The main dishes to remember:

- Investors find a new way of engaging with the crypto thanks to structured instruments.

- The approach reflects evolving preferences for managed indirect exposure.

- These products may encourage traditional cryptography trading methods.

- Market strategies can adapt because risk management occupies the scene.

Volatility Share LLC is preparing to introduce the very first ETF Solana based on future in the United States, the launch scheduled for Thursday, according to a Bloomberg report.

The Florida -based company will deploy two ETFs: volatility sharing Solana ETF (Solz) and the Sharing 2x Solana ETF volatility (SOLT).

Solz will follow Solana Futures and offer a standard exhibition to cryptocurrency, while Solt will provide a lever effect exhibition, aimed at double the potential gains and losses.

ETF received approval from the American Securities and Exchange (SEC) commission at the beginning of the month.

This marks the first time that Solana ETF will be available for American investors, expanding access to one of the largest cryptocurrencies by market capitalization.

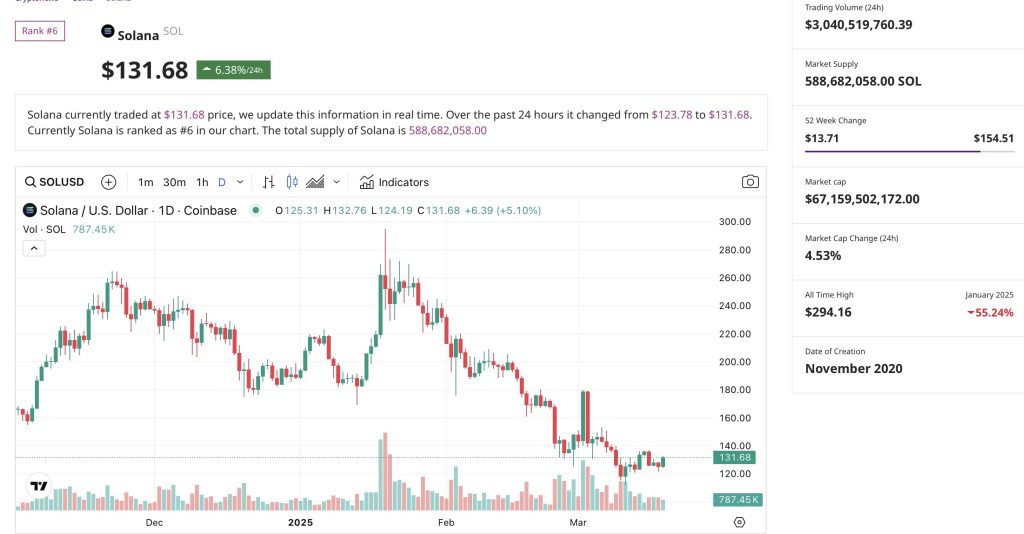

Soil does not react to ETF News, market value at 67 billion dollars

Solana, valued at around $ 67 billion, has gained popularity for its rapid transactions and low costs.

The upcoming launch of Solana ETFs reflects the growing interest of investors in diversified crypto products beyond Bitcoin and Ethereum, which historically dominated the market.

After the announcement of the launch of the Solana ETF, the floor price remained relatively stable.

It exchanged about $ 131.68, up 6.3% in the last 24 hours, showing little immediate reaction to the news.

The New Solana Futures FNB follow the success of the FNB Bitcoin Futures, who attracted significant investors’ demand.

Unlike the ETF Spot, which hold the underlying cryptocurrency, the commercial ETFs based on future prices.

This structure allows investors to win an exhibition without buying Solana directly, offering a regulated avenue and potentially at risk.

Volatility actions first submitted deposits for ETF Solana in December 2024.

The expenditure ratios is set at 0.95% for Solz and 1.85% for SOLT, covering the costs associated with the management of term contracts.

“Our launch comes at a time of optimism renewal for the innovation of cryptocurrencies in the United States,” said Justin Young, CEO of Volatility Shares, in an interview with Bloomberg.

Once live, the ETF Solana will offer investors new ways to access the cryptocurrency market without the need to keep digital assets directly.

The post-valatility shares to launch the first ETF Solana in the United States appeared first on Cryptonews.