- A decline below the $0.34 support may confirm a structured breakout.

- Derivatives data for ADA showed mixed sentiment.

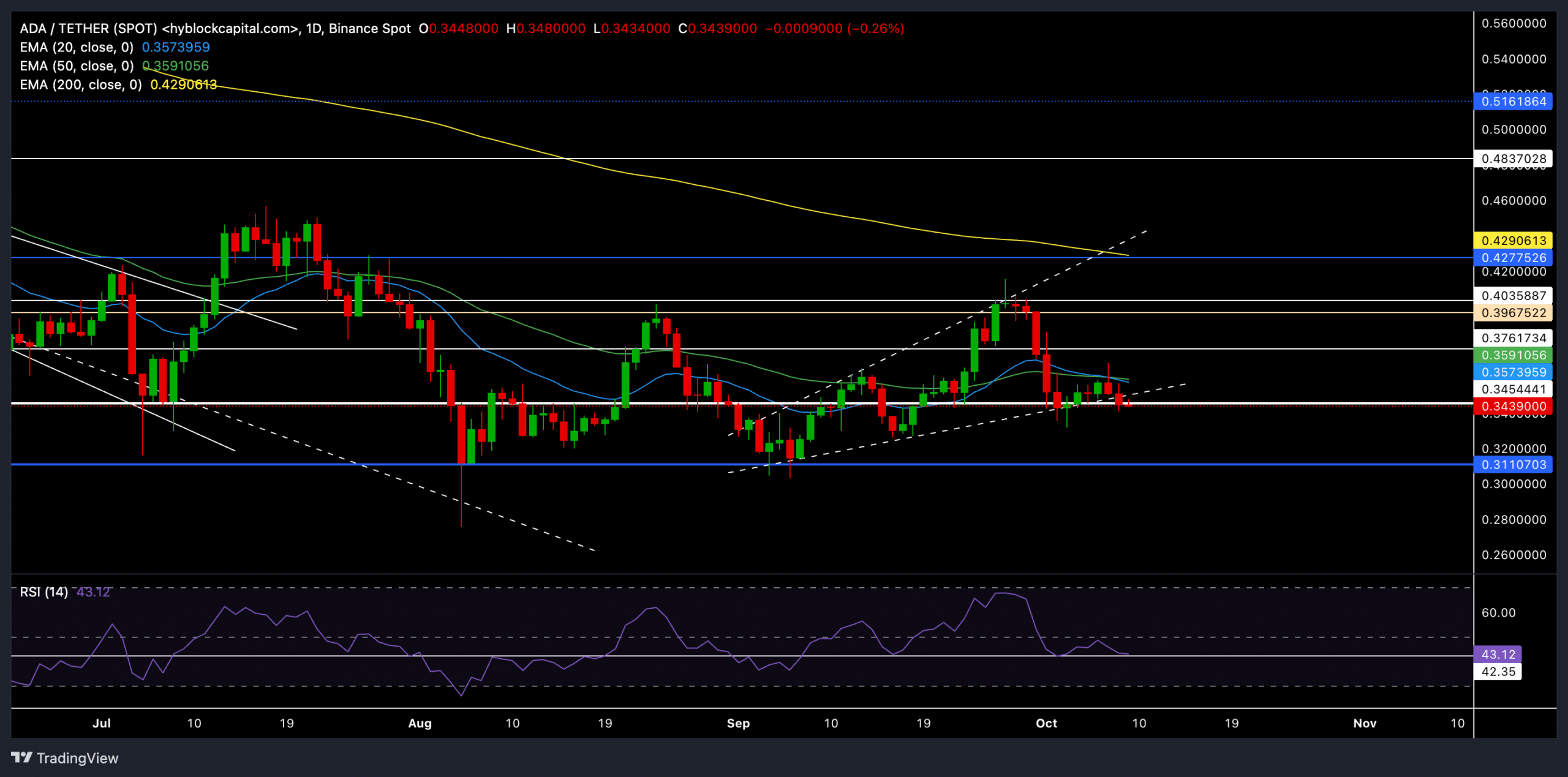

Cardano (ADA) continued its current downtrend and recently fell below the 20-day and 50-day exponential moving averages (EMA) to assert bearish advantage.

After its recent decline, ADA was struggling to maintain a foothold above crucial support levels. It was trading at around $0.3439 at press time, down 2.5% in the last 24 hours.

Is a rebound for Cardano in sight?

Source: TradingView, ADA/USDT

ADA’s recent rebound from the $0.30 support region has given rise to a classic widening wedge pattern on the daily chart.

The altcoin attempted to settle above the 20-day and 50-day EMAs, only to be rejected at the $0.40 resistance level.

This rejection led to a depreciation of almost 14% over the past two weeks, and the price action fell back below the EMAs.

ADA’s downtrend now positions the $0.34 mark as a vital threshold.

If ADA maintains a close below this level, it could confirm a breakout of the widening wedge pattern, increasing the likelihood of further losses.

The immediate target for Cardano bears could be around $0.31, where buyers could re-enter to defend the psychological support zone.

Adding to the downward pressure, the 20-day EMA has fallen below the 50-day EMA, suggesting increased bearish strength in the market.

This crossover could further increase the bearish pressure, leading ADA to retest the $0.31 support level ahead of a possible bullish rebound.

The Relative Strength Index (RSI) formed relatively flatter lows, while the price action marked lower lows.

This divergence may indicate that selling pressure is weakening, hinting at a potential reversal in the coming sessions.

A rebound from the $0.3 level, coupled with a rise in the RSI above 50, could signal a buying opportunity for traders looking to capitalize on near-term rebounds.

Derivatives Data Reveals…

Source: Coinglass

Derivatives data provided a mixed outlook for ADA. The 24-hour long/short ratio was 0.941, indicating somewhat balanced sentiment.

However, the Long/Short ratio on Binance and OKX was significantly biased towards the longs, at 3.5893 and 3.05.

Read Cardano (ADA) Price Prediction 2024-2025

Despite this optimism, trading volume fell by 34.43%, indicating reduced market activity and a possible lack of conviction among Cardano market participants.

Liquidation data revealed that long positions were larger, with short liquidations minimal, suggesting that profit-taking may be fueling the current bearish move more than aggressive short-selling.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.