- Upper gains: mantra (+ 16%), hyperliquid (+ 3%), gold attachment (+ 2%).

- The best losers: Dogwifhat (-30%), Kaspa (-28.3%), virtual (-27%).

The cryptography market displayed a contrasting dynamic this week, with established tokens showing resilience while the active assets were faced with significant sales pressure.

This week’s movements highlight the growing disparity between the different market segments and the continuous evolution of the feeling of investors.

The greatest winners

Mantra (OM)

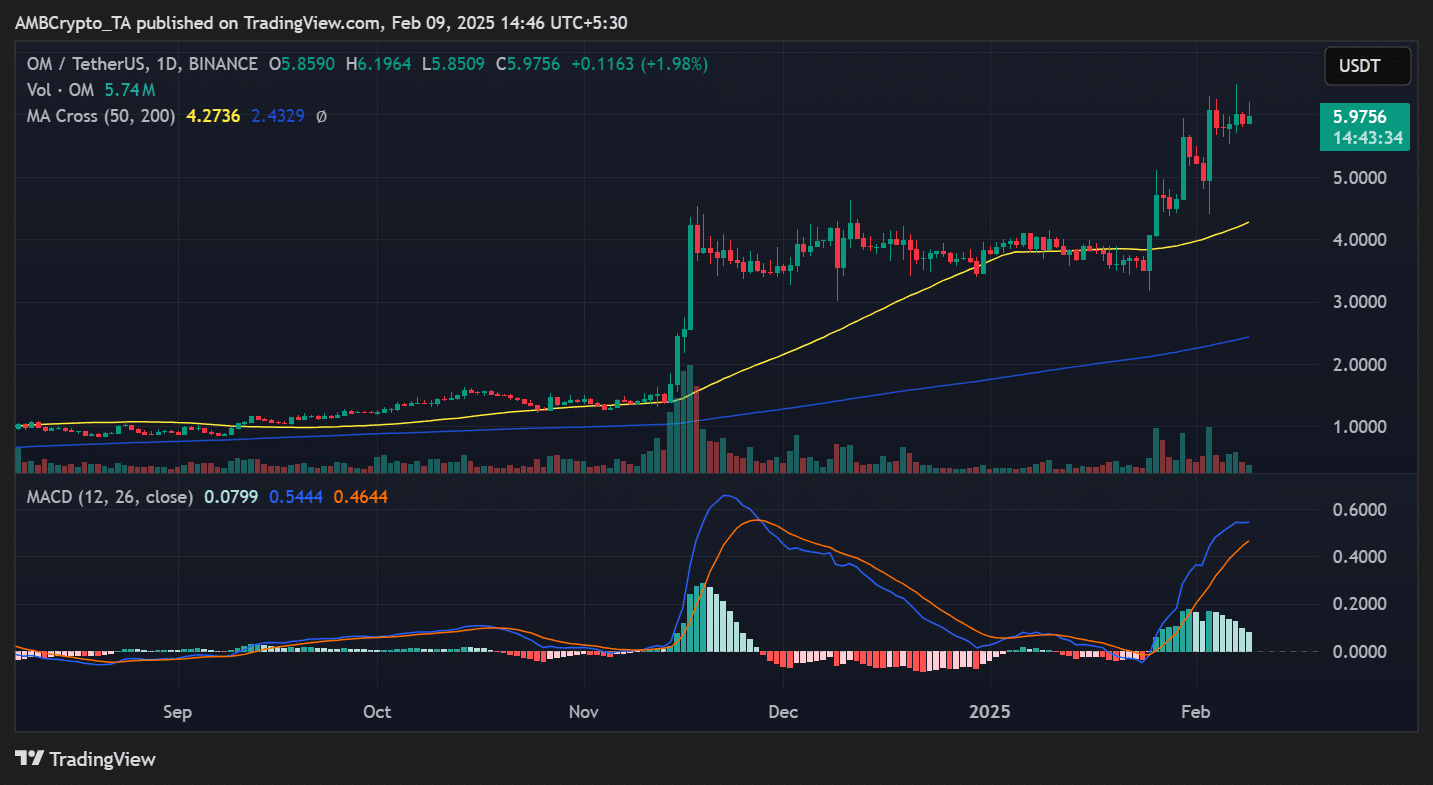

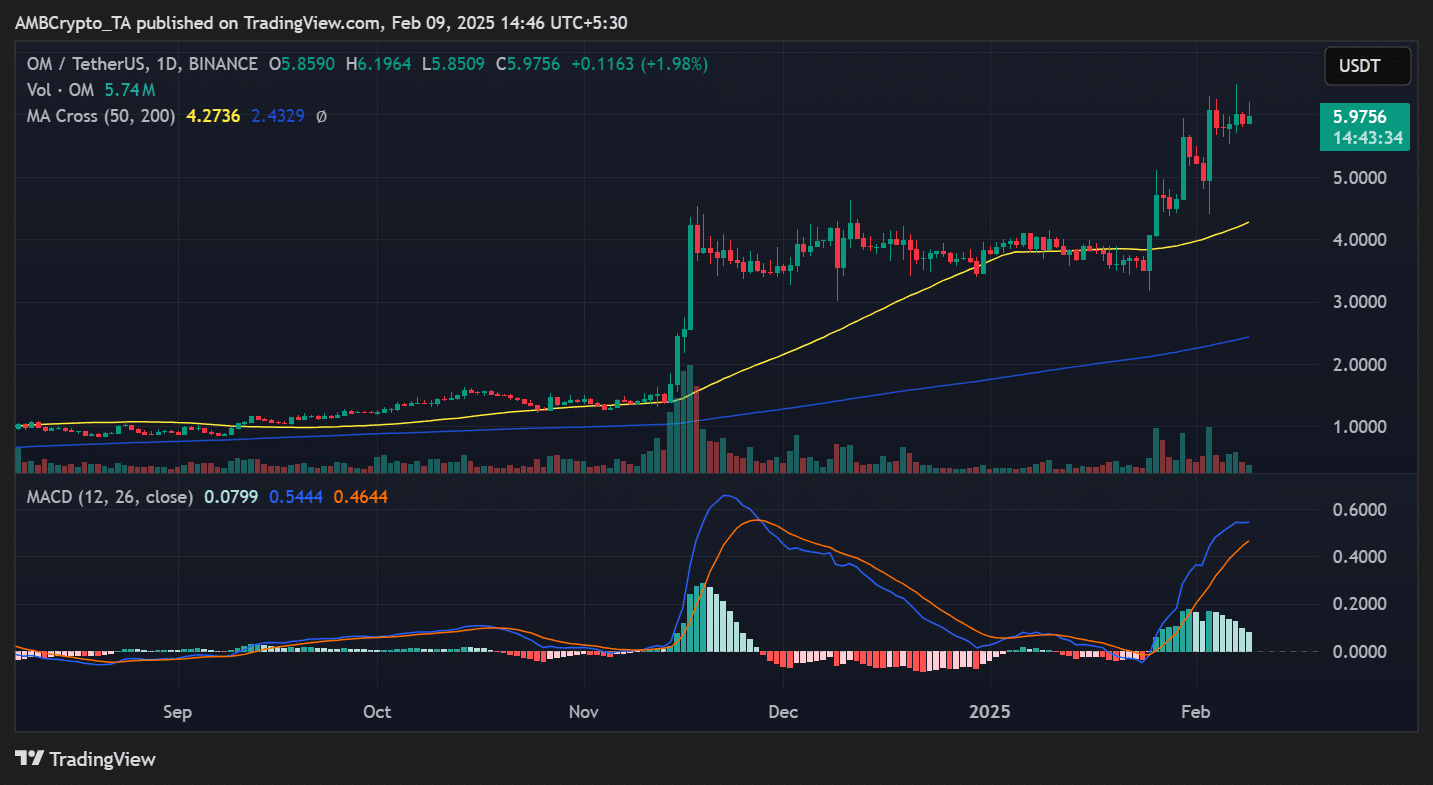

Mantra (OM) continued its impressive race, guaranteeing first place for the second consecutive week with a gain of 16%, prices going from $ 5.10 to $ 5.97.

The sustained momentum of the token has demonstrated a remarkable force in a generally volatile market.

The week opened its doors with om support at $ 5.10 before staging a decisive escape on February 4 which spent prices over $ 5.75.

After a brief consolidation phase, buyers remained in control, maintaining the ascending trajectory of the token.

The volume of exchanges was particularly remarkable, reaching 5.74 m OM, suggesting a strong institutional interest for the rally.

Source: tradingView

From a technical point of view, Mantra continued to negotiate herself well above her 50-day moving averages (4.2736) and 200 days (2,4329), confirming the robust upper trend.

The MacD indicator has shown a positive dynamic with readings at 0.0799, while the divergence between signal lines and MacD suggests the potential of the increase.

Today’s trading shows a continuous force, with a gain of 1.98% while the token consolidates almost $ 5.97.

What is particularly impressive is the token’s ability to maintain its momentum up for two consecutive weeks, a rare feat on the cryptography market.

The price action displays a lower and higher high series, which indicates a sustained conviction of buyers.

