Senate delays crypto bill as new provision gives XRP, SOL, DOGE and LINK equal status to Bitcoin and Ethereum.

- Democratic senators have reportedly asked Senate Banking Committee leaders to delay implementation of the CLARITY Act.

- The request comes as lawmakers address concerns about the timing of passing the legislation.

- Industry leaders commented on market sentiment and the potential impact of the bill on market structure.

Democratic senators reportedly asked Senate banking leaders on Monday to delay implementation of the CLARITY Act, according to journalist Eleanor Terrett.

Terrett wrote on

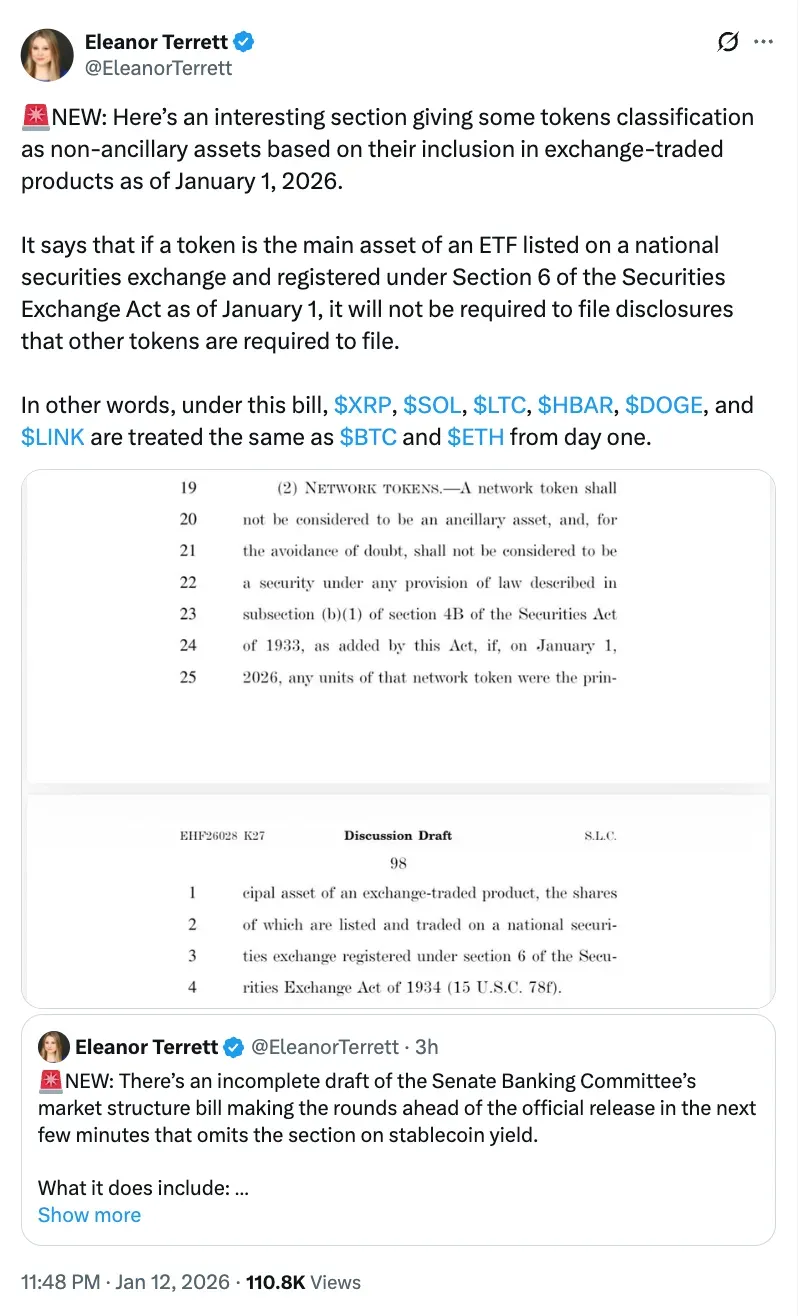

In the letter, senators objected to receiving the bill, just two days before markup. They called the timetable inadequate for “voting on the most important legislation considered by the committee this century.” Later, Terrett highlighted an interesting section of the law, noting that under it, certain crypto tokens will automatically receive regulatory parity with Bitcoin and Ethereum when included in exchange-traded products.

