- The greatest winners: Mantra (OM), Kaspa (Kas) and Sonic (s).

- Larger losers: Bitget Token (BGB), Onyxcoin (XCN) and Ethena (ENA).

The cryptocurrency market remains a battlefield of volatility, some tokens rising to new summits while others are faced with strong drops.

This week is no exception, with notable winners amount of the bullish momentum and assets in difficulty succumbing to the pressure of the sale.

Here is a complete ventilation of the greatest winners and losers in the last seven days.

The greatest winners

Mantra (OM)

Mantra (OM) continues its impressive rally, guaranteeing first place for the third consecutive week with a high gain of 26%, while prices went from $ 5.90 to $ 7.54.

The persistent domination of the token underlines the strength of the exceptional market and the growing institutional interest.

The week started with OM consolidating around $ 5.90, displaying a relatively silent price action until February 14.

However, February 15 marked a turning point while prices exploded, breaking the multiple resistance levels to reach $ 7.65.

The trading volume increased to 549.34K OM, validating the force behind this movement upwards.

Source: tradingView

From a technical point of view, OM remained well above its 50-day mobile averages ($ 5.38) and 200 days ($ 4.01), maintaining a robust bullish structure.

The significant gap between its current price and these averages reported a strong dynamic, although certain caution is justified for a potential overextension.

OM stabilized nearly $ 7.54 when writing this article, with a minor adjustment -0.57% while traders absorb recent gains.

His ability to at the top of the list of weekly winners for three consecutive weeks is a rarity on the cryptography market, highlighting a sustained conviction of buyers.

The key support amounted to $ 7.00, which could act as a solid base for all short -term retractions.

Kaspa (Kas)

KASPA (KAS) made an impressive recovery this week, from 25.6% from $ 0.087 to $ 0.109. This rebound is particularly important, given the drop in prices last week.

Kas found initial support at $ 0.087, which led to a constant rise. An increase of February 11 pushed prices to $ 0.105, establishing a new support area.

While volatility in the middle of the week has seen fluctuations close to $ 0.095, buyers remained in control, maintaining a bullish momentum.

At the time of the press, he consolidated $ 0.109, and Kas continues to establish higher stockings, strengthening the renewed confidence of the market.

Although certain benefits at this level are expected, regular accumulation and high purchase pressure indicate that the upward trend may persist.

SONIC (s)

Sonic (s), formerly FTM, posted a gain of 25.3%, going from $ 0.41 to $ 0.51. This well -structured recovery follows recent market turbulence.

The week began with a side movement nearly $ 0.41, before an escape on February 13 offers Sonic at $ 0.56 in the midst of a solid commercial activity.

Although certain benefits have emerged, buyers have maintained the control of the trend.

When writing these lines, it was about $ 0.51, with support for higher levels, the momentum of Sonic seems durable.

The measured pace of his advance suggests a real accumulation rather than speculative overvoltages. If the purchase of interest continues, another upward potential remains at stake.

Top 1,000 winners

Beyond the most efficient, the wider market has seen notable overvoltages.

Unchain X (UNX) led the 1,000 best tokens with a gain of 387%, while Trust AI (TRT) and Sturdy (Stry) followed closely, displaying 384% and 113% of earnings respectively.

Biggest losers

Bitget Token (BGB)

Bitget Token (BGB) was a drop of 24.3%, from $ 6.45 to $ 5.05, because the sales pressure dominated throughout the week.

The decline accelerated on February 12, breaking the main levels of support and triggering other sales. Each rebound attempt has been faced with strong resistance, forming a model of lower ups and lower stockings.

Currently conversing around $ 5.05, any recovery would require a recovery of $ 5.50 to stabilize. However, the sustained sales pressure suggests a more risk of decline.

Onyxcoin (XCN)

Onyxcoin (XCN) was the second with the second interpreter, from 14.6% from $ 0.026 to $ 0.023. The privacy token failed to maintain the momentum, meeting with coherent drop pressure.

A sharp drop in February 11 and 12 pushed ONYX to $ 0.020, before a brief rebound at $ 0.025. However, the lack of support for sustained purchase has dropped the price.

The volume of negotiation has remained stable, suggesting a sustained downward trend rather than the sale of panic.

The level of support of $ 0.022 is now critical – if it is raped, another wave of sales could occur. Conversely, for any recovery, the Onyx must maintain above $ 0.025.

