- Uni joined 17% to $ 7.67, overthrowing its $ 7.5 resistance and displaying a price of two months.

- A golden cross nearly $ 7.818 can validate the upward trend, to contain $ 6.87 could trigger a trace.

During the last day, Uniswap (UNI) made a sharp increase in its price graphics. The UNI has gone from a hollow of $ 6.2 to a summit of $ 7.67, breaking from a downward trend.

Two weeks ago, UNI faces a rejection at $ 7.50 while trying to get out of the downhill channel.

Now he has managed to exceed this resistance, defending support at $ 5.60 and increasing 17% to a two -month $ 7.60. This time, however, buyers seemed much more aggressive.

We can see this request while the Uniswap volume jumped 89.5%, reaching a total of $ 1.53 billion with a daily negotiation volume of $ 901.6 million.

Whale activity comes into force

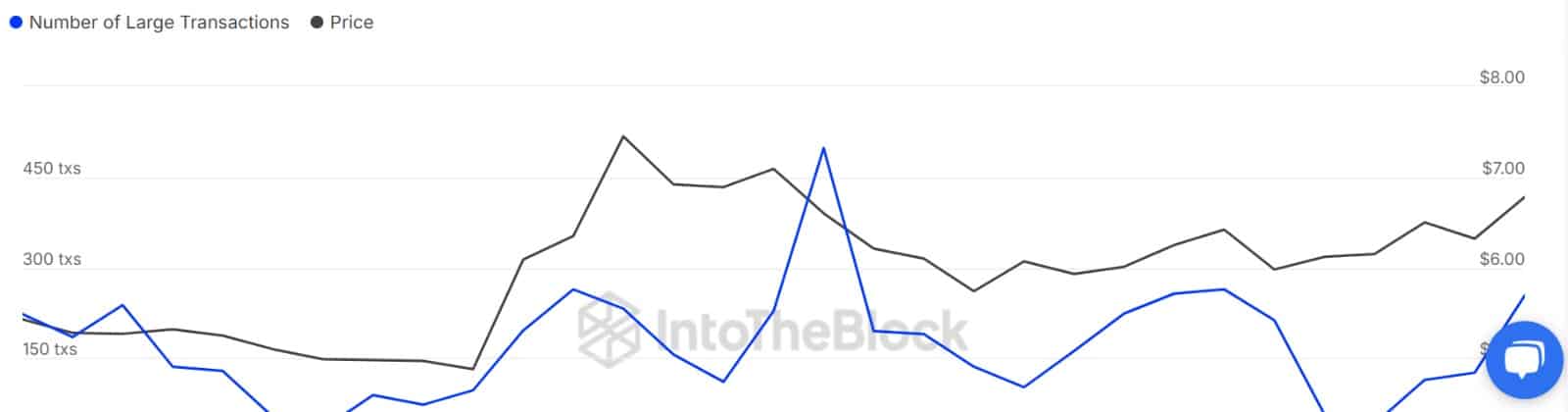

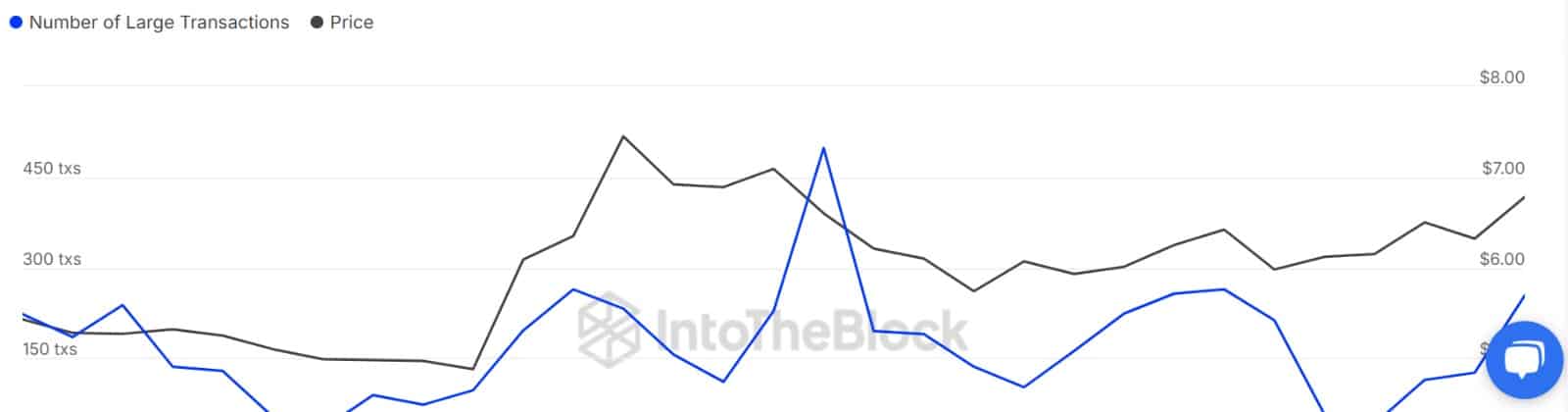

Source: intotheblock

This request was motivated not only by the increase in retail activity, but also a high whale activity during the last day.

During the last three days, the number of large transactions has increased from 41 to 254. Naturally, these kinds of questions have raised questions – buying a turn or a discharge?

By looking more deeply, the Netflow data clarified the image.

