- Uniswap is up more than 6% in the past 24 hours amid rising trading volumes.

- UNI open interest increased by over 11% as bullish sentiment grows.

The cryptocurrency market is showing signs of rebounding after limited action over the weekend. Bitcoin (BTC) has bounced back above $58,000 and altcoins are following suit. Uniswap (UNI) led the market rally with a gain of nearly 6%.

At the time of writing, UNI was trading at $6.06. These gains come amid growing market interest in the altcoin. Data from CoinMarketCap showed that UNI trading volumes have surged by over 60% in the past 24 hours.

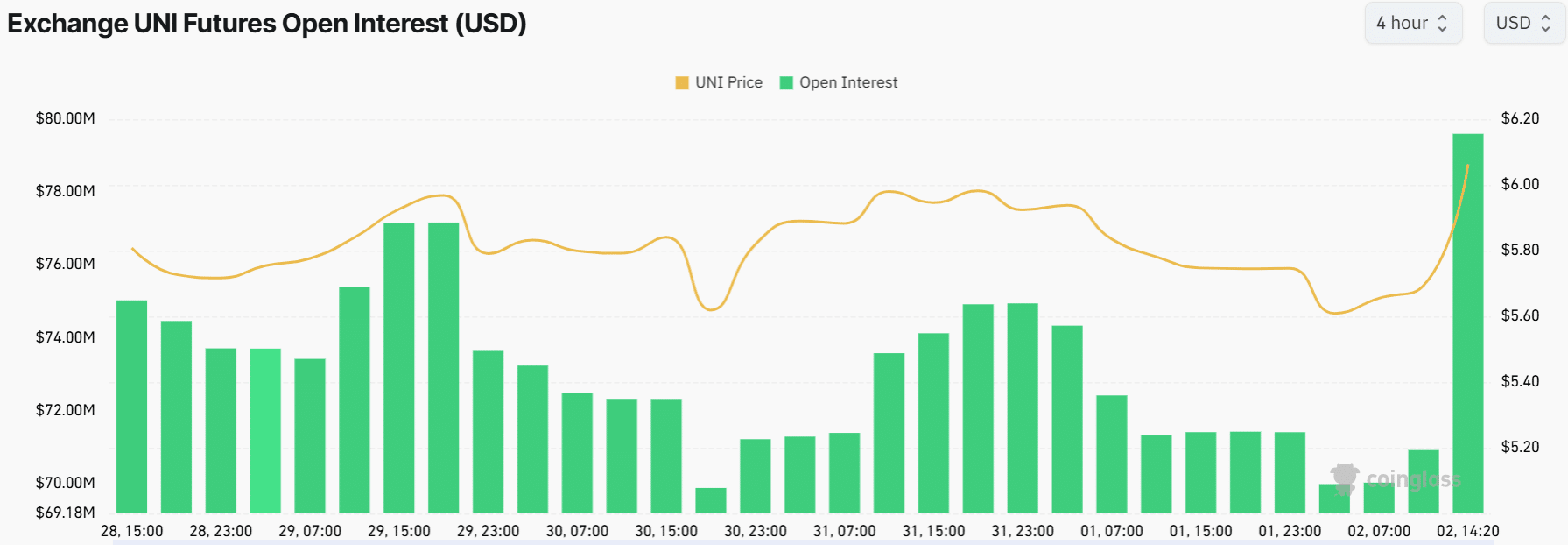

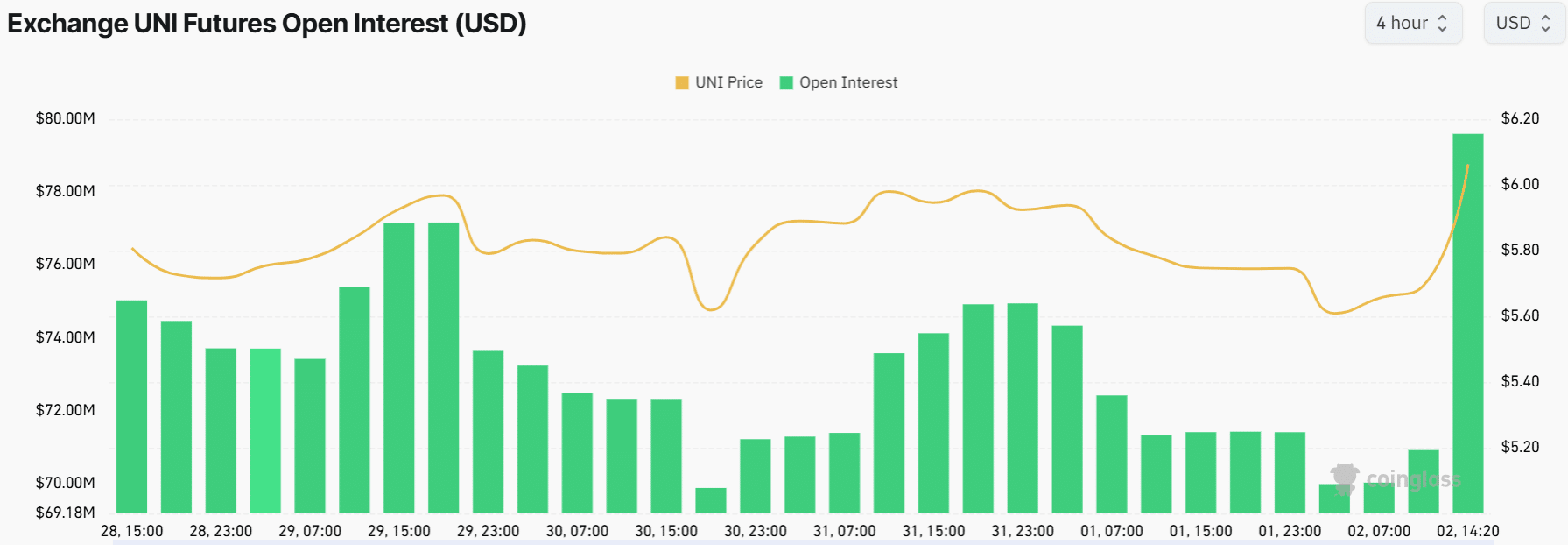

In addition to the growing interest in the spot market, the futures market is also experiencing strong trading activity.

Coinglass is showing a significant increase in open interest (OI). In the last 24 hours, Uniswap’s OI has increased by 11% to $79 million.

Source: Coinglass

Such an increase tends to show upward momentum, especially if it coincides with a rise in prices.

However, will UNI extend its gains or will the bears regain control?