Although a certain consolidation can be expected after such an execution, the solid volume profile and the technical indicators suggest that this rally could have more room to operate.

The level of key support to monitor is $ 5.75, which should provide a base for all retractions.

Hyperliquid (hype)

Hyperliquid (Hype) obtained its position as a second best performer of this week, from $ 22.50 to $ 23.75 for a modest gain of 3%. The price of the token prices presents a measured recovery after the volatility of the beginning of the week.

The exchanges of the week started with the media threshing finding its base at $ 22.50 before starting a constant climb which brought prices to $ 27.00.

February 5 experienced particularly active exchanges, the tokens testing higher levels before undergoing sales pressure. While profit has removed the prices from these summits, the global trend has remained constructive.

A recent price action shows that the bracing media consolidating above $ 23.50, the buyers emerging during the drops to support the ascending trajectory of the token.

The methodical nature of recovery, characterized by higher stockings and a sustained purchase interest during persons, suggests the potential for additional gains. However, the level of $ 24.00 remains a key resistance area to monitor.

Tether Gold (Xaut)

Tether Gold (XAUT) posted regular performance this week, going from $ 2,800 to $ 2,865, guaranteeing a gain of 2% in growing interest in digital gold tokens.

The action of the token prices reflects the stability of physical gold while offering blockchain efficiency. Although Stablecoin to support basic products, it has experienced a better price movement than most other digital assets.

The week opened with Xaut finding support at $ 2,775 before launching a methodical climb through the level of $ 2,800.

A notable increase on February 5 pushed prices above $ 2,850, establishing a new support area.

The advance demonstrated a particular force on February 7, briefly affecting $ 2,900 before settling in current levels.

Recent exchanges have shown that XAUT consolidating approximately $ 2,865, with a remarkably tight price action suggesting a strong market balance.

The measured pace of the advance, associated with coherent trading volumes, said a real institutional interest rather than a speculative activity.

While the token maintained its bias on the rise, the level of $ 2,900 represented immediate resistance for new gains.

Top 1,000 winners

Beyond the main performers, the wider cryptography market has shown an important activity, Fartboy (Fartboy) leading the 1,000 best tokens with a overvoltage of 386%.

After closely, Swarmnode.ai (SNAI) and Andy BSC (Andy) displayed impressive gains of 249% and 159%, respectively.

Biggest losers

Dogwifhat (WIF)

