Key takeaways

- US spot Bitcoin ETFs have accumulated $1 billion in three days.

- This record growth indicates strong market demand for Bitcoin investments.

Share this article

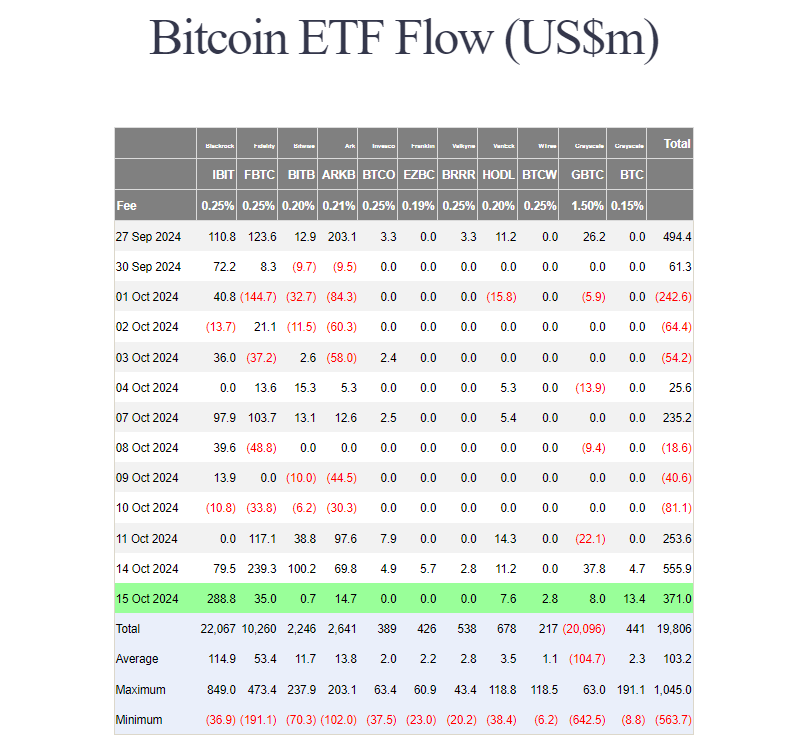

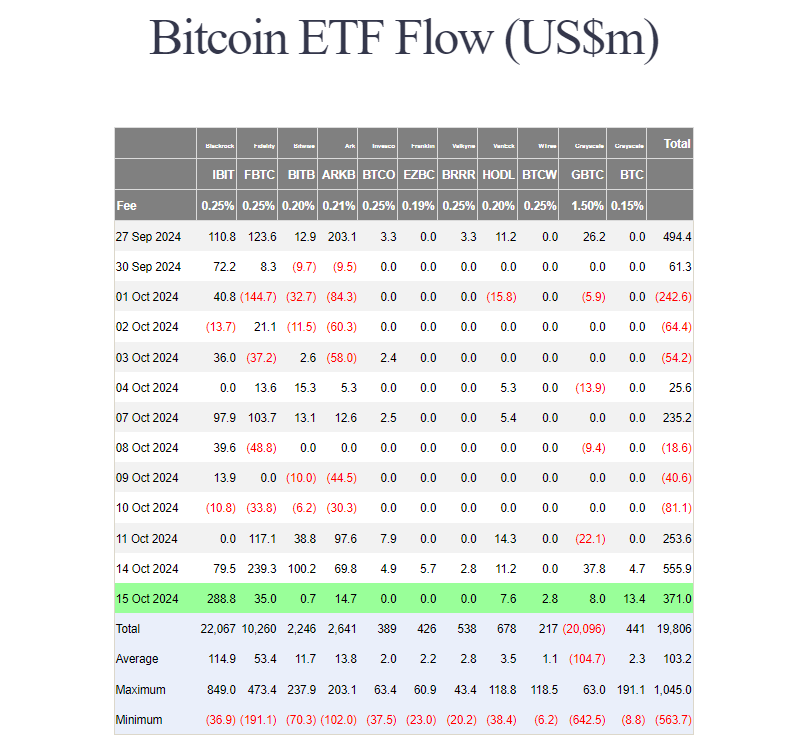

U.S. spot Bitcoin ETFs have seen a significant increase in net purchases, totaling more than $1 billion over the past three trading days, according to Farside Investors. Fidelity and BlackRock were the best performers, together attracting around $760 million during this period.

Flows returned to the green last Friday as Bitcoin ETFs collectively raised $253 million, ending their brief outing streak that lasted three consecutive days. On Monday, these funds recorded nearly $556 million in net inflows, the highest level since early June.

Yesterday alone, ETF net purchases exceeded $371 million and no redemptions were reported. BlackRock’s IBIT captured the largest stock inflows, accumulating more than $288 million, while Fidelity’s FBTC took in about $35 million.

Other competing funds managed by Bitwise, Ark Invest/21Shares, VanEck, WisdomTree and Grayscale, also saw gains. Grayscale’s GBTC and BTC extended their winning streak to two days.

Inflows increased amid a Bitcoin rally, with the price surpassing $65,000 on Monday and closing in on $68,000 yesterday, according to CoinGecko data. Bitcoin is now only 9% from its all-time high.

Analysts at Standard Chartered predict that Bitcoin could approach its previous high of around $73,800 ahead of the US presidential election.

Analysts also note that Donald Trump’s improving re-election chances could create a favorable environment for Bitcoin, as historically his presidency has been viewed positively by many in the crypto community.

Share this article