Bullish indicators emerge

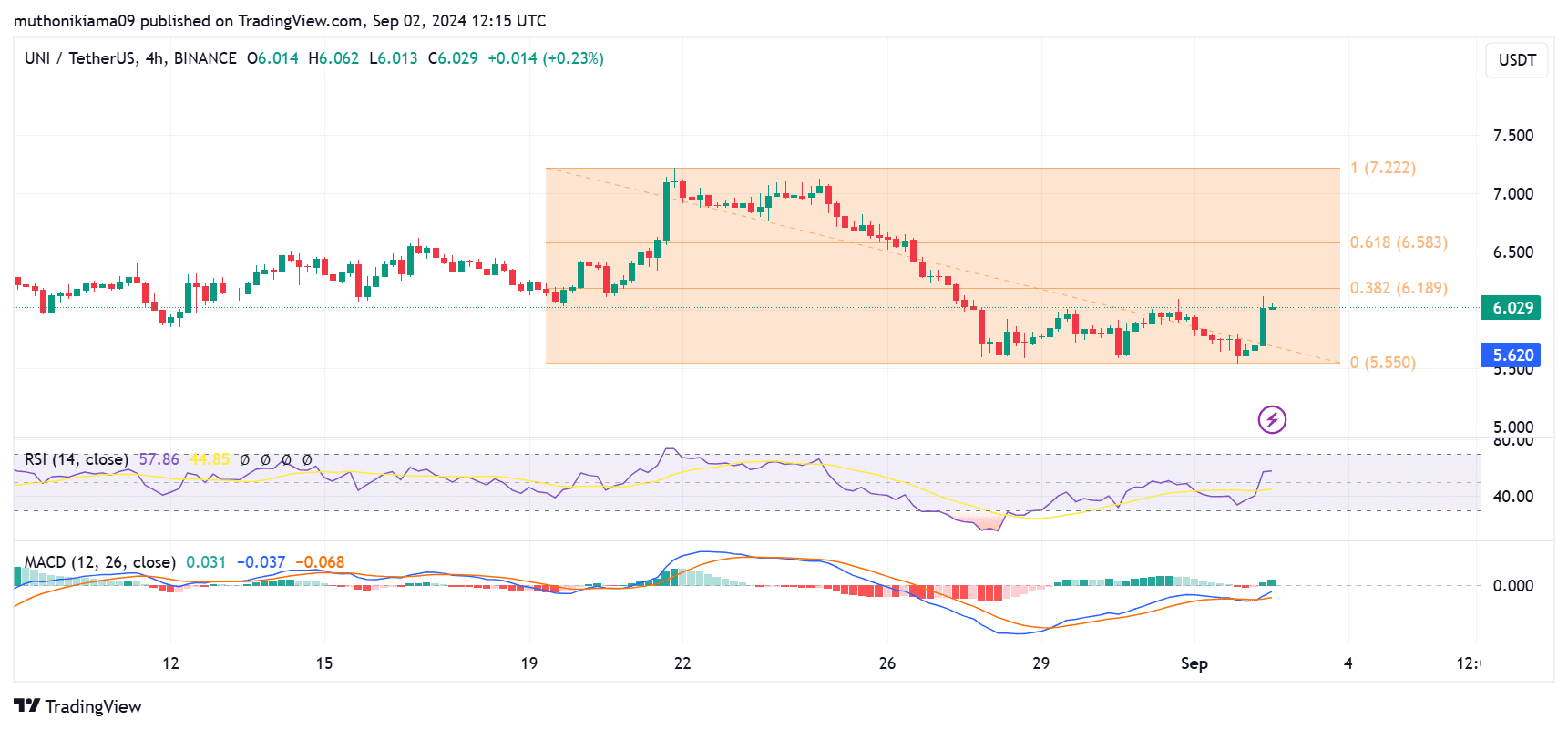

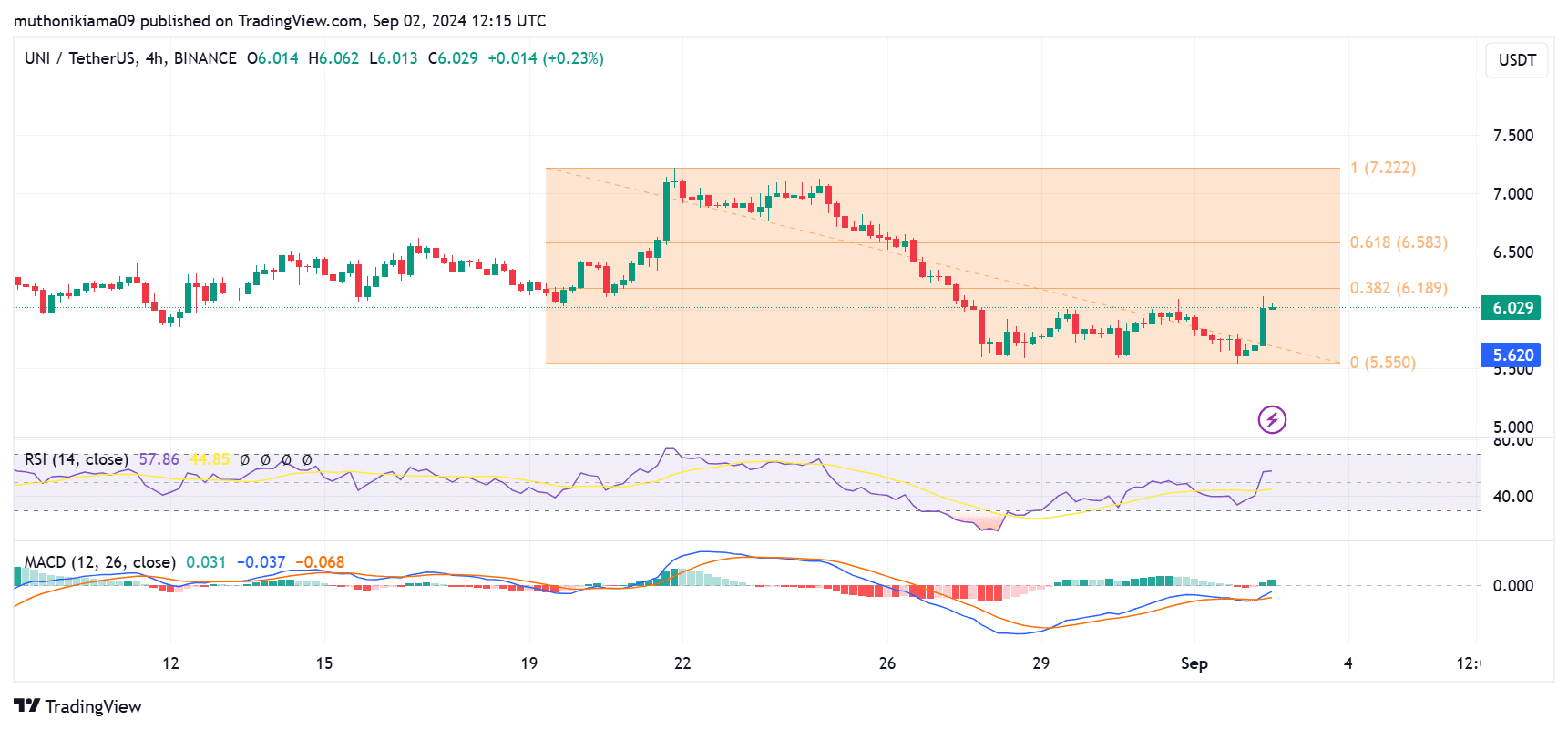

Several technical indicators confirm that UNI is in a bullish dynamic.

The Relative Strength Index (RSI) is showing a bullish reversal with a sharp rise. Additionally, it has crossed above the signal line, an indicator that buyers have overwhelmed sellers and taken control of the price action.

The bullish thesis is also confirmed by the Moving Average Convergence Divergence (MACD) line that has moved above the signal line. The MACD histogram bars have also turned green, showing the dominance of the bulls.

However, to confirm the strength of the uptrend, the MACD line must cross the zero line.

Source: Tradingview

If the bullish momentum continues, the bulls will target the next key resistance level at $6.18. Breaking above this level will open the way for further gains.

On the other hand, if this uptrend fails, UNI could drop lower to test the crucial support level at $5.62. The coin has been holding this support level since last week.