The provision states that any digital asset that is the underlying asset of an ETF listed on a national securities exchange and registered under Section 6 of the Securities Exchange Act on or after January 1, 2026, would be considered a “non-incidental asset.”

As a result, these tokens would not be subject to the additional issuer disclosure requirements that many other crypto projects would face under the bill. Terrett highlighted XRP (XRP), Solana (SOL), Litecoin (LIT), Hedera (HBAR), Dogecoin (DOGE), and Ripple’s Chainlink (LINK).

The total crypto market was valued at $3.13 trillion, with Bitcoin (BTC) trading at $92,051.12, up 0.3% over the past day. On Stocktwits, retail sentiment towards the top currency moved from ‘bullish’ to ‘bearish’ territory as discussions remained at ‘normal’ levels over the past day.

A markup is a formal committee meeting in which lawmakers “mark up” the text of a bill, meaning they go through it line by line, discuss and suggest changes. They can also vote on these changes and decide whether to move the bill to the next step, which is usually a vote in the full committee, followed by a vote in the full house.

Cryptography experts weigh in

Terret noted that all three senators had previously opposed crypto legislation. As the bill moves through the Senate, Mark Hougan, chief investment officer at Bitwise, said the bill could influence broader market sentiment.

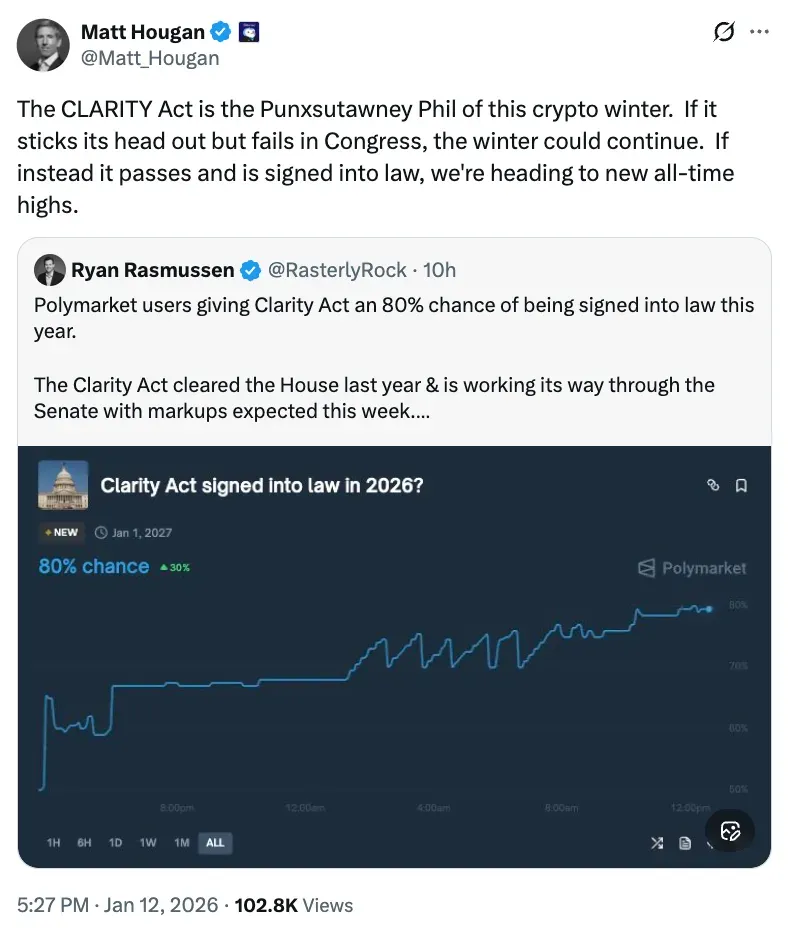

Hougan called the CLARITY Act the “Punxsutawney Phil of this crypto winter,” meaning the law acts as an early signal for the direction of the crypto market. He said the bill’s failure in Congress could prolong the current downturn, while its passage could lead us to a “new (historic) high.”

Separately, Ryan Rasmussen, head of research at Bitwise, said on

The CLARITY Act, passed by the House last year, aims to establish a regulatory framework for digital assets.

Read also: Bitcoin, Ethereum and Solana plunge amid Washington policy gridlock

For updates and corrections, email newsroom(at)stocktwits(dot)com.

Learn about our editorial guidelines and ethics policy