- Smart Money, whales and KOLs reaccumulated VIRTUAL after the price fell below the $2.50 level, leading to a rebound.

- VIRTUAL’s positive momentum towards the Ichimoku cloud suggests a bullish outlook, reinforced by the MACD.

The recent activities of Smart Money, Whales and Key Opinion Leaders (KOLs) in the Virtual Protocol (VIRTUAL) market have marked a notable phase of re-accumulation. This happened especially as the price of VIRTUAL fell below $2.50.

Large buyers made significant purchases at average prices of $2.35 and $2.45, pumping over $551,000 into VIRTUAL as reported on the DEX position. These transactions marked a first foray into this asset, highlighting a strategic entry point.

An increase in purchasing volumes coincided with these acquisitions, reflecting a broader consensus among smart money circles. This suggests that the lower price threshold presented a buying opportunity.

Source: iCryptoAI

This influx, especially after a decline, likely catalyzed the short-term rebound seen in VIRTUAL’s price, confirming the impact of substantial and coordinated purchases on market dynamics.

This trend has highlighted the influential role of large market players in precipitating price rallies during economic downturns.

VIRTUAL Price Action and Prediction

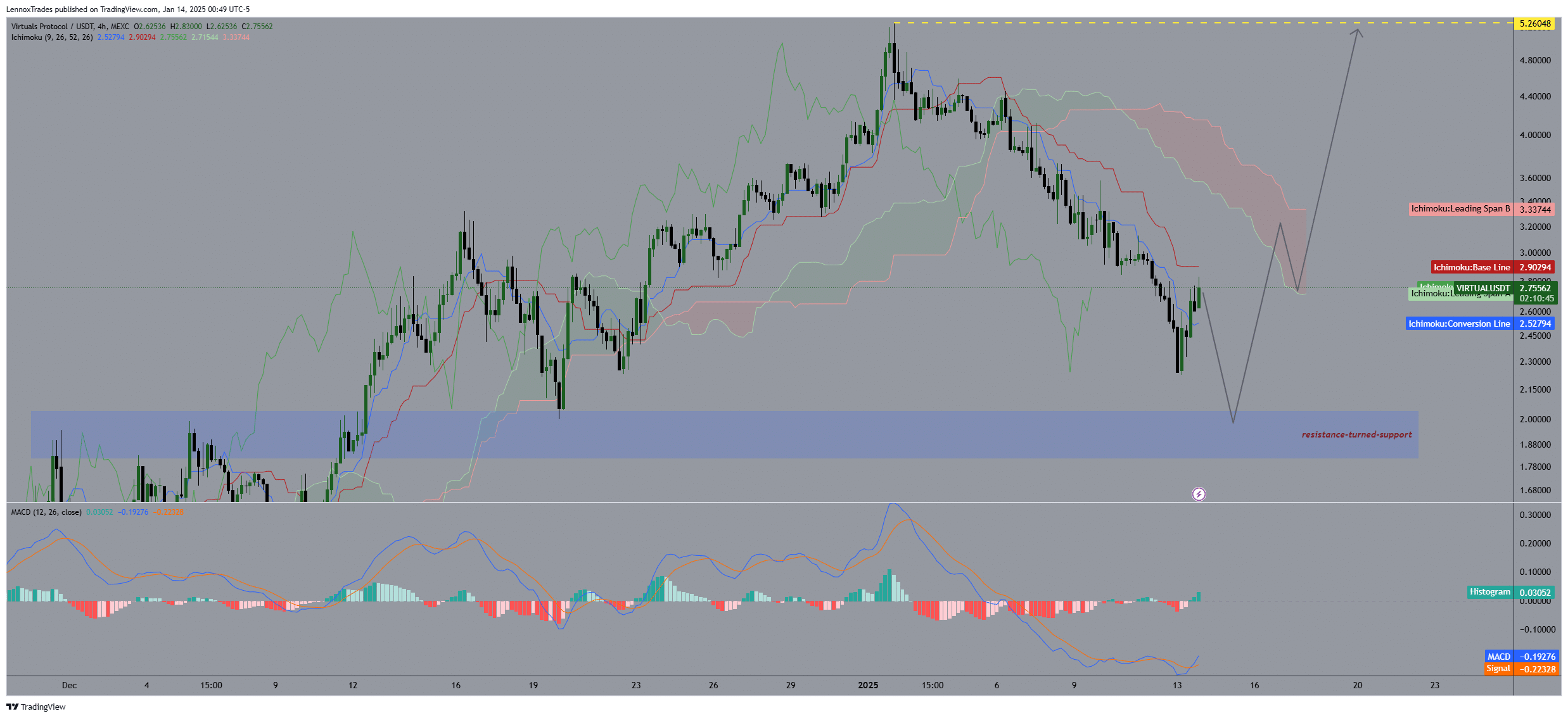

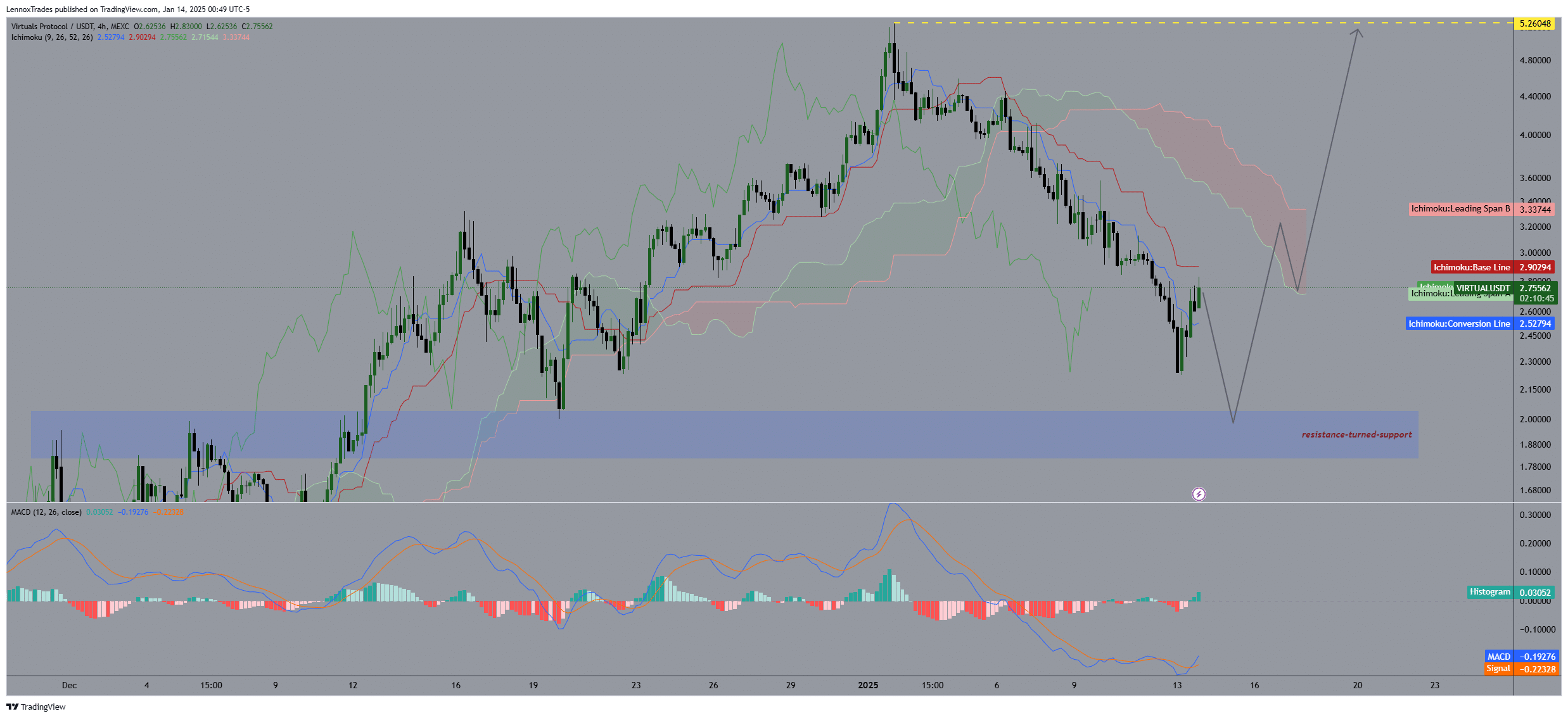

Analysis of the VIRTUAL/USDT chart shows significant resilience when navigating the Ichimoku cloud.

The conversion line at $2.50 highlighted its role as crucial near-term support, facilitating an initial rebound. This bullish movement could find additional support at $3.00, reinforcing the asset’s potential for stability.

MACD indicators support this optimistic outlook. The MACD line crossing above the signal line is a classic bullish signal, suggesting an increase in bullish momentum.

Source: TradingView

Furthermore, price successfully tested the resistance-turned-support level at $2.2, validating it as a key support area for future price action. VIRTUAL is now targeting the resistance level at $5.26 as a significant potential top if the uptrend continues.

However, caution remains in order as a reversal below the $2.2 support could trigger a downtrend, calling into question the current optimistic scenario.

