- UNI price has formed a bullish triangle, indicating potential for a significant breakout

- The channel’s bullish metrics and growing long sentiment hint at a strong move higher.

Uniswap (UNI) The dominance of the decentralized exchange (DEX) market continues to grow, with its network activity growing from 36.8% to an impressive 91.3% in 2024. This remarkable growth has attracted over 45.3 million users, strengthening its position as the leading DEX for user acquisition.

Meanwhile, a $1.42 million USDC whale’s recent purchase of 100,000 UNI at $14.24 highlighted strong investor confidence. At press time, UNI was trading at $13.07, with the altcoin down 4.07% and key price levels likely to dictate its next direction.

Key Levels to Watch for a Breakout

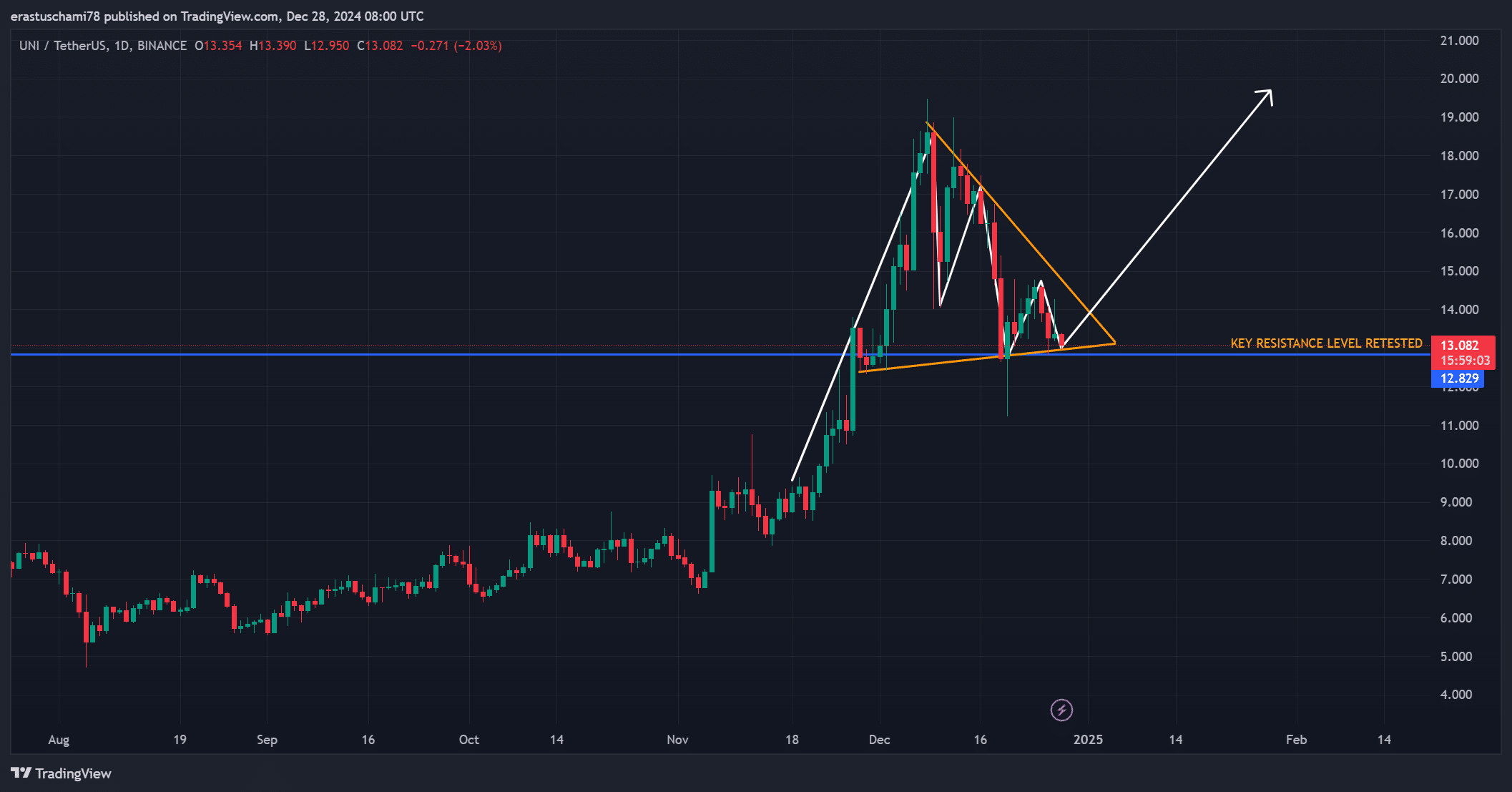

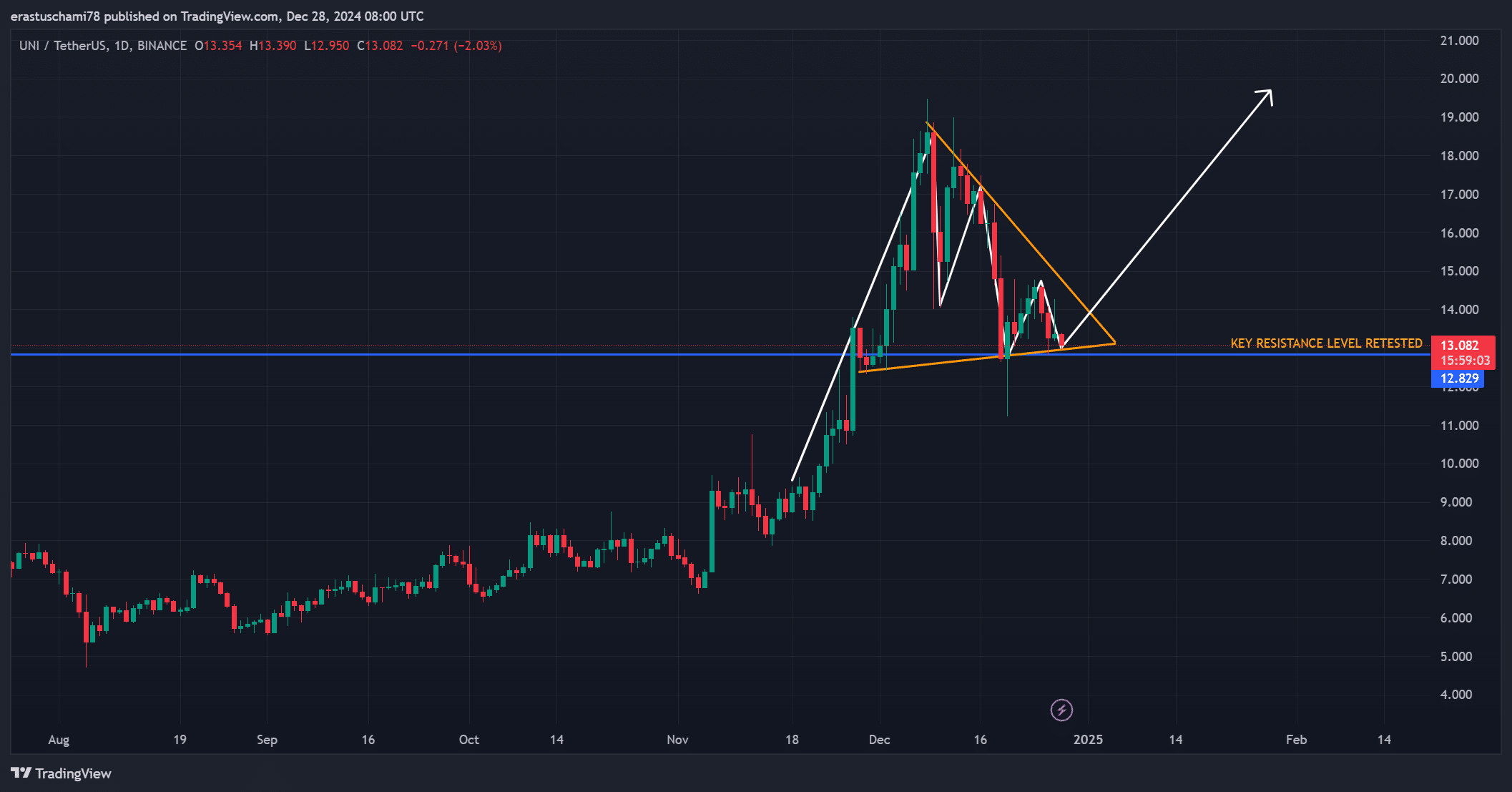

UNI’s price chart highlighted the potential for a major breakout, as a symmetrical triangle pattern formed. Such a structure often signals significant movement, and the retest of the $12 resistance level has added to the bullish possibilities.

A break above this level could propel UNI towards $20 or more, generating substantial upside potential for traders. However, recent selling pressure on the chart has highlighted the importance of sustained buying momentum.

