- Bitcoin has seen sustained demand from institutional investors with nearly $13 million in inflows in a week, according to data from IntoTheBlock.

- The US government transferred $600 million in Bitcoin, not with the intention of selling it, but to hold it through a partnership with Coinbase Prime.

- Bitcoin is hovering around $60,000 on Sunday, wiping out nearly 2% of its value over the past seven days.

- BTC could extend its 12% gains and climb to $67,000, a key resistance for the asset.

At the time of writing, Bitcoin (BTC) is hovering around key psychological support at $60,000 on August 18. Data from IntoTheBlock shows that Bitcoin exchange-traded funds (ETFs) saw nearly $13 million in net inflows during the week.

Flows into ETFs show sustained demand among institutional investors, likely to catalyze Bitcoin gains.

Bitcoin Could Rebound For These Reasons

Major developments last week included BTC fees hitting yearly lows for the third week in a row as cryptocurrency markets continued to stabilize following the stock market crash. Data from IntoTheBlock shows that net inflows to cryptocurrency exchanges totaled $418 million, including the U.S. government transfer to Coinbase Prime.

The US government transfer was not intended to sell but to transfer to Coinbase Prime, via an official partnership. IntoTheBlock analysts note that even though the price of BTC has fallen, demand from institutional investors has been strong, as evidenced by the inflows of nearly $13 million to ETFs.

BTC Could Extend 12% Gains

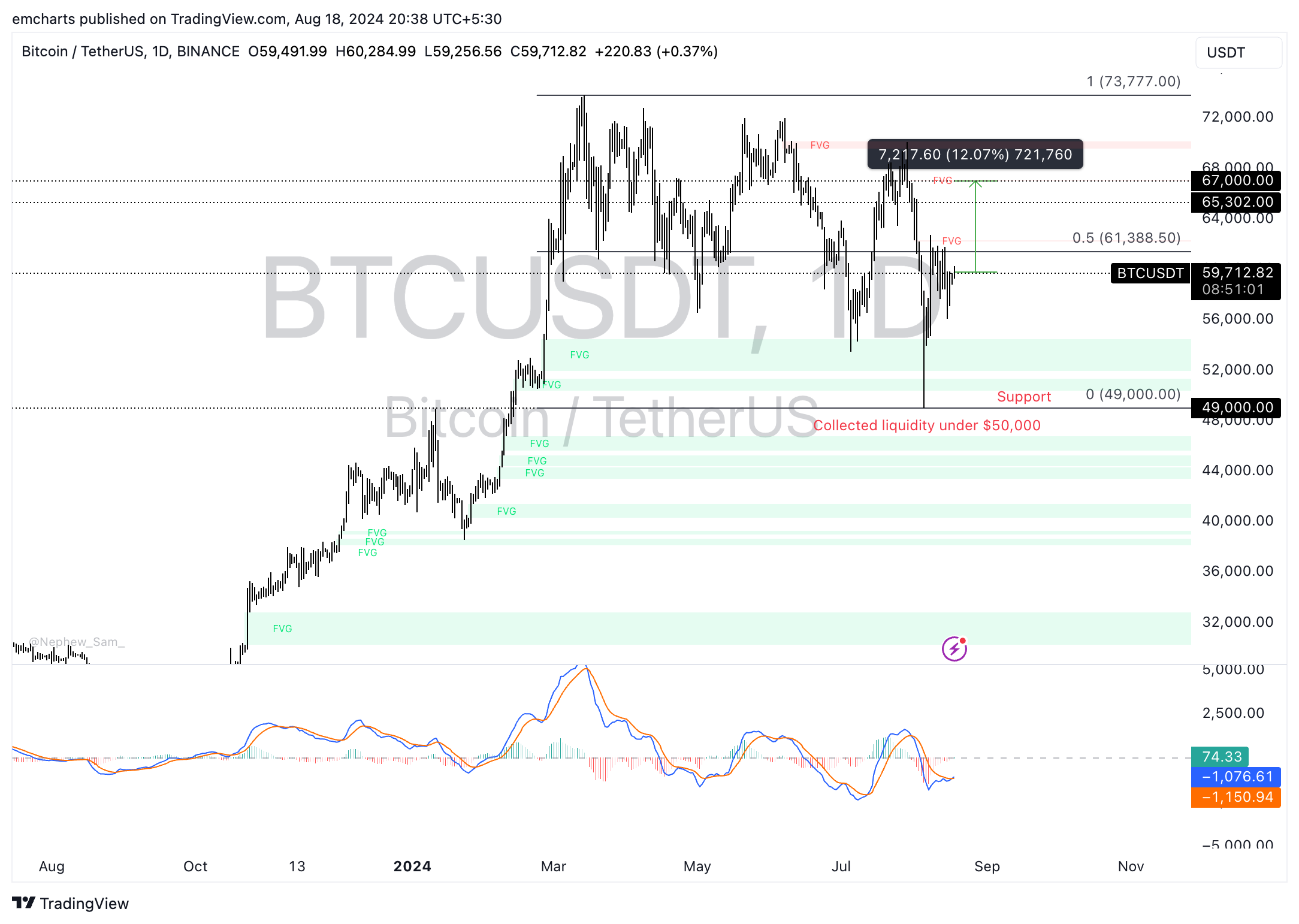

Bitcoin is hovering around the key psychological level of $60,000. BTC could extend its gains by more than 12% and climb back to the fair value gap (FVG) at $67,000. The largest asset by market cap faces resistance at $61,388, the 50% Fibonacci retracement of the decline from the March 14 high at $73,777 to the August 5 low at $49,000.

The Moving Average Convergence Divergence (MACD) indicator shows underlying bullish momentum in the Bitcoin price trend.

BTC/USDT Daily Chart

Looking down, Bitcoin could sweep liquidity to the fair value gap between $50,368 and $51,300.

FAQ about Bitcoin, Altcoins and Stablecoins

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any person, group or entity, which eliminates the need for third-party involvement in financial transactions.

Altcoins are all cryptocurrencies other than Bitcoin, but some also consider Ethereum to be a non-altcoin cryptocurrency because it is from these two cryptocurrencies that the fork occurs. If this is true, then Litecoin is the first altcoin, derived from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset they represent. To achieve this, the value of each stablecoin is tied to a commodity or financial instrument, such as the US dollar (USD), with its supply regulated by algorithm or demand. The primary purpose of stablecoins is to provide an on/off ramp for investors to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market cap to the total market cap of all cryptocurrencies combined. It gives a clear picture of the interest in Bitcoin among investors. A high BTC dominance usually occurs before and during a bull run, during which investors resort to investing in relatively stable, high-cap cryptocurrencies like Bitcoin. A decline in BTC dominance usually means that investors are shifting their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.