Join our Telegram channel to stay up to date with the latest news

U.S. lawmakers moving to limit rewards on U.S.-issued stablecoins would give China and others a strategic advantage, warns Faryar Shirzad, policy director at Coinbase.

“If this issue is mishandled during Senate negotiations on the Market Structure Bill, it could provide valuable assistance to our global rivals by giving non-US stablecoins and CBDCs a critical competitive advantage at the worst possible time,” the executive said in a Dec. 30 statement. job.

Chinese central bank revises its CBDC strategy

The warning comes as China prepares a major overhaul of its central bank digital currency (CBDC) strategy that aims to boost adoption of the digital yuan (e-CNY).

This digital yuan has struggled to gain traction in the market despite years of pilot programs and research. In a bid to boost adoption of the token, the People’s Bank of China (PBOC) announced earlier this week that it would allow commercial banks to pay interest on customers’ digital yuan holdings. This is part of a new framework that is expected to come into effect on January 1, 2026.

🚀 China offers massive Digital Yuan (e-CNY) upgrade for 2026!

The PBOC has just announced that banks will soon pay interest on CBDC holdings in order to encourage mass adoption.Highlights:

💰 Interest-bearing: Earn interest on your digital yuan wallet.

🏦 New status: evolves…– Dollars with Prasad (@p3prasad) December 29, 2025

Under the new policy, e-CNY will move from functioning as digital money to “digital deposit currency”, said People’s Bank of China Deputy Governor Lu Lei.

Debate on Yield-Providing Stablecoins in the United States

Shirzad’s post also comes after US President Donald Trump signed the GENIUS Act in July. This is the first stable US regulatory framework at the federal level.

Under the GENIUS Act, stablecoin issuers are prohibited from offering returns directly to token holders. However, this same prohibition is not extended to third-party service providers. Critics have argued that this “loophole” allows stablecoin issuers to circumvent the ban.

Coinbase, for example, offers returns on the USDC stablecoin, issued by Circle.

This ban on stable yields has been the subject of debate in 2025, particularly regarding how strictly the ban should be enforced.

On the one hand, crypto companies argue that limiting rewards could weaken the competitiveness of U.S. stablecoins against foreign alternatives and CBDCs. Meanwhile, banking groups are urging regulators to impose a blanket ban.

In a December 18 letterThe Blockchain Association, along with more than 125 crypto industry participants, urged Congress to reject the banking industry’s efforts to expand the GENIUS Act’s ban on stablecoin interest or returns.

The same day, the American Bankers Association issued a letter on its own initiative, calling on lawmakers to strictly enforce the GENIUS Act’s ban on yield-producing stablecoins. He argued that some crypto exchanges are interpreting the law in a way that allows rewards-like incentives. The group warned that this could harm traditional banking business.

USD stablecoins dominate the market

While the debate over stablecoin yields in the United States continues, tokens linked to the US dollar still represent the lion’s share of the market.

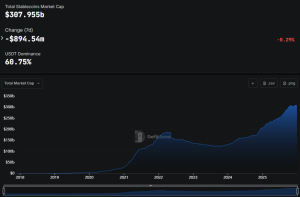

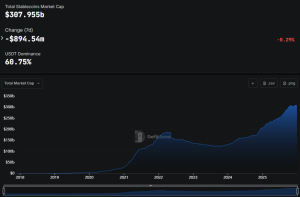

Data from DefiLlama shows that the stablecoin market capitalization stands at approximately $307.95 billion.

Stablecoin market capitalization (Source: DefiLlama)

Of this amount, non-USD stablecoins only account for around $1.4 billion.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news