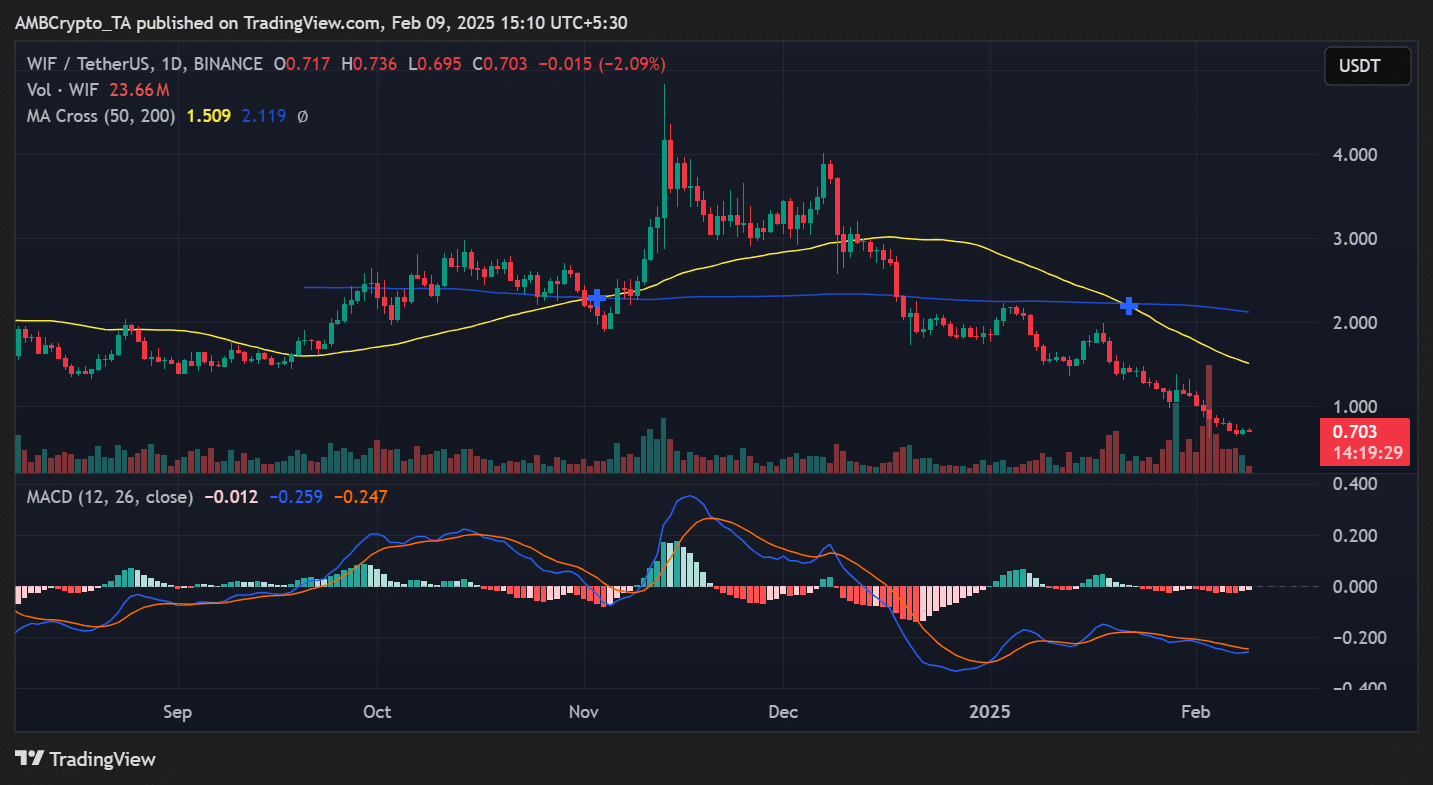

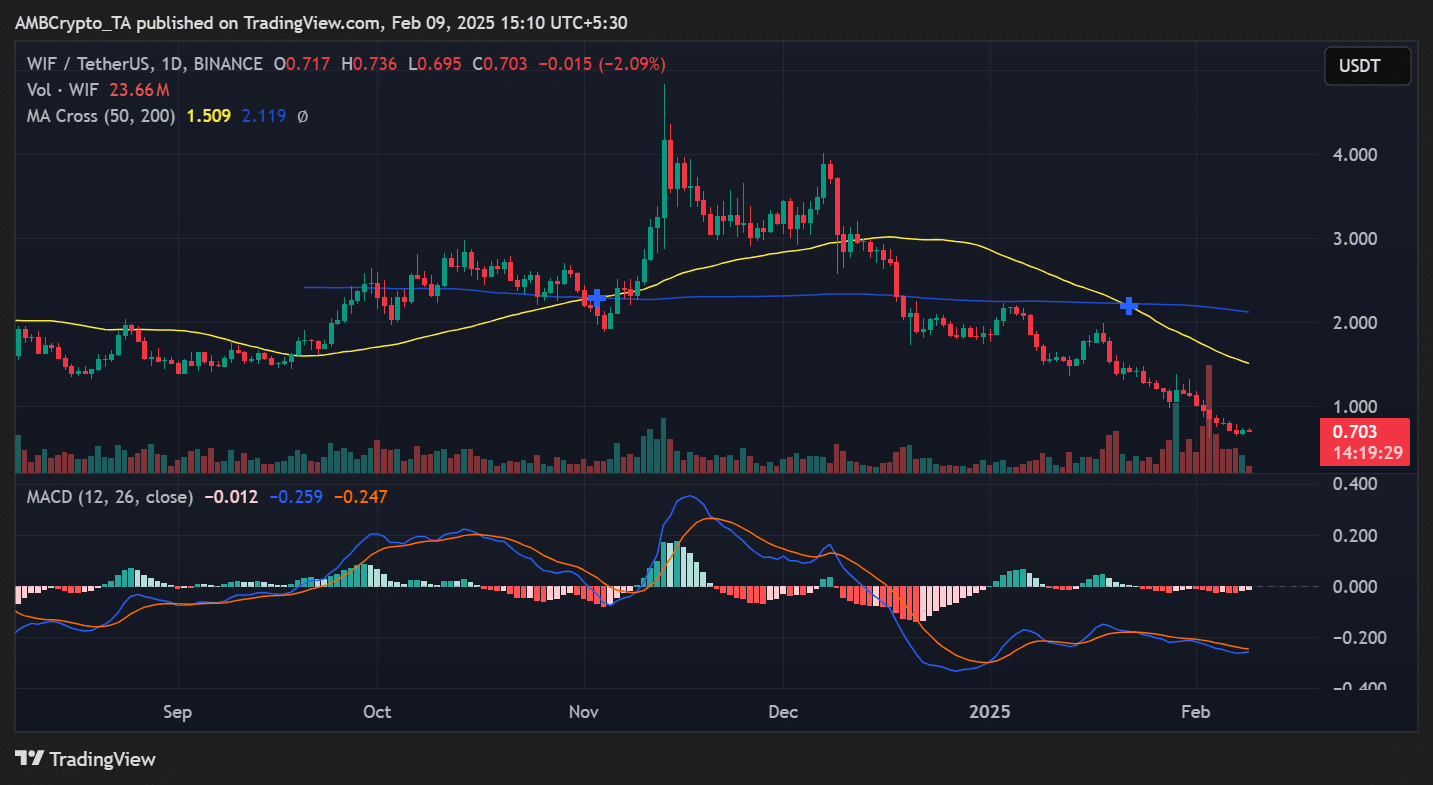

At the opposite end of the spectrum, Dogwifhat faced significant opposite winds, emerging as the biggest loser of this week. Its value increased from $ 1.05 to $ 0.703, recording a sharp drop of 30%.

The descent of the token marks the second consecutive week according to which a same led the losses of the market, after the dramatic fall of the grassouillis of the Penguins (Penguins) last week.

Trade measures have painted a worrying image, the volume going to 23.66 million points in the middle of the accelerated sales pressure.

The token exchanged well below its 50 -day mobile averages (1.509) and 200 days (2,119) at the time of the press, indicating significant technical damage.

The MacD remained in negative territory at -0.012, with divergent signal lines suggesting a continuous decline momentum.

Source: tradingView

The week started with immediate sales pressure while WIF broke below its crucial support at $ 1.00.

Each attempt at recovery throughout the week has met new waves of sale, creating a model of lower ups and lower stockings.

A brief consolidation of around $ 0.80 in the middle of the week proved to be temporary, because the sellers pushed prices at current levels close to $ 0.70.

Today’s trading shows WIF down 2.09%, which has trouble finding support even at these depressed levels.

The technical image seems particularly worrying, with the formation of death (my 50 days below 200 days) suggesting a potential for weakness.

Although the surveillance conditions can generally trigger a technical rebound, the deterioration of the market structure and the increase in volume on the movements down suggest prudence.

The token must recover and maintain above $ 0.80 to start repairing its technical damage, although immediate perspectives remain difficult without a significant change in the feeling of the market.

Kaspa (Kas)

Kaspa (KAS) endured a week of punishment, from $ 0.122 to $ 0.087, recording a substantial drop of 28.3%. The downward trajectory of the token reflects the increase in sales pressure and the deterioration of market confidence.

The week opened its doors with immediate weakness while Kas fell $ 0.122, briefly finding support for almost $ 0.110 before another wave of sellers is lower than prices.