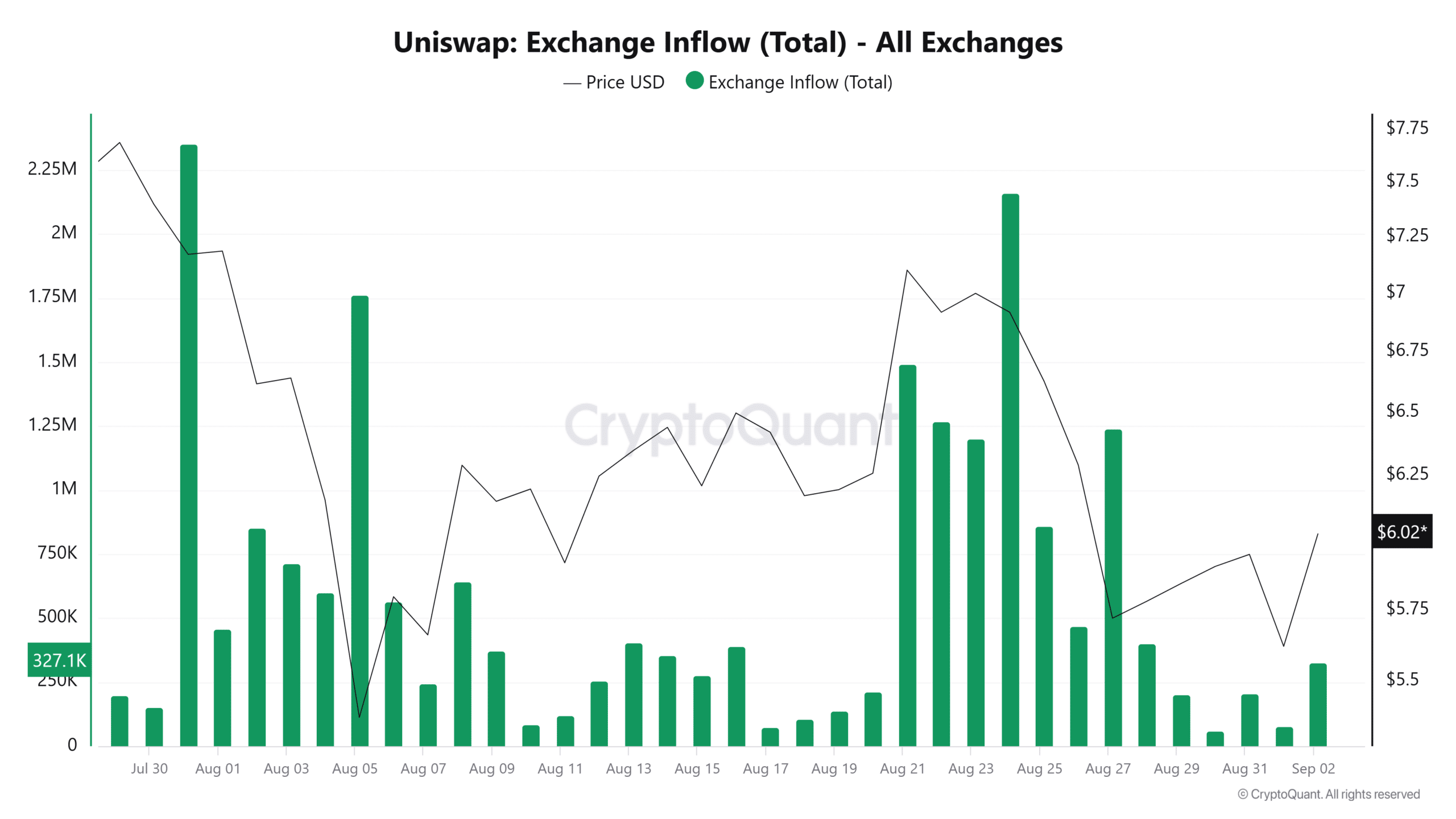

The recent UNI price rally may have been caused by seller exhaustion. Data from CryptoQuant shows that UNI exchange inflows hit a monthly high on August 24.

Is your portfolio green? Discover the UNI Profit Calculator

These flows have since slowed as buyers now have the opportunity to make further gains.

