Join our Telegram channel to stay up to date with the latest news

US Federal Reserve Governor Stephen Miran said policy must catch up with the growing stablecoin market, which he said could reach as much as $3 trillion by the end of the decade.

“Stablecoins could become a multi-trillion dollar elephant in the room of central bankers,” Miran, who is the newest member of the Fed’s board of governors after his recent confirmation, said in a statement. speech.

“Based on the surveys I’ve seen and the forecasts I’ve seen, it’s definitely a force to be reckoned with,” he said of the stablecoin market.

“The interquartile range of private sector estimates compiled by Federal Reserve staff roughly projects that stablecoin adoption will reach between $1 trillion and $3 trillion by the end of the decade,” he added.

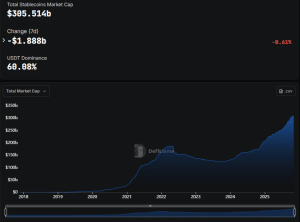

This predicted market cap range is significantly higher than the current industry capitalization of approximately $305.514 billion, according to DefiLlama data.

Stablecoin market capitalization (Source: ChallengeLlama)

Miran said “stable coin growth may not live up to expectations” and cited potential yield and reward arrangements that could “limit adoption.”

The GENIUS Act Provides Industry with Regulatory Clarity

Miran’s prediction comes after US President Donald Trump signed the GENIUS Act earlier this year in July. The new Fed governor said that as a result of this signing, “there is now a clear regulatory pathway in the United States for stablecoin issuers to expand their reach and solidify stablecoins as a critical part of the payments system.”

“I am encouraged that the Federal Reserve is taking steps to recognize the importance of stablecoins to the payments system,” he said.

However, Miran added that “economic research has some catching up to do.” He also mentioned that a number of questions remain open and need to be resolved.

These include questions about how many assets stablecoin issuers will manage, whether funds will come from domestic or foreign sources, as well as the systemic risks that stablecoins pose to the traditional financial system.

Stablecoins will strengthen the global dominance of the dollar

Miran also said that stablecoins contribute to the global dominance of the US dollar. Indeed, the largest stablecoins in terms of market capitalization, such as Tether’s USDT which represents more than 60% of the sector, are tokens indexed to the greenback.

The fastest growing stablecoins based on 30-day growth (%) in market cap.

A key point to remember:

The stablecoin market attracts both TradFi and crypto-native teams; many of them rely on @ethereum. pic.twitter.com/epKfKxBTAI

– Token Terminal 📊 (@tokenterminal) November 6, 2025

“My thesis is that stablecoins are already increasing demand for U.S. Treasuries and other dollar-denominated liquid assets by buyers outside the United States and that this demand will continue to grow,” the Fed governor said.

He added that even stablecoins outside the jurisdiction of the GENIUS Act “are likely to drive demand for Treasuries and other dollar-denominated assets.”

“Stablecoins that do not comply with the GENIUS Act can invest reserves in a much broader range of assets, but, to be considered reliable stores of value, they will likely end up still investing substantially in U.S. dollar securities with minimal credit risk,” Miran explained.

This increased demand will also reduce the cost of borrowing for the U.S. government, he added.

However, for stablecoin adoption to happen, Miran argued that there must be a bridge between local fiat currencies and stablecoins.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news