Whales are net buyers – to now

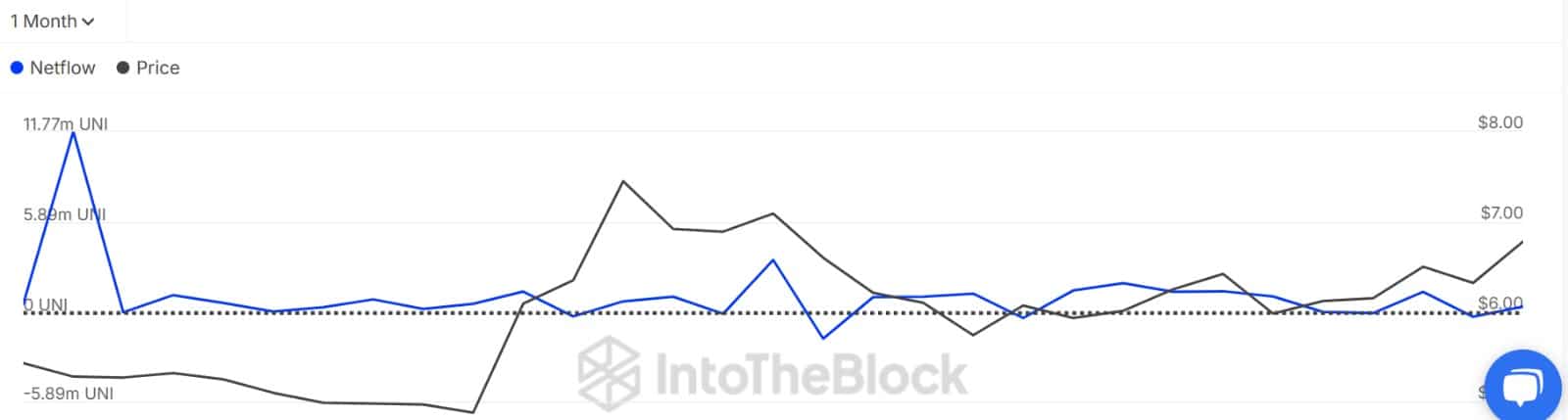

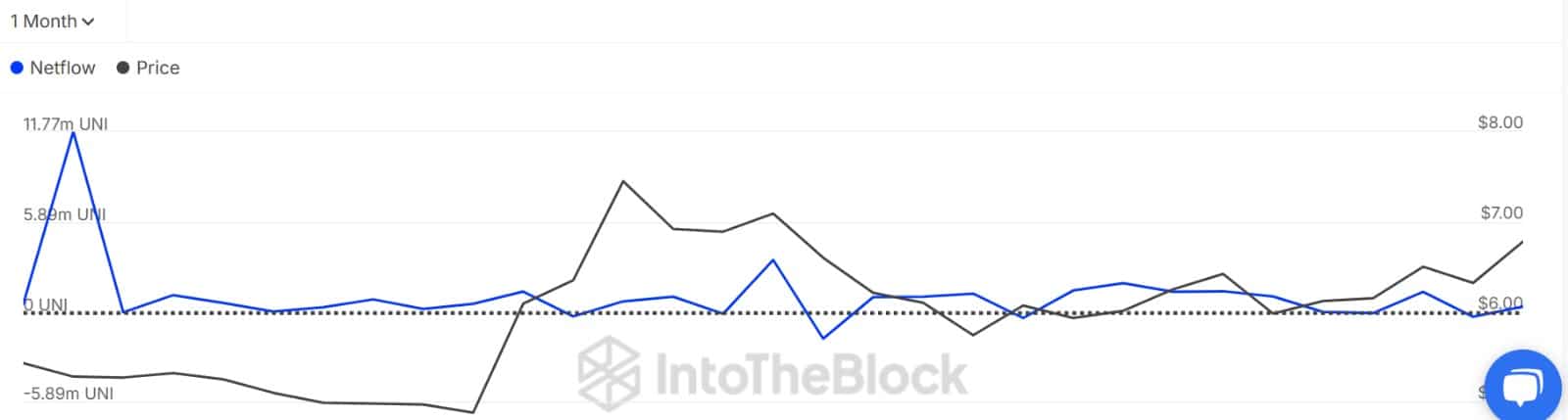

Source: intotheblock

According to the Netflow of large holders, most whales accumulated Altcoin at the time of the press. Thus, the capital entries of large holders increased to 6.75 million USI.

On the sale side, the whales actively unloaded 6.3 million tokens. This leaves the market with a holder of large positive holders of 339K.

Thus, the whales buy more than they sell.

Source: cryptocurrency

The same case can be said when we examine activities on the cash market.

Uni has seen 6.96 million tokens purchased via controls of takers, overthrowing the MCV (Cumulative Delta volume) in dominant buyer territory. Obviously, the Bulls did not sit on this rally.

Uniswap maintain the upward trend?

As observed above, UNISWAP demand increased considerably during the last day, whales and small traders entering the market to buy.

That said, a new risk has emerged – achievement of the goal.

As such, Uniswap Exchange Netflow remained positive for two consecutive days. A positive Netflow indicates higher exchange inputs than outputs.

Source: cryptocurrency

Investors may have been underwater since the beginning of April have used this rebound to go out, capping in the short term.

In order for the UNISWAP to maintain the upward trend, Uni must complete a golden cross on the MA in the short term.

Looking at this indicator, the 9DMA in the short term crosses almost 21 DMA from the disadvantage. The completion of this decision will validate the upward trend.

Source: tradingView

If this cross ends and the price is more than $ 7.818 (200 EMA), UNI can extend the gains.

However, not containing $ 6.87 (21DMA) could open the door to a step back to $ 6.4.

In short, the demand has returned to all levels, but if the gluching rally depends on the way Uni sails in the next wave of profit.