Key notes

- The partnership allocates VCI Global A management participation of 70% while the partner retains custody of the substantial reserves of Bitcoin.

- The platform ESVAULT will store cryptocurrency using material encryption and quantum resistant safety measures for institutional protection.

- VCIG shares jumped 17.6% after the announcement despite the authorization of 99.98% of losses since its inception in April 2023 in the NASDAQ.

The company will manage marketing with a participation of 70%, while its partner maintains custody of Bitcoin reserves. The areas of interest include active active worlds, the provision of safe services and the connection of IA computers.

According to VCI Global’s announcement, Bitcoin will be stored in EtriVault, a platform with quantum material and resilient functionalities, responding to certain increasing concerns concerning quantum IT and the safety of cryptocurrencies. This configuration aims to support governments and institutions with secure digital executives.

The initiative is based on the work of VCI Global in cybersecurity and AI, including recent launches such as Qsecore and its GALANTE V Division for GPU equipment. Dato ‘Victor Hoo, President and CEO, said the partnership is helping to build secure and scalable digital asset systems aligned with regulations.

“This partnership is an important step towards the manufacture of Bitcoin infrastructure, in accordance with sovereigns and RWA.

With the Bitcoin market capitalization of $ 2.25 billions of dollars when writing this article, according to CoinmarketCap data, this positions VCI Global among the companies listed at NASDAQ combining large Bitcoin farms with advanced infrastructure.

VCI Global (Nasdaq: VCIG) Price analysis

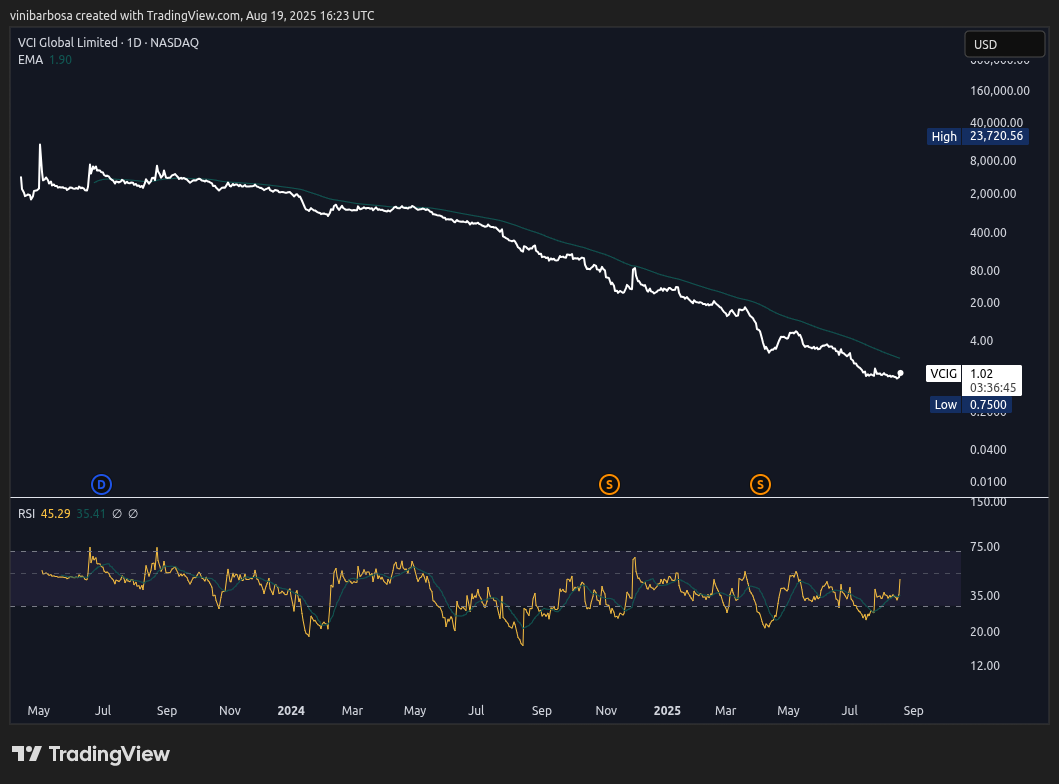

Actions VCI Global (NASDAQ: VCIG) was negotiated at $ 1.02 per press day, up 17.6% per intraday, after the announcement. However, the VCIG has had price performance difficulties since its registration for the NASDAQ, accumulating 99.98% of the losses of April 13, 2023 in its current evaluation.

From the point of view of technical analysis, the stock was negotiated in a neutral dynamic at Bastard, according to the daily index of relative force (RSI), and its trend is always well below the exponential mobile average of 50 days (1D50EMA).

VCI Global (Nasdaq: VCIG) 1D Historical Tample Price | Source: tradingView

Historically, companies like the old microstrategy, now a strategy (NASDAQ: MSTR), have used a Bitcoin reserve strategy as a means of regaining market interest and the action of positive prices, betting on Bitcoin’s success against dollar and other traditional assets.

On a similar note, Bitmine went further, announcing a cash reserve based in Ethereum, also seeing a positive action on prices after cancellation. Brevan Howard, one of the greatest hedge funds in the world, recently revealed an important allowance in BlackRock Bitcoin ETF (Ibit), representing 21% of the fund portfolio. This is another testimony to the growing institutional interest for the main cryptocurrency.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but must not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Vini Barbosa has covered the cryptography industry professionally since 2020, summarizing up to more than 10,000 hours of research, writing and related content for the media and the main players in the industry. Vini is an active commentator and a heavy user of technology, really believing in its revolutionary potential. Subjects of interest include blockchain, open-source software, decentralized finances and real world usefulness.

Vini Barbosa on X