- DEX trading volume increased by over 9% in 24 hours, with Uniswap leading the rise.

- Uniswap’s total value locked (TVL) reached $4.9 billion, highlighting a significant increase in activity.

DEX trading volume has seen a significant increase over the past week, with the last 24 hours seeing even greater growth. Decentralized exchange leads the way Uniswapwhile noting significant commercial activity. This contributed to the overall increase in volume and increase in its total value locked (TVL).

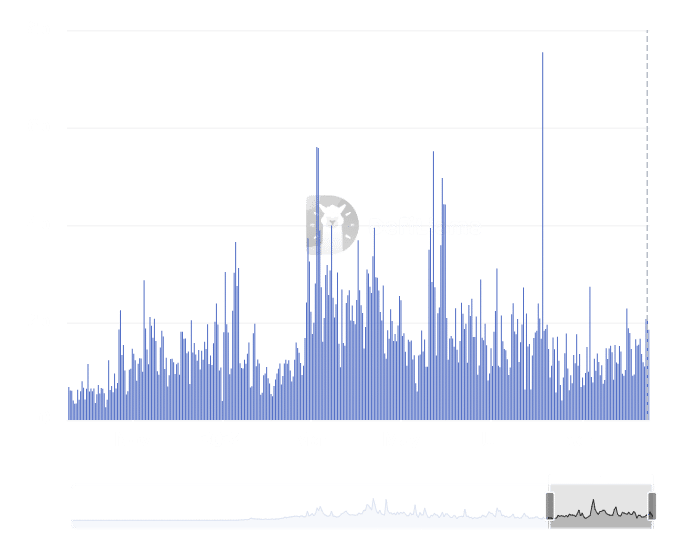

DEX trading volume sees 24-hour spike

According to recent data, DEX trading volume has seen a sharp rise over the past seven days, with a notable rise in the past 24 hours.

In fact, the data from CoinGecko revealed that volume increased by over 9% in the last 24 hours alone. The total trading volume exceeded $544 trillion at the time of writing.

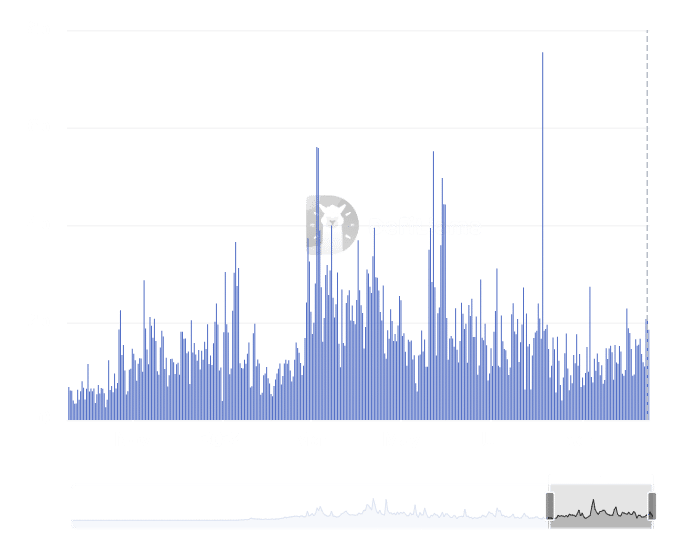

Uniswap dominates DEX trading volume

Further analysis revealed that Uniswap has been the most dominant player in the decentralized exchange space.

Over the past week, Uniswap recorded over $10 billion in trading volume, significantly outpacing the second-largest DEX. Uniswap’s 24-hour trading volume stood at over $1.8 billion at press time.