A series of recovery attempts missed around the level of $ 0.100 preceded additional drops, each rebound meeting, a renewed sale pressure.

Recent exchanges have shown that the token is struggling to maintain land greater than $ 0.087, with a decreasing volume during rescue rallies suggesting a decline in buyers’ interest.

Although the current price level can generally attract good deals, persistent sales pressure and significant lack of support areas brush a table concerning.

The succession of the lower ups and lower stockings indicates that the downward momentum could continue unless a significant catalyst emerges.

Virtual (virtual) virtual protocol

Virtuals Protocol (Virtual) extended its losses for a second consecutive week, from $ 1.60 to $ 1.20, marking another net drop by 27%.

The continuous weakness of the token suggested deepening market concerns after the significant drop in last week.

The week opened with immediate sale when Virtual had trouble containing $ 1.60, quickly giving way to a sales cascade which made prices to $ 1.40.

A brief consolidation phase of approximately $ 1.50 on February 4 proved to be temporary, because the sellers remained firmly in control of the market management.

Recent exchanges have shown that the token was trying to stabilize around $ 1.20, although each recovery attempt was facing new sales pressure.

The consecutive weekly declines have considerably damaged the confidence of the cryptography market, with a drop in volume during rebound attempts suggesting a limited interest in buyers.

While the surveillance conditions have probably triggered a technical recovery, the persistent weakness over two weeks indicated an additional potential for drops unless substantial purchase interest is emerging.

Top 1,000 losers

In the context of the wider market, Elon4Afd (Elon4AFD) led the 1000 best tokens with a drop of 66%, followed by Flay (Flay) and Akumainu (AKUMA), which recorded 65% respectively and 60% losses.

Conclusion

Here is the weekly summary of the greatest winners and losers in the cryptographic market. It is crucial to keep the volatile nature of the market in mind, where prices can change quickly.

Thus, doing your own research (Dyor) before making investment decisions is the best.