Key takeaways

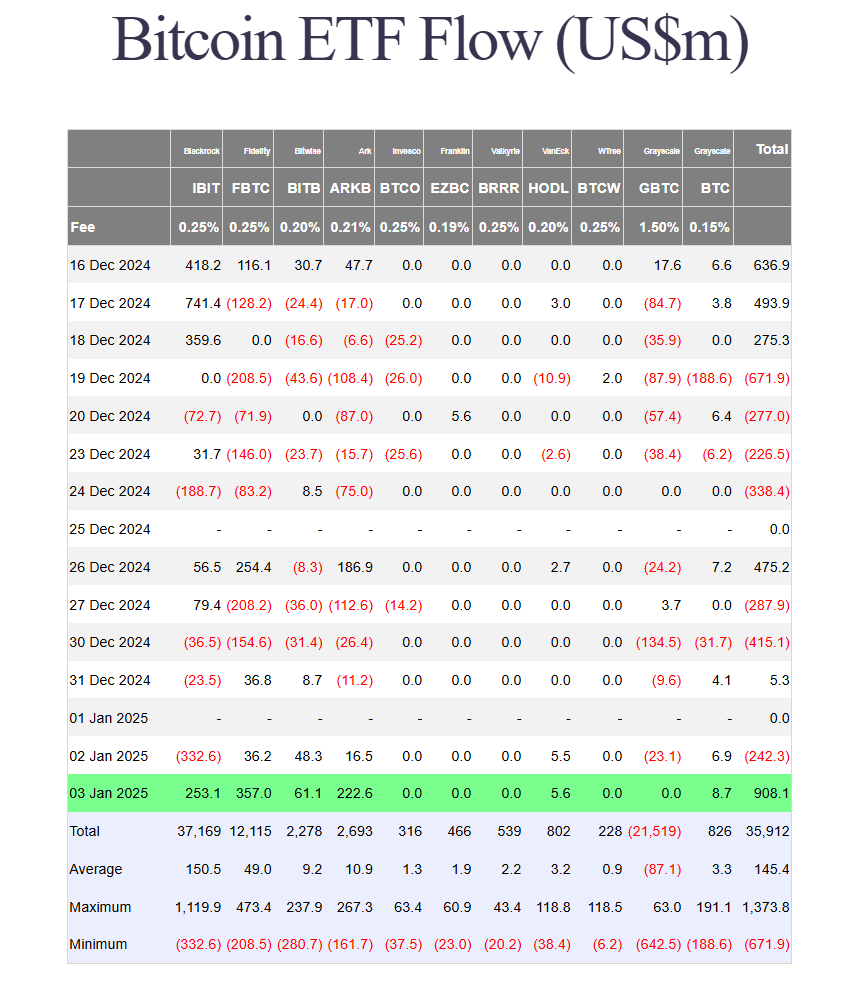

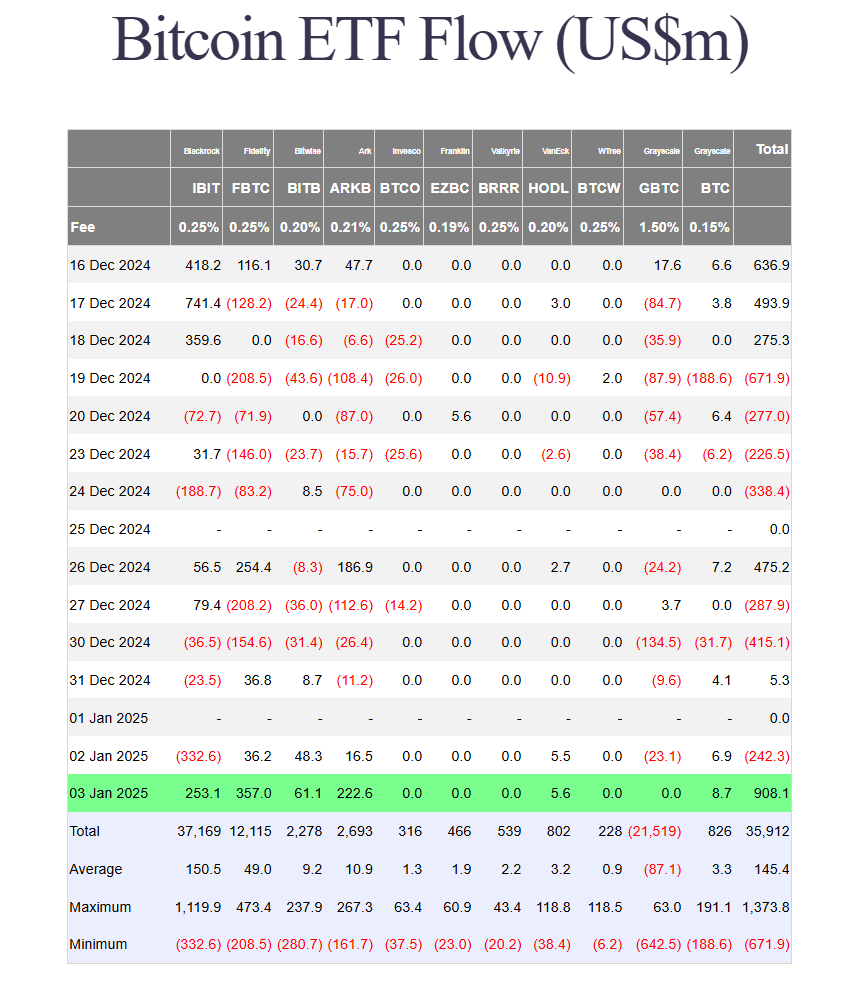

- US Bitcoin ETFs saw $908 million in net inflows, a rebound from the previous day’s outflows.

- Fidelity’s Bitcoin fund saw net inflows, with significant contributions from BlackRock and ARK Invest funds.

Share this article

U.S. spot Bitcoin ETFs raked in $908 million in net inflows on Friday, rebounding from Thursday’s outflows of $242 million, according to data from Farside Investors.

BlackRock’s iShares Bitcoin Trust (IBIT) brought in $253 million, ending a three-day negative streak that resulted in losses of $392 million. Total net inflows to the fund came in at $37 million, with holdings of 548,506 Bitcoins valued at $53.4 billion.

Fidelity’s Bitcoin Fund (FBTC) led Friday’s gains with $357 million in net inflows, one of its strongest daily performances since its launch. FBTC has accumulated over $12 billion in new investments as of January 3.

The ARKB fund, managed by ARK Invest and 21Shares, recorded $222 million in net inflows. Bitwise, Grayscale (BTC) and VanEck funds also saw gains, while other ETF providers reported no flows.

Bitcoin recovers the $98,000 mark

Bitcoin hit $98,900 on Friday, surpassing $98,000 for the first time since Dec. 26, according to CoinGecko data. The digital asset is currently trading above $98,000, showing a 4% increase over the past week.

Analysts predict a bullish year for Bitcoin, driven by growing institutional and domestic adoption.

Galaxy Research predicts that five Nasdaq 100 companies and five countries will add Bitcoin to their balance sheets in 2025 to diversify their portfolio and meet their trade settlement needs. The company also projects that U.S. spot Bitcoin ETFs will reach $250 billion in assets under management.

Jan van Eck, CEO of VanEck, recommends investors increase their holdings of Bitcoin and gold through 2025, as these assets provide valuable protection against inflation, fiscal uncertainty, and global dedollarization trends.

Van Eck predicts that Bitcoin could reach $150,000 to $170,000. This position is supported by other financial analysts and institutions recognizing Bitcoin’s potential to protect against financial risks.

Share this article