The United States Senate Banking Committee is set to create its first-ever subcommittee dedicated to regulating cryptocurrencies and digital assets.

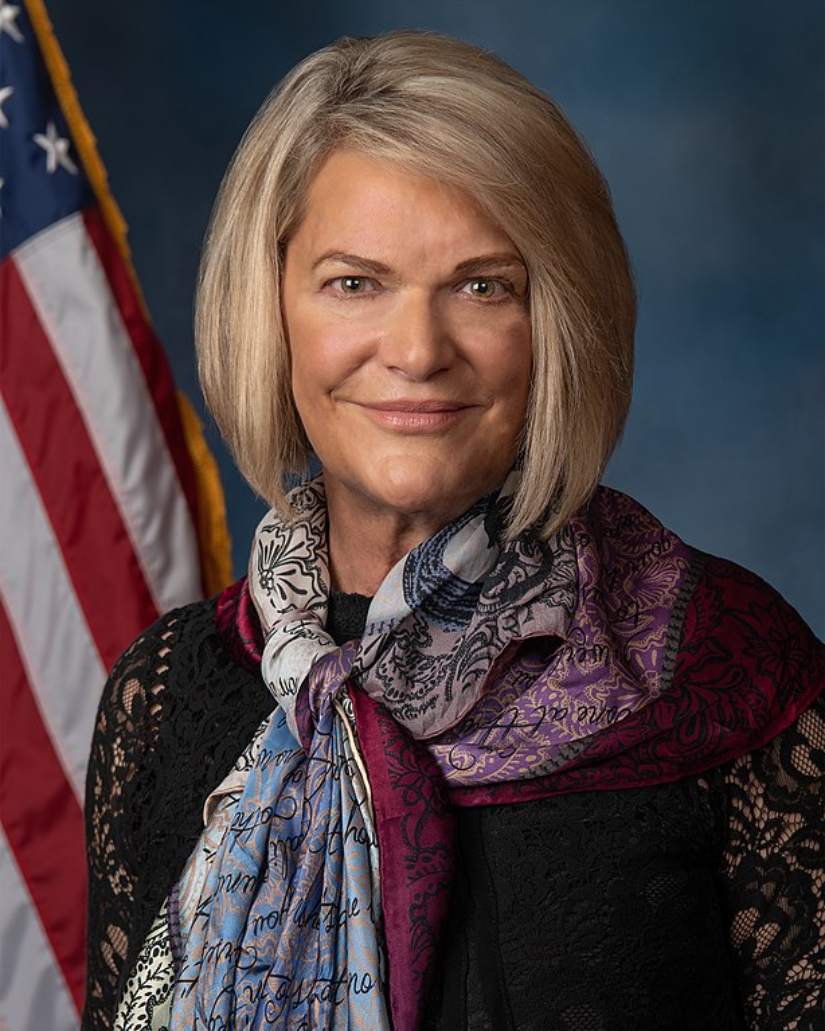

This decision represents an important step towards creating a more structured regulatory framework for the growing cryptocurrency sector. Wyoming Republican Sen. Cynthia Lummis, a staunch Bitcoin advocate, has been tentatively selected to chair the new subcommittee, pending a confirmation vote next week.

A milestone in crypto regulation

Under the leadership of Senator Tim Scott, the Senate Banking Committee is making cryptocurrency oversight a priority as regulatory scrutiny and public interest in the sector continues to grow. The move echoes the crypto subcommittee launched in 2023 by former Congressman Patrick McHenry within the House Financial Services Committee.

Source: Éléonore Terrett via

This subcommittee will establish new regulatory clarity regarding digital assets, stablecoins, and other blockchain technologies. Aides in Senator Scott’s inner circle say the subcommittee aims to balance the scales with the industry’s growth down the road and to mitigate the possibility of risk from high volatility or major security breaches.

Pro-crypto leadership and membership

Senator Lummis’ nomination reflects years of support for blockchain innovation and Bitcoin adoption. She has proposed legislation that would establish a strategic Bitcoin reserve that would revolutionize the way the United States manages digital assets.

Senator Cynthia Lummis Source: Wikipedia

Newly elected Senators Bernie Moreno of Ohio and Dave McCormick of Pennsylvania, joined by Thom Tillis of North Carolina and Bill Hagerty of Tennessee, round out the subcommittee’s initial list of tentative members. Moreno and McCormick each received millions of dollars in support from pro-crypto political action committees during their campaigns, a pretty clear signal that they will be supportive of industry-friendly policies.

Main legislative priorities

The subcommittee will review critical legislation, including the Financial Innovation and Technology for the 21st Century Act, or FIT21. The bill aims to clarify whether cryptocurrencies are securities or commodities, thereby attempting to end long-standing jurisdictional disputes between the SEC and CFTC.

Additionally, the Bitcoin Strategic Reserves bill introduced by Senator Lummis could become another hot topic, perhaps transforming federal approaches to cryptocurrency. It also follows broader initiatives to position the United States as a global leader in the use and development of digital assets.

New rules, big changes

The timing of this initiative coincides with the Republican majority in Congress and Donald Trump’s second term as president, providing an opportunity for a unified government to enact crypto-friendly policies. The subcommittee’s formation also highlights the growing integration of digital assets into traditional finance, as highlighted by recent events such as the Justice Department’s $6.7 billion Bitcoin auction in the case Silk Road.

Source: Crypto Edition via

Although the crypto industry has welcomed these developments, public opinion remains divided. Supporters argue that regulatory clarity will encourage innovation and stabilize the market, while critics cite concerns about volatility and possible overreach.

Looking to the future

The new subcommittee is expected to begin its work shortly after Lummis’s confirmation vote. With its pro-crypto makeup and focus on legislative clarity, it is well-positioned to shape the future of cryptocurrency regulation in the United States, potentially setting a global standard for the industry.

This initiative represents a pivotal moment for digital asset governance, signaling the US government’s growing commitment to fostering a secure and innovative crypto ecosystem.