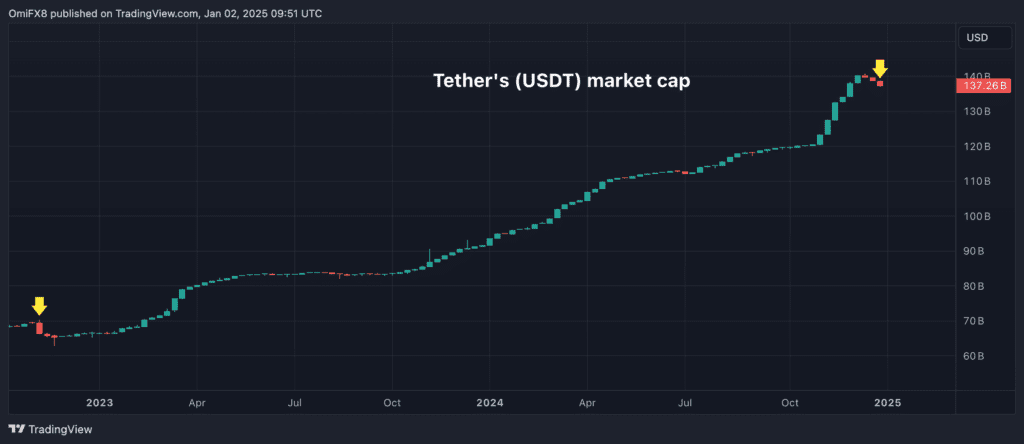

Tether’s USDT, the world’s leading dollar-pegged stablecoin, saw the biggest weekly drop in market value in two years, sparking concerns over market volatility.

USDT’s market capitalization slipped more than 1% to $137.24 billion this week, the biggest drop since the FTX stock market crash in the second week of November 2022, data from TradingView. It reached a record $140.72 billion in mid-December.

The drop follows the decision by several European Union (EU) exchanges and Coinbase (COIN) to delist USDT due to compliance concerns with the European Markets in Crypto-Assets (MiCA) regulation which came into full force on December 30, even though rules on stablecoins – cryptocurrencies whose value is tied to a real-world asset like the dollar – took effect six months ago.

The regulations require issuers to have a MiCA license to publicly offer or trade asset-referenced tokens (ART) or electronic money tokens (EMT) within the block. An ART is a crypto asset that seeks to maintain a stable value by referencing another asset like gold, crypto tokens, or a combination of the two, including one or more official currencies. ERTs refer to a single national currency, just like USDT.

EU-based traders can still hold USDT in non-custodial wallets, but cannot trade them on centralized MiCA-compliant exchanges.

USDT is a gateway to the crypto market, with investors using it widely to fund cryptocurrency spot purchases and derivatives trading. As such, the delistings and falling market value have sparked speculation of a broader crypto market slump on social media.

These concerns may be unfounded, however, and the negative impact, at best, may be limited to the eurozone, said Karen Tang, head of APAC partnerships at Orderly Network, a permissionless Web3 liquidity layer, in an article on X.

“Access to @Tether_to, which is expected to be restricted in the EU due to MiCa regulations, will not harm USDT dominance,” Tang wrote. “The EU is not the largest crypto market. Most cryptocurrency trading volumes take place in Asia and the US. All this will only hinder digital asset innovation in the EU, which is already slow due to excessive and convoluted regulation If I could short the EU, I would…”

Crypto analyst Bitblaze said Asia accounts for the giant share of tether volume, downplaying the impact of MiCA-led delistings in Europe.

“USDT is the largest stablecoin, with a market capitalization of $138.5 billion and a daily trading volume of $44 billion. Currently, 80% of USDT’s trading volume comes from from Asia, so delisting from the EU will not have a major impact” Bitblaze rated on X.

Tether has invested in MiCA-compliant companies StablR and Quantoz Payments in an effort to ensure regulatory alignment.