Source: TradingView

What do metrics reveal about network activity?

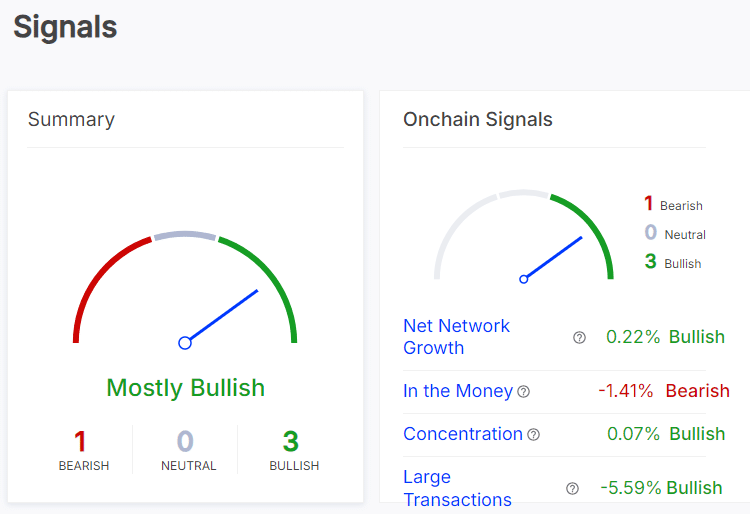

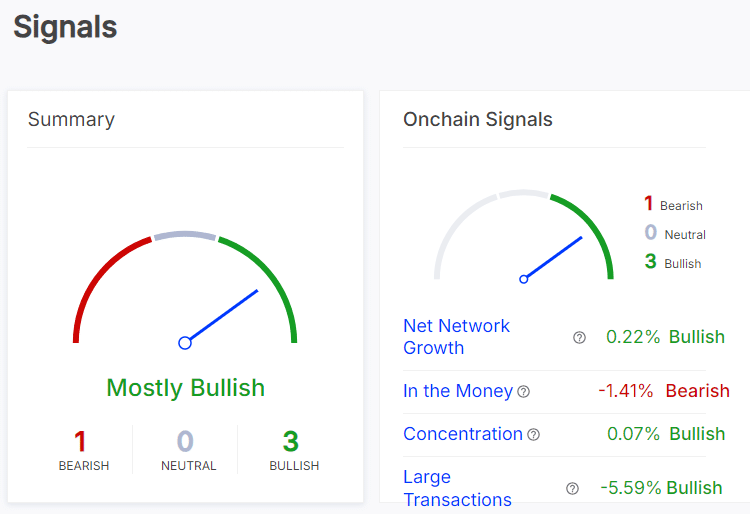

On-chain metrics indicate a mostly bullish outlook for UNI. Network net growth increased by 0.22%, indicating an influx of new users. Additionally, whale activity remained constant, with the concentration increasing by 0.07%.

However, the “In the Money” indicator decreased by -1.41%, indicating profit-taking behavior from some holders. Large transactions fell -5.59%, signaling near-term caution. These mixed signals highlighted the importance of monitoring whale movements and overall market sentiment to assess UNI’s trajectory.

Source: In the block

Analysis of UNI’s foreign exchange reserves

Exchange reserves saw a modest increase of 0.21%, bringing the total to 70.22 million tokens. While this may hint at slight selling pressure, the low rate of increase suggests that most holders have maintained their positions.

This appears to be in line with the overall market retracement, although a significant rise in reserves could signal bearish intent.

Source: CryptoQuant

Gain momentum or run out of steam?

Technical indicators provided insight into the state of Uniswap’s press time. The average directional index (ADX) at 26.77 highlighted moderate trend strength. Meanwhile, the 9-day moving average was below the 21-day moving average, indicating a short-term bearish trend.

However, the symmetrical triangle highlighted that a bullish crossover could soon spark renewed buying interest.