Source: CryptoQuant

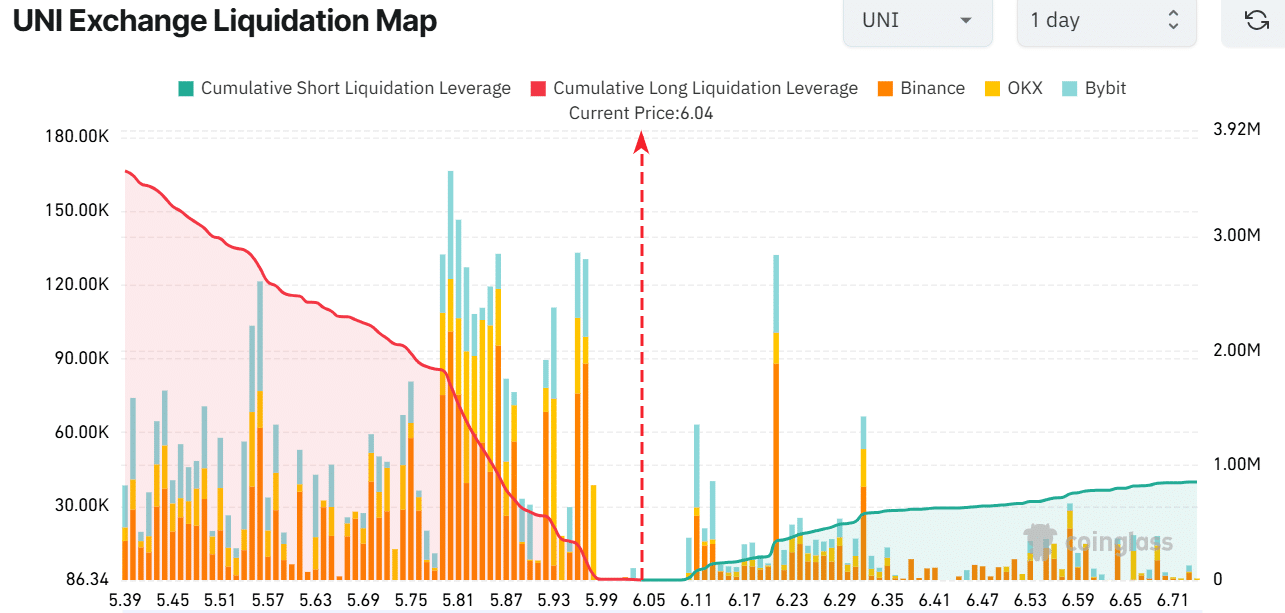

One of the key levels to watch on UNI is $6.21. A large number of short positions are at risk of being liquidated if UNI reaches this price. This situation would trigger a short squeeze that would support further gains.

Source: Coinglass