direction and provide better trading opportunities.

Key scenarios – What could happen next?

Is your wallet green? View the SUI Profit Calculator