Ethereum lost the critical $3,000 level on Sunday, sliding towards $2,800 and triggering a new wave of fear in the market. The drop highlights a deepening correction that has pushed short-term investors into steep unrealized losses, prompting many to reassess their risk exposure.

Related reading

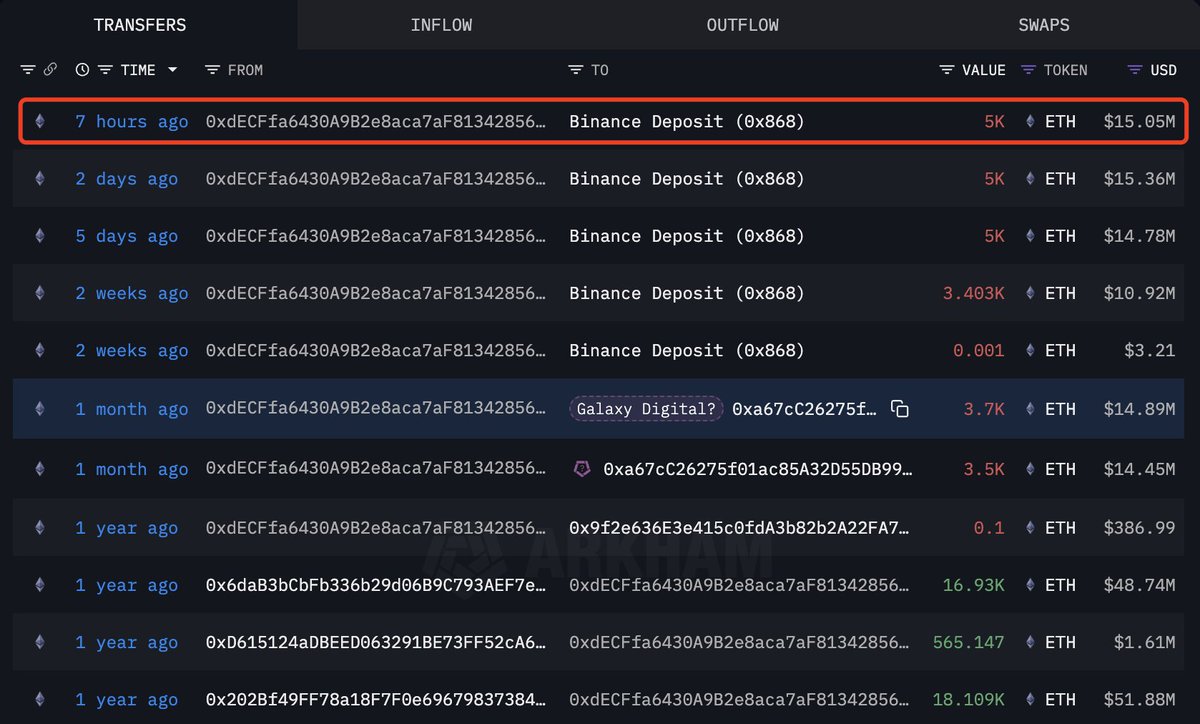

To add to the uncertainty, new on-chain data revealed a new distribution of top holders. According to Arkham data, shared by Lookonchain, the famous whale 0xdECF deposited an additional 5,000 ETH, or approximately $15.05 million, into Binance.

The move expands a pattern of consistent selling pressure from large holdings often seen during heightened market stress. While a whale does not define the broader trend, these filings generally reinforce bearish sentiment among traders who monitor FX flows as an indicator of potential sell-side liquidity.

Whale Distribution Intensifies Amid Broader Market Anxiety

Since October 28, the same whale wallet has ramped up its selling activity, offloading 25,603 ETH, or approximately $85.44 million, onto Binance and Galaxy Digital. Despite this aggressive distribution, the wallet still holds 10,000 ETH valued at approximately $30.34 million, leaving open the possibility of continued selling pressure if market conditions weaken further. Large-scale moves like these often signal a change in sentiment from sophisticated holders who tend to anticipate volatility earlier than the market as a whole.

This sales frenzy comes at a time when confidence is already fragile. The recent Tether FUD, fueled by speculation over reserve transparency and possible regulatory scrutiny, has added stress to liquidity conditions.

Meanwhile, new headlines about an alleged Bitcoin ban in China have resurfaced on social media, amplifying fear among retail traders and short-term investors. Although neither narrative reflects new fundamental risks, emotional markets often react sharply to sensational news during corrections.

Related reading

Together, these factors create a context in which whale distribution acquires outsized influence. If the remaining 10,000 ETH goes public, it could intensify the downward pressure in the short term. Conversely, a pause in selling may suggest that the whale views current levels as near capitulation territory, providing a potential floor for stabilization.

Ethereum price tests support as downtrend remains intact

Ethereum’s 4-hour chart shows a market still struggling to regain momentum after losing the $3,000 mark. The broader structure remains decidedly bearish, with prices trading below the 50 SMA, 100 SMA, and 200 SMA, a clear indication that sellers continue to control the trend. Each attempt to recover above the moving averages was rejected, reinforcing the downward trend that began in late October and continued into November.

The recent rebound from the $2,750 to $2,800 support zone shows that buyers are defending this level, but the reaction lacks conviction. Volume remains low and the last attempt to reclaim $3,000 quickly failed, forming another lower high. This signals hesitation and suggests that the bulls are not yet strong enough to change market structure.

Related reading

The squeeze seen towards the end of the chart formed a small symmetrical triangle, but the ensuing breakdown confirms that sellers still dominate the short-term momentum. As long as ETH remains below the 200 EMA – now near $3,350 – the macro trend favors continued decline.

If $2,800 breaks sharply, the next pockets of liquidity lie around $2,600 and $2,450, levels that could attract greater buyer interest. For now, Ethereum needs to reclaim $3,000 with sustained volume to neutralize the downside pressure.

Featured image from ChatGPT, chart from TradingView.com