Source: TradingView

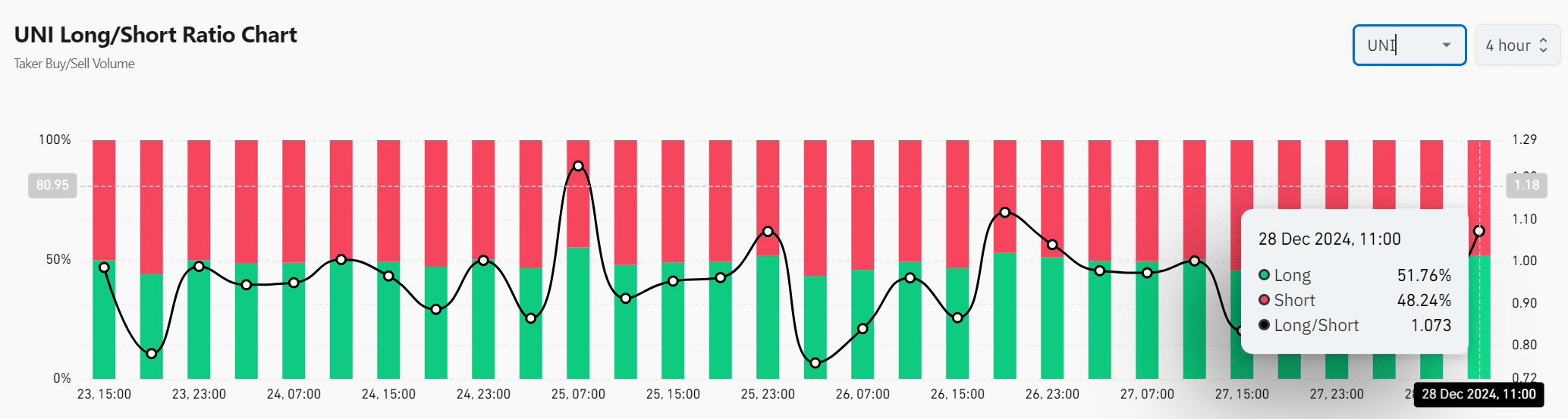

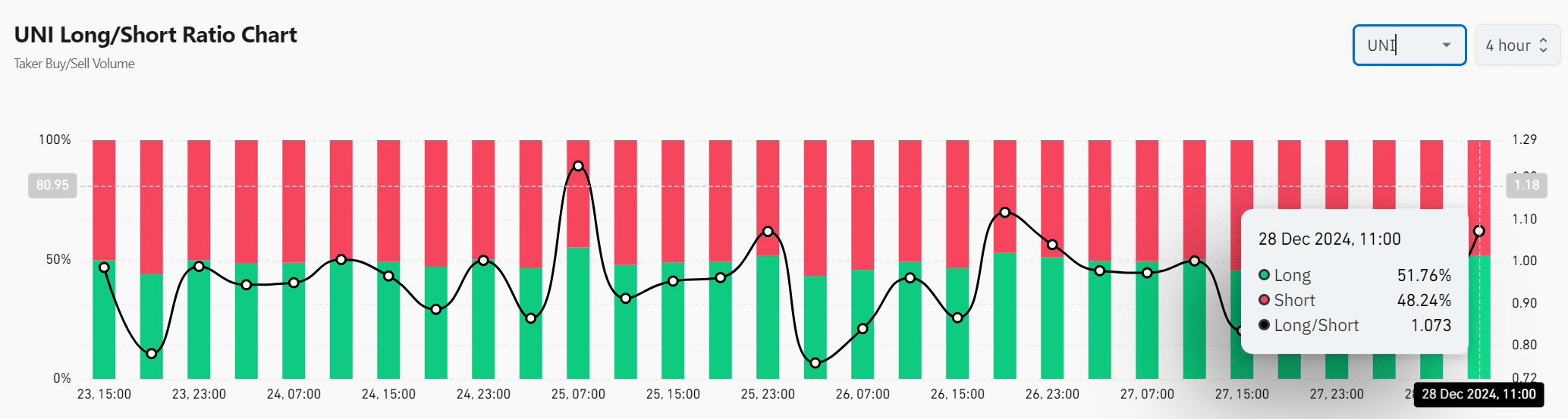

Long/Short Ratio – Is the Market Bullish?

The long/short ratio for UNI stood at 1.073 at press time, with 51.76% of taker volume favoring long positions. This growing bullish sentiment suggests traders are positioning themselves for a possible breakout. Additionally, the shift to long positions aligned with broader expectations of rising prices.

However, whether this sentiment continues will depend on UNI’s ability to break through critical resistance levels and maintain momentum over the coming sessions.

Source: Coinglass

Read Uniswap (UNI) Price Forecast 2025-2026

Is Uniswap ready for a breakout?

UNI charts have shown signs of strong breakout potential, supported by on-chain bullish signals and technical patterns.

If UNI manages to decisively surpass $14, it is likely to rebound towards $20, further strengthening its strength in the DeFi market. Therefore, UNI could be poised for significant upside, especially if key indicators and market sentiment align favorably.