Source: DéfiLlama

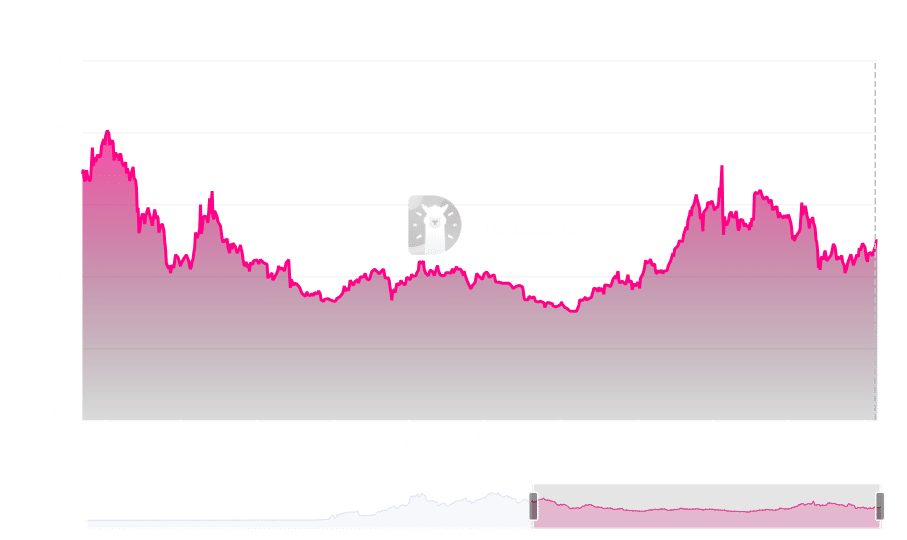

Uniswap TVL nears $5 billion

Along with the increase in DEX trading volume, Uniswap also saw an increase in its total value locked (TVL). At the time of writing, Uniswap’s TVL appeared to be approaching $5 billion, with data showing it to be worth $4.9 billion. This increase in TVL aligns with the recent increase in commercial activity.

TVL started its uptrend around October 11, when it was recorded at around $4.5 billion. Since then, Uniswap has added almost $500 million to its TVL – a sign of the growing interest and activity on the platform.

Source: DéfiLlama

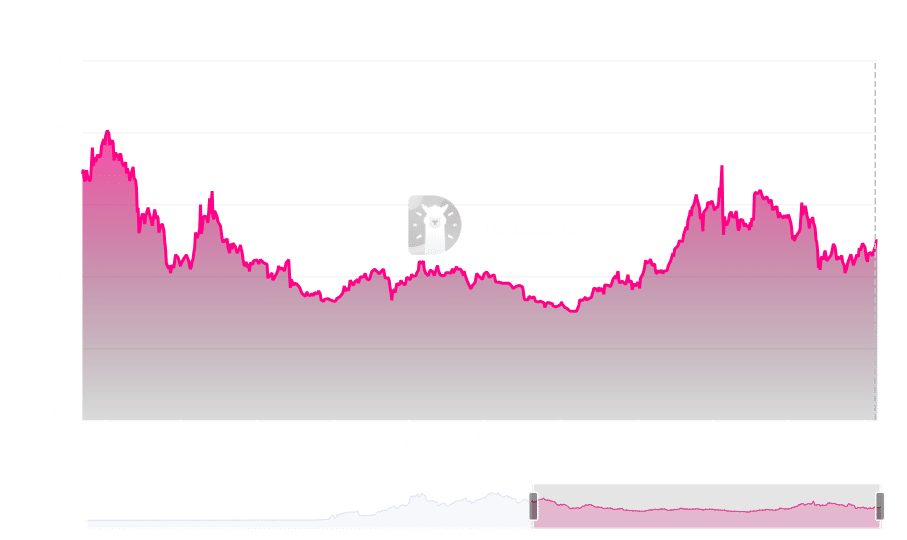

The increase in trading volume and TVL comes at a time when Uniswap announced the launch of its Layer 2 (L2) solution. This launch is expected to further increase trading volume and attract more liquidity to the platform, as users take advantage of the improved scalability and lower transaction fees that L2 solutions offer.

Trading volume highlights greater activity

The increase in DEX trading volume, notably driven by Uniswap, highlights the growing demand for decentralized finance (DeFi) services. As Uniswap continues to dominate the market and improve its infrastructure with Layer 2 solutions, its transaction volume and TVL are expected to see further growth.