Amid tension in parts of the Ethereum ecosystem, Vitalik Buterin outlined proposals for Ethereum’s L1 and L2 scaling, focusing on data throughput and proof systems to address the network requests.

In his latest blog post, he outlined expansions on blob capability and coordinated interoperability initiatives that aim to simplify cross-operations. The post highlighted a plan to balance technical solutions with Ethereum’s social structure, emphasizing that a single chain cannot serve all needs without risking decentralization. Buterin suggested that better security on L2s through multiple activation systems and standardized bridges could make it easier to trust assumptions while allowing different networks to experiment with various virtual machines.

Buterin highlighted the role of blob space expansion as an immediate solution to alleviate layer-2 congestion and suggested that Ethereum’s base layer must meet growing data demands. The ecosystem currently processes about three spots per location – 210 transactions per second – although updates titled PECTRA and PEERDAS could double or triple that throughput.

He emphasized the need for a coordinated roadmap, with pacing mechanisms possibly adjusting Blob targets to match technical improvements. Buterin also mentioned more experimental concepts, including partial trust assumptions for stakers with fewer resources, although he advised caution with designs that risk undermining Ethereum’s fundamentals.

He explained that interoperability is a central priority. Rollups function as single shards controlled by different entities, leading to inconsistent standards for message passing and address formats. This has created fragmentation for developers and users, motivating calls for cross-cutting tools that preserve trustless security rather than relying on multisig bridges.

Buterin proposed unified methods for verifying proofs, expedited depositions and timelines, and chain-specific addresses, including identifiers for each Layer 2 environment. Some developers see this approach as a key step toward user-friendly cross-navigation , although Buterin emphasized that maintaining explicit security guarantees remains critical for all implementations.

Protecting the value of ETH in the Ethereum ecosystem

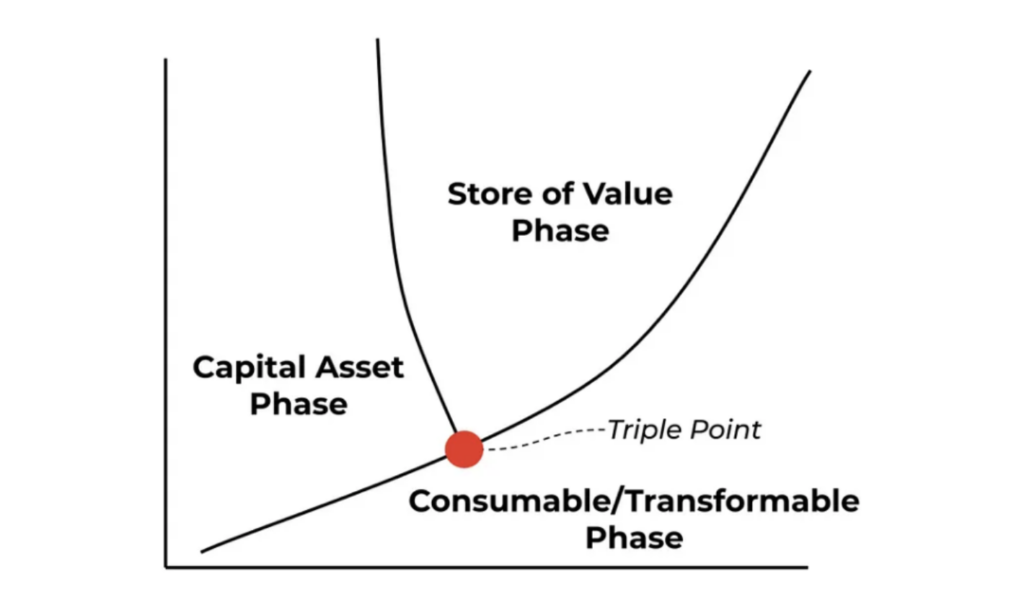

The post also addressed the economic incentives to bolster ETH as a triple-point asset, noting that a combination of reel up fees, ongoing data fees from “blobs,” and on-chain revenue from Potential maximum extractable value channels could anchor Ethereum’s monetary role.

He said that the ecosystem system must

“Broadly agree to cement ETH as the primary asset of the larger Ethereum economy (L1+L2), supporting applications using ETH as primary collateral, etc.”

He argued that Rollups should consider depositing some fees into the Ethereum ecosystem, potentially through permanent stimulation or targeted funding of public goods. He cautioned, however, that fee structures and demand remain uncertain, and no single mechanism guarantees long-term support for ETH prices.

Layer 2 adoption and rollups are currently driving ecosystem growth, but Buterin emphasized that a full transition to rollups requires both technical advancements and social coordination. He urged developers to focus on production-ready proof systems, shared sequencing solutions, and standards that unify cross-hike operations.

He also called on wallet providers to implement new address formats and bridging protocols, explaining that achieving these goals will require direct collaboration between the Ethereum Foundation, customer teams and layer 2 projects .

Buterin’s post concluded with a reminder that Ethereum’s social ethics underpin its technical plan, referencing the community’s role in maintaining a decentralized project. He called for direct involvement of all stakeholders, including token holders, who can influence roadmap decisions by engaging in governance and open discussions.

He noted that network evolution depends on balancing capacity for scale, preserving security, and maintaining a cohesive user experience. The final message called for continued collaboration to ensure Ethereum remains an open platform capable of supporting widely used decentralized applications.

The leadership and financial movements of the Ethereum Foundation

The position comes amid community division and a leadership restructuring at the Ethereum Foundation as it focuses on strengthening developer collaboration while adhering to core values like decentralization and privacy. Striving to remain politically neutral, the foundation continues to emphasize its commitment to advancing the development of the protocol without engaging in ideological or lobbying activities.

However, Buterin’s role as co-founder has been endlessly debated on social media, with some calling for him to become more involved in Ethereum projects and NFT collections while others are pushing for complete neutrality.

The community is pushing a narrative that Ethereum’s success depends on maintaining a robust L1 and a thriving L2 ecosystem that can accommodate varied use cases. Buterin’s blog highlighted the importance of flexible but understated systems of trust, calling for adoption of L2 that reflects early visions of Ethereum’s fragile architecture.

He argued that prioritizing BLOB overflows and shared rolling standards would allow developers to fine-tune Defi, social apps, enterprise solutions, and more. He also highlighted the need for unified address formats, faster transaction finality, and cross-cutting message protocols so users can navigate different L2s without fragmented workflows.