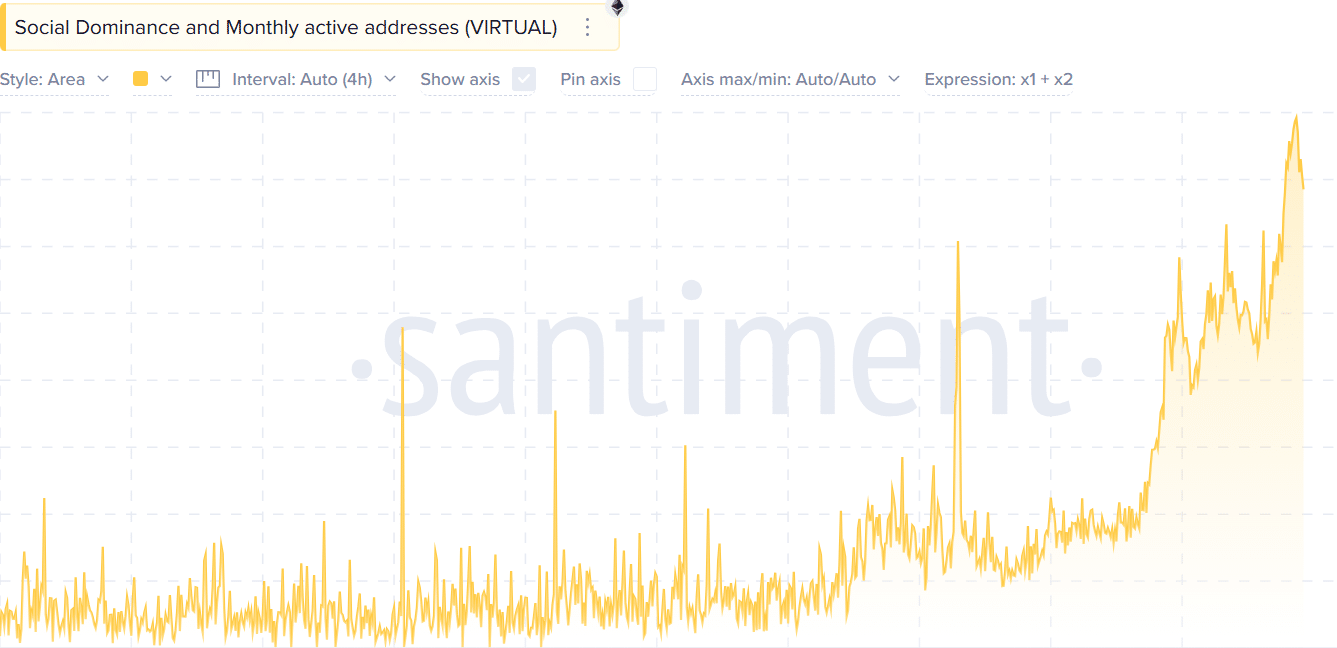

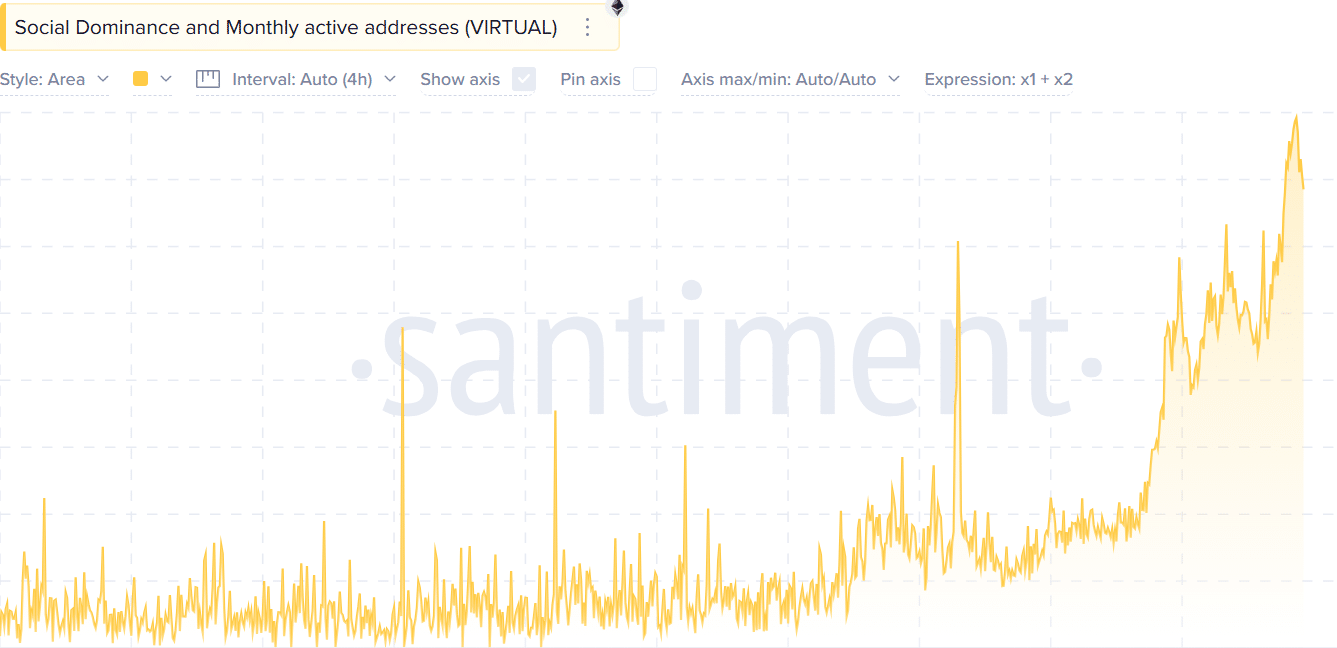

Social dominance and monthly active addresses

Virtuals Protocol’s combined social dominance and monthly active addresses show a clear correlation. As social dominance increased, reflecting increased community interest, active addresses also increased.

This trend suggests increased user engagement and possible speculative activity.

Source: Santiment

Read Virtual Protocol (VIRTUAL) Price Forecast 2025-2026

Historically, these spikes aligned with upward price movements. Increased social attention and active participation could lead to higher prices.

However, these measures also warn of potential volatility. Rapid increases often precede corrections. If this trend continues, the price of VIRTUAL could experience significant fluctuations in the short term.