The Federal Reserve’s quarter-point rate cut strengthened the crypto market, but what does FOMC crypto impact mean for the FOMC Bitcoin rally?

The Fed’s quarter-point cut in interest rates at the FOMC has sparked a speculative wildfire, particularly among cryptocurrencies. With a new federal funds rate target of between 4.5% and 4.75%, the Fed aims to navigate a slowing labor market and dampen inflation without causing economic shockwaves.

Here’s what the recent Federal Open Market Committee meeting will mean for the future price of Bitcoin.

FOMC Rate Cut Triggers Crypto Market Volatility

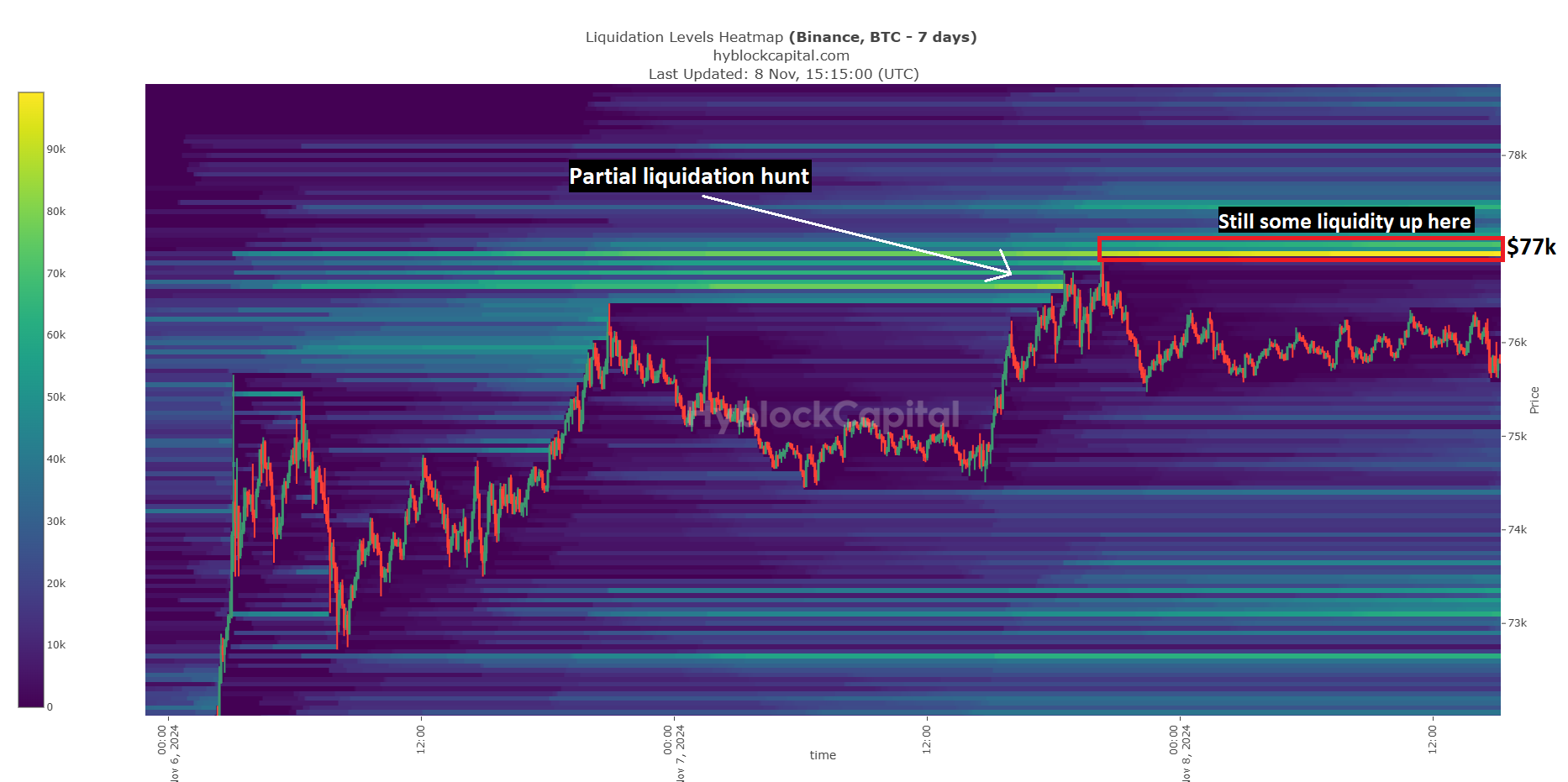

The air was filled with anticipation heading into the FOMC decision on Thursday, with Bitcoin recently hitting new highs above $75,000. Analysts predict increased volatility due to the impending rate cut, considered a near 97.4% certainty by CME Group’s FedWatch tool.

The fact is that the price of Bitcoin did not climb as traders hoped, leaving us mired in a stagnant crab market. Instead, most of the crypto gains came as a result of Donald Trump’s presidential victory on Wednesday morning.

Everyone’s eyes are on Bitcoin’s chance of reaching that elusive $100,000. Even though the FOMC has turned into a “news sell” event, we are poised for six-figure Bitcoin by the end of the year.

JUST IN:

Federal Reserve Chairman Jerome Powell said he would not resign if President-elect Trump asked him to. pic.twitter.com/wQLNU7AN0D

– Watcher.Guru (@WatcherGuru) November 7, 2024

Why did this happen? Well, everyone knew the FOMC was going to happen, and the price was already set.

Additionally, assets typically stagnate or collapse after a presidential election — and this one is only different because Trump is likely to cut taxes and deregulate crypto for developers and traders.

Analysts at 99Bitcoin are considering the possibility that Bitcoin will soon reach $100,000, thanks to a strong rally in the stablecoin market. Significant whale activity is also driving Bitcoin price movements, with two major players scooping up significant amounts of BTC post-FOMC. These whales, or large investors, are key influencers in market trends.

Recent data shows that two whales purchased 1,910 BTC worth $145.16 million on Binance in the last 24 hours. With patience, things are about to get crazy for crypto.

DISCOVER: The easiest way to buy Ethereum in November 2024

Navigating the Crypto Market Amid Rate Cuts

As the Fed adjusts its interest rates, the crypto market cannot dodge the consequences. The spotlight is on Bitcoin, which is holding strong and aiming for new highs. With an evolving economy and major players making calculated decisions, the future of Bitcoin looks bright, but not without obstacles.

The key will be to hold on even if we don’t see an immediate pump. It shouldn’t be too difficult, right?

The Fed’s decisions and Trump’s cabinet choices will dictate how Bitcoin prices move in the months to come. However, the current setup suggests that Bitcoin will surpass $100,000 before 2025.

EXPLORE: Trump Election Victory Fuels Bitcoin Price Past $75,000 as Pump.Fun Rival Pepe Unchained Breaks $25 Million Milestone

Join the 99Bitcoins News Discord here for the latest market updates

The article What does the FOMC mean for the price of Bitcoin? Will crypto continue to rise? appeared first on .

Federal Reserve Chairman Jerome Powell said he would not resign if President-elect Trump asked him to.

Federal Reserve Chairman Jerome Powell said he would not resign if President-elect Trump asked him to.