VISIONVAST Trading Center has strengthened its anti-money laundering and transaction oversight framework to support its compliance-driven operating model and institutional-grade risk management.

This upgrade reflects VISIONVAST Trading Center’s ongoing efforts to align its internal controls with evolving regulatory expectations in key jurisdictions, while supporting a secure and transparent trading environment for global users.

Strengthening Compliance-Focused Oversight

The enhanced framework introduces more granular transaction monitoring, enhanced behavioral analysis, and automated alert mechanisms designed to identify unusual activity patterns at an early stage. These measures aim to improve the effectiveness of monitoring while maintaining a consistent user experience across trading services.

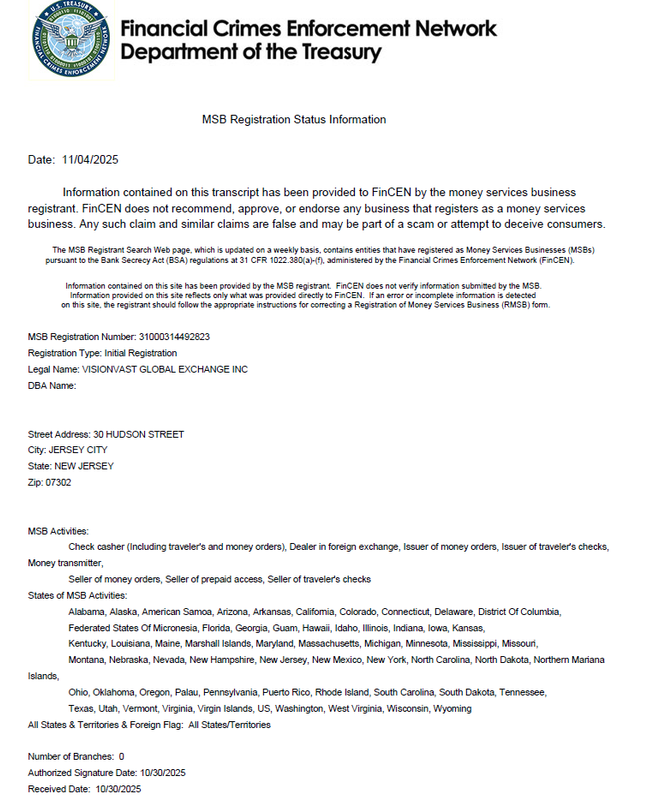

The upgraded systems operate within the VISIONVAST Trading Center’s US Money Services Business (MSB) registered operational framework under the Financial Crimes Enforcement Network (FinCEN), meeting regulatory expectations related to transaction monitoring, recordkeeping and risk reporting.

Integrated risk controls and automation

VISIONVAST Trading Center’s monitoring and anti-money laundering framework integrates automated AML/KYC workflows, AI-assisted risk scoring, and end-to-end audit trails. Together, these components help to strengthen internal transparency, improve traceability and support ongoing compliance monitoring processes.

By integrating transaction monitoring directly into its core platform architecture, VISIONVAST Trading Center aims to reduce manual intervention while improving the consistency and reliability of compliance operations across all regions.

Executive commentary

According to Stephen Wallace, Director of Compliance and Risk at VISIONVAST Trading Center, effective monitoring systems are essential for the sustainable operation of digital assets.

“As regulatory expectations continue to mature globally, transaction monitoring and AML controls must be both robust and adaptable,” Wallace said. “Our goal is to create systems that support regulatory alignment, risk discipline and operational integrity over the long term. »

Wallace added that compliance infrastructure is viewed as an ongoing process rather than a one-time implementation.

Continuous Compliance Development

VISIONVAST Trading Center noted that the enhanced framework is part of a broader compliance development roadmap, which includes periodic system reviews, internal training and continuous assessment of regulatory developments in global markets.

The company emphasized that its approach prioritizes operational resilience and responsible growth, rather than short-term expansion.

About VISIONVAST Shopping Center

VISIONVAST Trading Center is a global digital asset trading platform focused on creating a secure, transparent and operationally robust financial infrastructure. Operating within a compliance-driven framework and supported by advanced risk management systems, the platform provides digital asset trading services to users around the world while pursuing sustainable international development.

Disclaimer: The information provided in this press release does not constitute an investment solicitation nor is it intended to constitute investment advice, financial advice or trading advice. Investing involves risks, including the potential loss of capital. It is strongly recommended that you conduct due diligence, including consulting a professional financial advisor, before investing in or trading cryptocurrencies and securities. Neither the media platform nor the publisher shall be liable for any fraudulent activity, misrepresentation or financial loss arising from the contents of this press release.