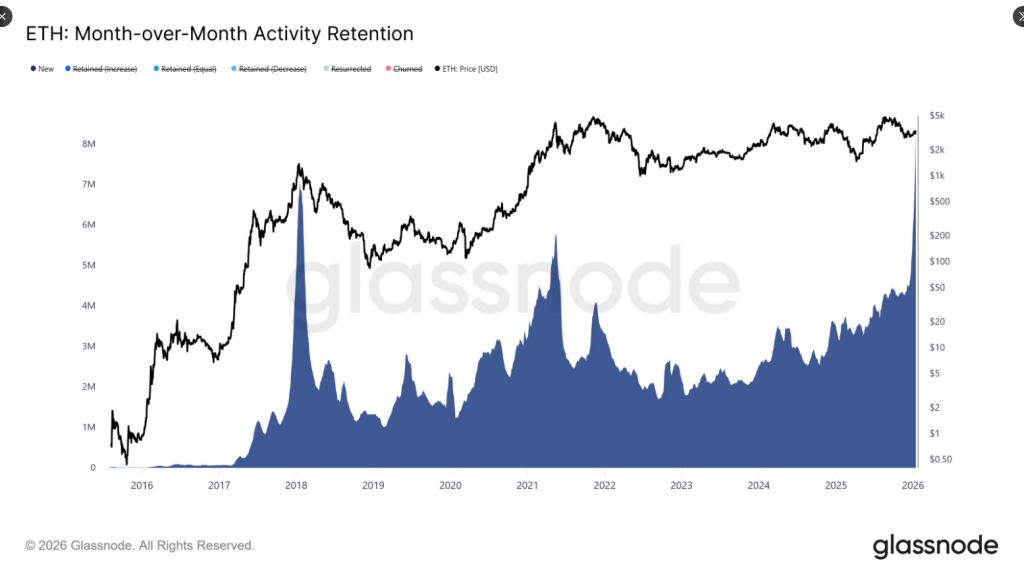

Ethereum’s on-chain activity has increased sharply, driven by a wave of new users and greater transaction flow across the network. According to Glassnode, new activity retention roughly doubled this month from around 4 million to around 8 million addresses, a development that indicates a new cohort of wallets interacting with Ethereum rather than just regular users.

Related reading

Increase in new users

Daily transactions hit a record high of 2.8 million on Thursday, up 125% from the same period last year. According to reports from Etherscan, active addresses more than doubled year-over-year, from around 410,000 accounts to more than a million as of January 15. These numbers suggest that real, widespread engagement is increasing, not just short-lived spikes.

Ethereum’s month-over-month activity retention shows a sharp increase in the “New” cohort, indicating an increase in the number of addresses interacting for the first time in the last 30 days.

This reflects a notable influx of new wallets engaging with the Ethereum network, rather than activity… pic.twitter.com/h8Zw7hXOSX– glassnode (@glassnode) January 15, 2026

Boom in transactions and L2 effects

Observers partly associate the growth in transactions with increasing stable activity and falling fees. Reports have revealed that many transfers are migrating their execution to Layer 2 networks while settlement remains on the Ethereum mainchain, ensuring finality security and helping to reduce gas costs. Staking has also increased, reaching almost 36 million ETH, adding another layer to the network’s supply crunch dynamics.

At the same time, market behavior remains cautious. Strong U.S. stocks have helped stabilize cryptocurrency prices, but the money flowing into Ethereum appears selective rather than broad.

It seems that the positioning is rather conservative; traders prefer to wait for more accurate signals regarding ETH prices rather than trying to predict a breakout. In turn, ETH is consolidating around a correction, but there is not enough momentum-driven buying.

Analyst Opinions and Price Developments

Some also showed optimism due to the channel’s improving fundamentals. For example, LVRG Research reported that the growing number of transactions and staking activities encouraged positive networking.

Some traders say the price squeeze could precede a breakout. Ether traded near a two-month high of $3,400 on Wednesday and was around $3,300 in early trading Friday, reflecting the tug-of-war between renewed demand and continued caution.

Despite stronger indicators, technical obstacles remain. Recent reports and analysis suggest that the market is in a repair phase and not in a confirmed uptrend.

Overhead supply is still limiting sustainable advances, and many market participants want to see ETH reclaim key long-term resistance levels, such as the 200-day EMA, before committing large-scale capital.

This explains why short-term traders operate within a set range while long-term players hold back.

Related reading

What this means for traders and investors

The health of the network has improved significantly – more users, more transactions and higher stakes – but price action has yet to keep up with these gains.

Based on the data presented, cautious optimism is reasonable. Traders may have an opportunity to trade on the range, while investors seeking conviction should wait for clearer technical confirmation before anticipating a sustained rally.

Featured image from Blockzeit/EthBurn, chart from TradingView