Ethena (ENA)

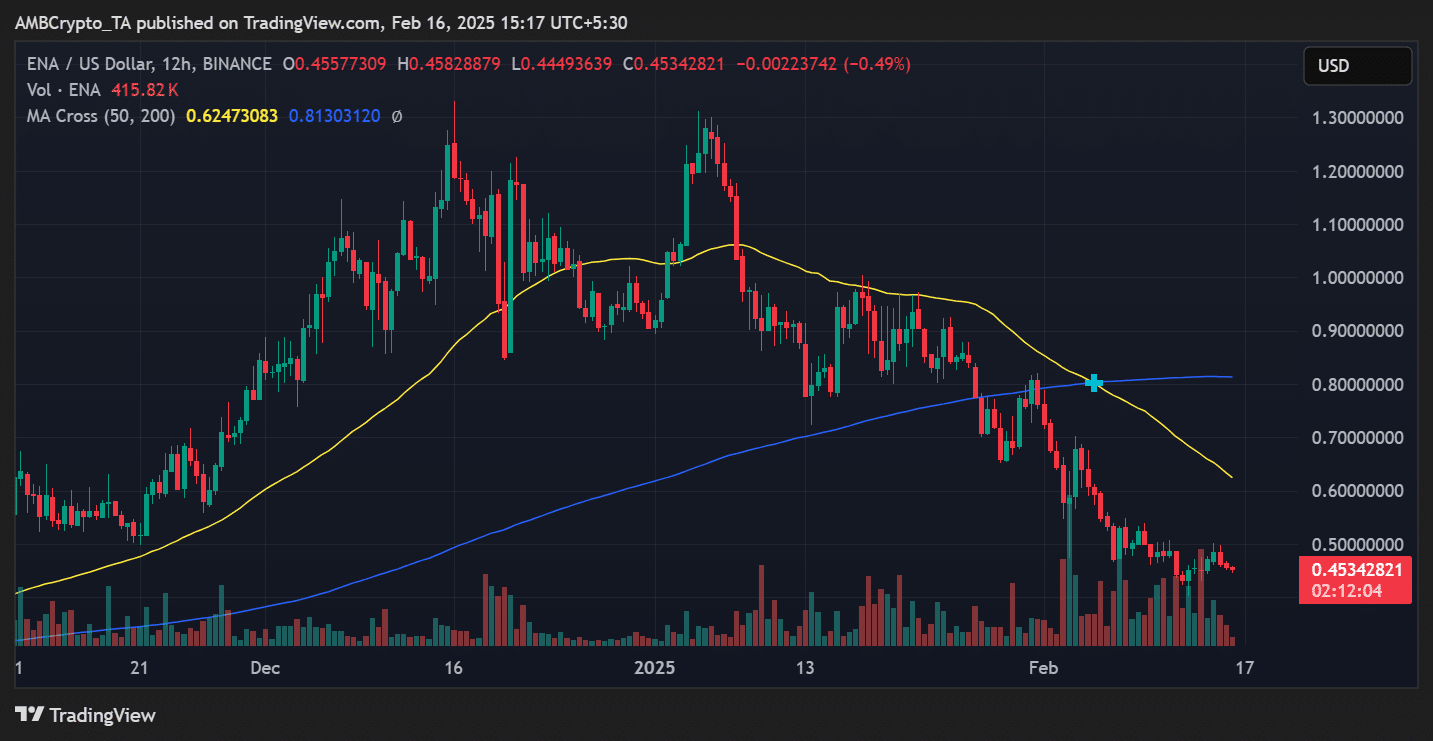

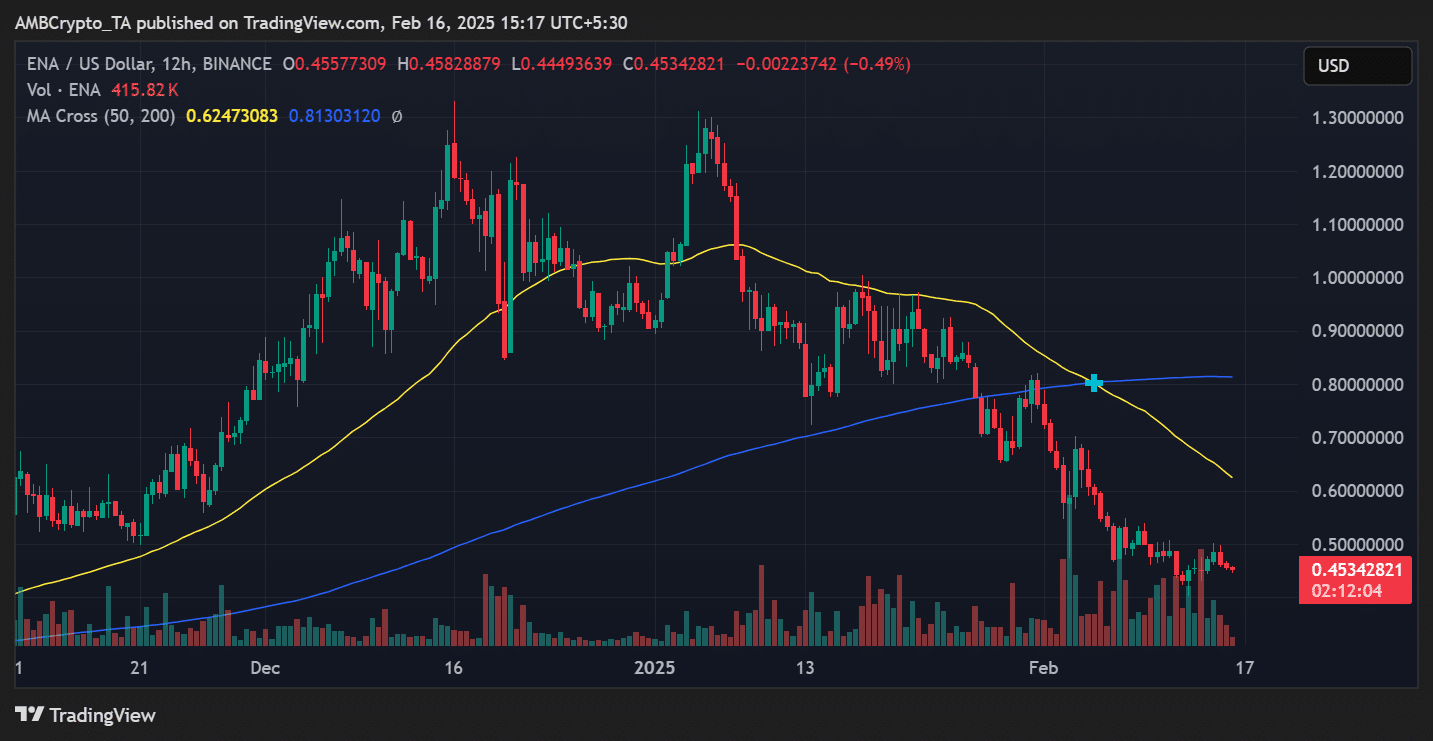

Ethena (ENA) has become the third largest loser in this week crypto, recording a sharp drop of $ 0.50 to $ 0.45.

The native token of the protocol was faced with intense sales pressure, in particular following its recent stabilization attempts above the crucial bar of $ 0.48.

The weekly price action has revealed a worrying technical configuration, ENA’s graphic forming a series of lower ups and lower stockings.

The most important ventilation occurred on February 12, when the token dived at $ 0.42, marking the lowest point of the week. Although buyers intervened to launch a recovery, the rebound turned out to be short -lived.

A deeper look at the technical indicators showed the average mobile crossing of 50 days below the 200 -day MA, forming a downstream crossover which generally signals a sustained momentum.

The volume of exchanges remained particularly high during the decline, suggesting a strong conviction behind the sale pressure.

Source: tradingView

While ENA managed to stage a brief recovery in the middle of the week, returned to $ 0.48 on February 14, the token failed to keep these earnings.

The sellers quickly regained control, postponing the price at the current level of $ 0.45. Constant rejection at higher prices indicates a resistance of significant general costs.

The level of $ 0.44 appears as a critical support area for traders who raise potential entry points. A break below could trigger another wave of sales, potentially testing recent stockings.

Conversely, the bulls must recover and maintain above $ 0.48 to indicate any significant trend reversal.

Top 1,000 losers

In the wider market, the test (TST) led the decreases with a drop of 78%, followed by 360Noscope420Balzeit (MLG) and the vine (vine), which dropped by 53%and 50%, respectively.

Conclusion

Here is the weekly summary of the greatest winners and losers. It is crucial to keep the volatile nature of the market in mind, where prices can change quickly.

Thus, doing your own research (Dyor) before making investment decisions is the best.