Join our Telegram channel to stay up to date with the latest news

Senator Cynthia Lummis says a national strategic reserve of Bitcoin could help combat “burgeoning” US debt.

“I sincerely believe that the Bitcoin strategic reserve is the only solution to offset our national debt,” she said in an article earlier today. She then praised Donald Trump’s administration for embracing the idea of a US Strategic Bitcoin Reserve (SBR), and said she couldn’t wait to “do it.”

I sincerely believe that the strategic Bitcoin reserve is the only solution to offset our national debt.

I applaud @POTUS and his administration for passing the SBR, and I look forward to making it happen. pic.twitter.com/e24NBOJ3v0

– Senator Cynthia Lummis (@SenLummis) November 5, 2025

Despite his comments, the price of Bitcoin fell more than 2% in the past 24 hours amid a crypto market sell-off. As a result, Bitcoin is now down more than 10% on the weekly time frame, according to CoinMarketCap.

US Seeks Ways to Build Bitcoin Reserve Beyond Gold Revaluation

In post X, Senator Lummis included an interview she had with Bloomberg.

During the interview, Lummis was asked if she had seen any “traction” around officials’ proposal to revalue U.S. gold to fund the reserve. Senator Lummis responded by saying that she had not yet seen any progress.

“I think the administration is looking at ideas other than using our gold certificates, putting them on the market, and then converting them to Bitcoin,” she said.

“There are other ways to have a strategic reserve of Bitcoin than converting our gold certificates,” she added.

Senator Lummis then praised the support of U.S. Treasury Secretary Scott Bessent and White House staff, who she said are working on the details of BSR funding.

Senator Lummis says SBR procurement could begin at any time

The interview comes after Lummis signaled urgency last month regarding the proposed Bitcoin Strategic Reserve, which President Trump signed an executive order to create earlier this year. She said the reserve purchasing framework could begin at any time and praised Trump for creating the conditions to act quickly.

Senator Lummis called the legislative process slow, but said the SBR funding mechanism should not wait.

Questions remain about how the reserve will be funded, especially since Senator Lummis has not provided a comprehensive plan for how the government would capitalize the reserve.

According to an administration fact sheet from March, the reserve’s initial funding would be Bitcoin, already controlled by the U.S. Treasury through criminal and civil forfeitures.

The factsheet adds that more Bitcoin could be added to the SBR through “budget-neutral strategies” that do not result in new costs for taxpayers.

If the United States funded its SBR with early seized Bitcoin, the United States would hold one of the largest sovereign assets in the world. This follows the record confiscation of nearly 130,000 BTC related to criminal cases. At current prices, this Bitcoin is valued at over $34 billion.

Despite the urgency of Lummis, traders on decentralized prediction market Polymarket are not convinced that SBR will be created this year.

Contract asking if the American SBR will be created in 2025 (Source: Polymarket)

A contract asking whether the US National Bitcoin Reserve will be established in 2025 shows Polymarket traders see only an 8% chance of that happening. This is a 5% rating decline over the past month, a 3% decrease over the past week, and a 1% decline over the past 24 hours.

US national debt hits record high

The desire to create an SBR comes as the American national debt reaches record levels.

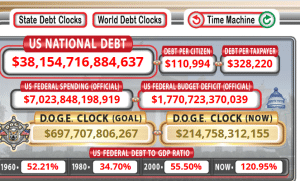

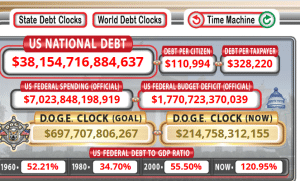

According to data from US Debt Clock, the national debt stands at more than $38.1 trillion. This equates to approximately $110,994 in debt per American citizen.

American national debt (Source: US Debt Clock)

The US debt-to-gross domestic product (GDP) ratio has also increased from 55.50% to 120.95% since 2000.

In addition to the skyrocketing debt, the US government was also shut down for 35 days, making it the longest government shutdown on record.

The shutdown was triggered because Congress failed to pass the appropriations bill needed to fund the government for the new fiscal year beginning October 1.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news