Hyperliquid is heading into one of its most scrutinized moments yet, as a $314 million token unlock scheduled for Saturday intensifies concerns over transparency, market stability and the long-term management of its tokenomics.

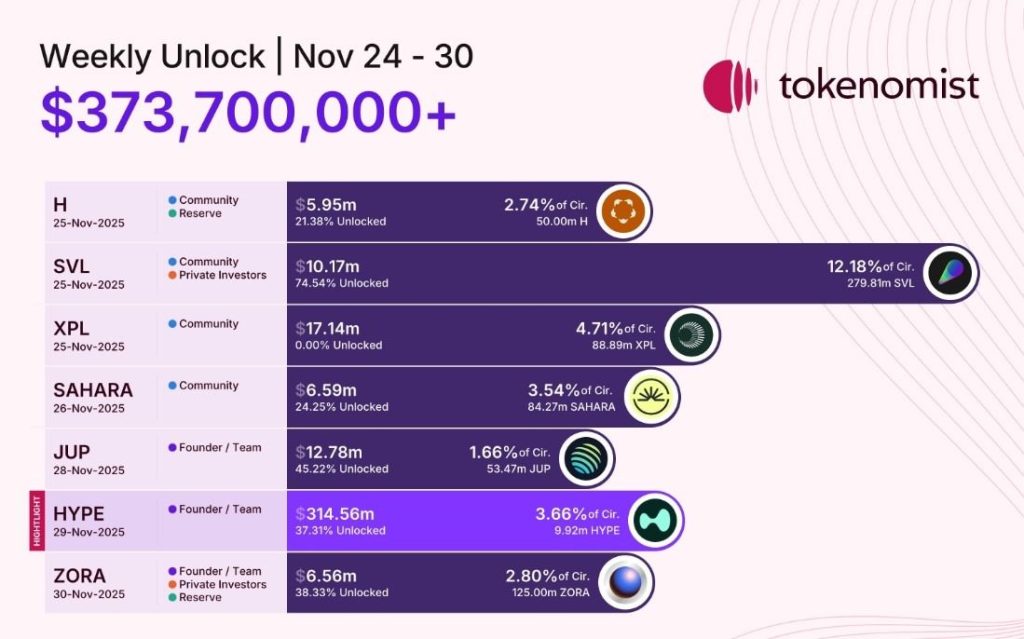

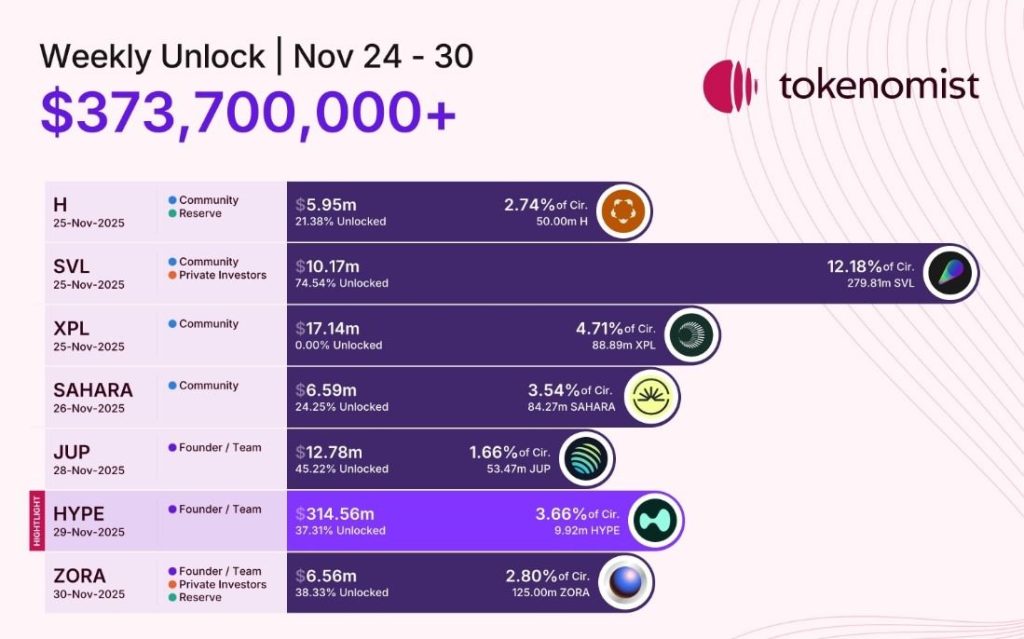

According to data from Tokenomist, the decentralized exchange focused on perpetuals will release 9.92 million HYPE tokens in a single “cliff unlock,” or 2.66% of the total supply.

The entire allocation will be released at once, a structure that has fueled questions about potential selling pressure and how the team intends to handle the newly released tokens.

Hyperliquid faces transparency push as community fears selling pressure

The unlock sparked wide discussions within the Hyperliquide community. Earlier this week, an X user named Andy posted an open letter urging the team to reach out to the community ahead of release.

He said holders were already worried about a broader market collapse and a month-long decline in HYPE, which has fallen more than 23% in the past month and now trades around $31.

“The team and airdrop recipients finally able to sell will ruffle feathers until you address the community head-on,” Andy wrote, adding that many traders remain emotionally scarred from previous collapses after unlock events.

Arthur Hayes, co-founder of BitMEX, also weighed in, warning that even if insiders agree not to sell, the market cannot rely on verbal assurances.

He highlighted the decline in Hyperliquide’s fully diluted price-to-valuation ratio since July, arguing that the market had already priced in the dilution risk.

According to him, only substantial income growth can offset the uncertainty created by increased supply.

Despite concerns, not all community responses have been aligned. Some have argued that the team has no obligation to disclose how it plans to use its unlocked tokens, saying that publishing the timeline and allocation amount is sufficient.

Others called the open letter “desperation,” insisting that Hyperliquide’s contributors “earned” their share and that the platform’s performance speaks for itself.

Hyperliquid remains one of the highest-volume venues in the decentralized perpetual market, and traders note that it has maintained significant liquidity throughout the year.

Weak Momentum and Cash Outflows Keep HYPE Below Resistance

Market data shows that HYPE struggled to maintain bullish momentum ahead of the unlock. The token is down 14.2% over the past week and over 22% over the past 14 days.

It is currently trading nearly 46% below its all-time high of $59.30. Technical indicators also point to continued pressure.

HYPE attempted to climb above its 20-day EMA on Thursday, but was rejected by sellers, and it fell below the $35.50 support level on Friday.

Analysts warn that a daily close below this threshold could trigger a broader downtrend towards $28 and potentially $24.

Chart readings show HYPE remaining below key resistance areas, with supply clusters between $36 and $42 acting as a ceiling for recovery attempts.

Indicators such as an RSI of 34 and negative Chaikin Money Flow show weakening momentum and persistent cash outflows.

According to market analysts reviewing the chart, buyers will need to quickly reclaim the $35.50 region to avoid a deeper breakdown, while further relief would require a move above the 50-day SMA near $41.

This release comes at a time when perpetual futures activity in the broader market remains high despite falling prices of major assets.

According to data from DefiLlama, the daily trading volume on decentralized exchanges ranges between $28 billion and $60 billion.

Over the past 30 days, the four largest platforms, Lighter, Aster, Hyperliquid and edgeX, have processed over $1 trillion in cumulative volume.

Lighter posted the highest monthly figure with $300 billion, followed by Aster with $289 billion, Hyperliquid with $259 billion, and EdgeX with $177 billion.

Hyperliquide also leads the industry in open interest, with over $6.3 billion in active positions, suggesting continued reliance on the platform even as its token faces downward pressure.

The post Unlocking of Hyperliquid Token Puts $314M at Risk as Transparency Fears Rattle Traders appeared first on Cryptonews.