- XRP saw a rapid increase in dormant activity which was followed by a 12% price drop.

- The decline in MDIA has given long-term holders some bullish hope.

Ripple (XRP) has seen an increase in whale activity over the past week, with whales holding over $5 million holding 55% of the token supply. This concentration among whales can lead to wild price swings, like the one we saw on July 10, 2023.

The price was also in a consolidation phase in recent months and struggled to break the highs of the $0.7 range in place since August 2023. On-chain metrics showed that short-term selling pressure on XRP could increase.

The largest spike in dormant traffic in over a year

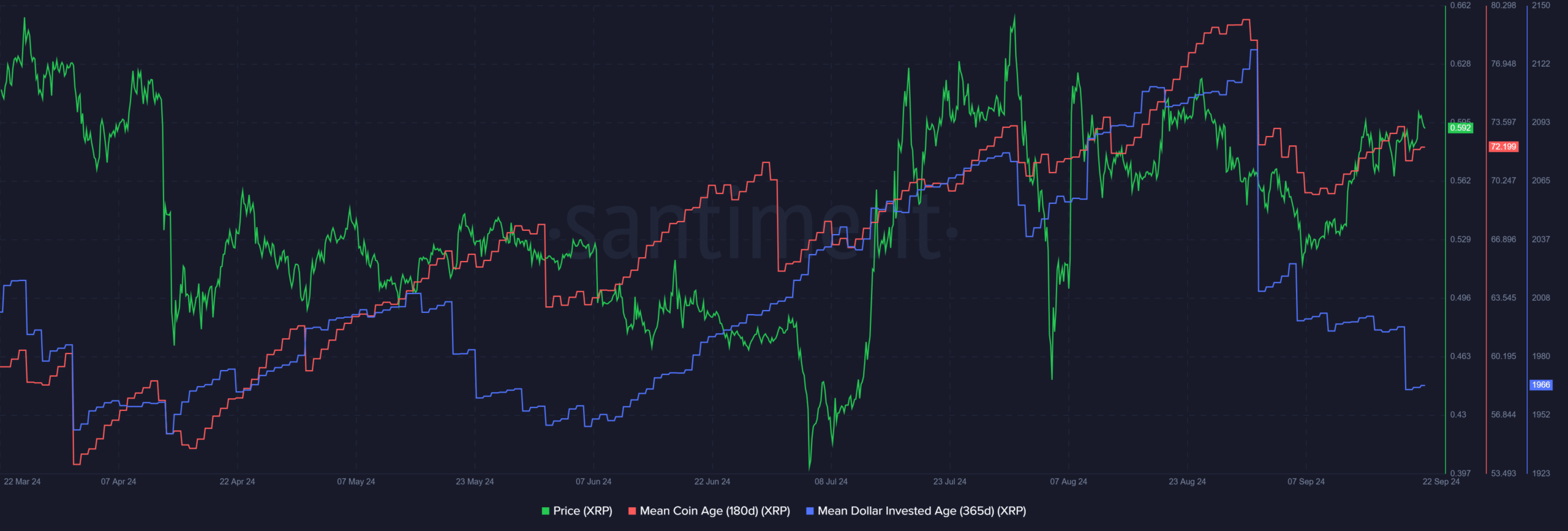

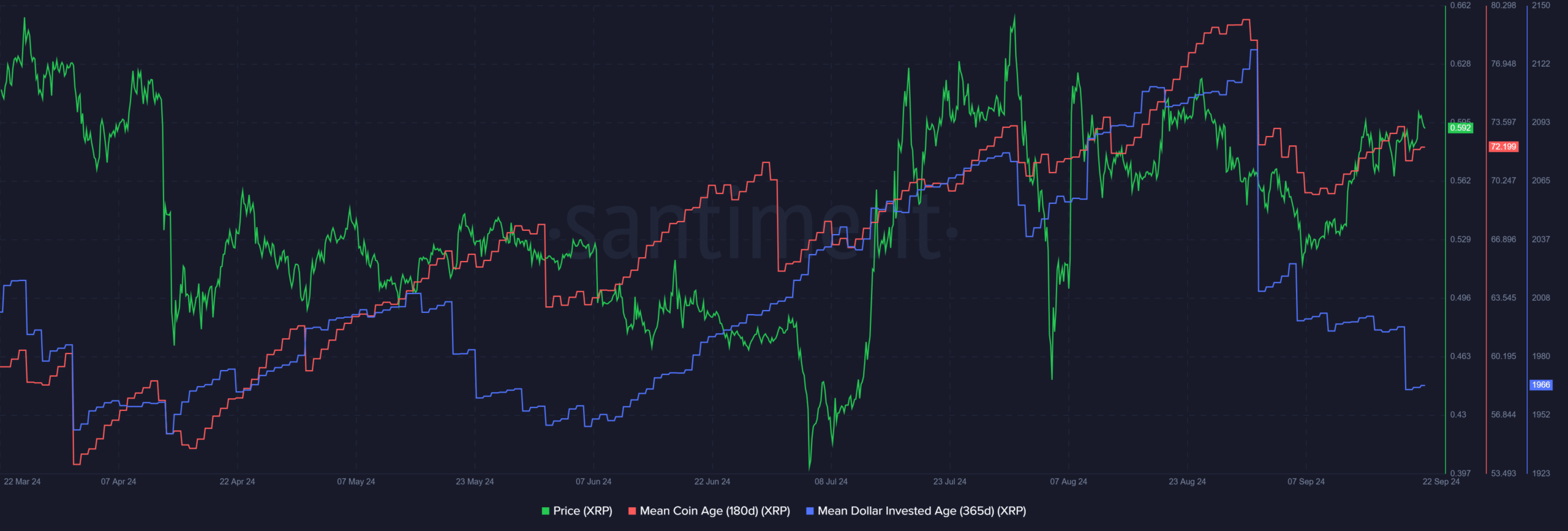

Source: Santiment

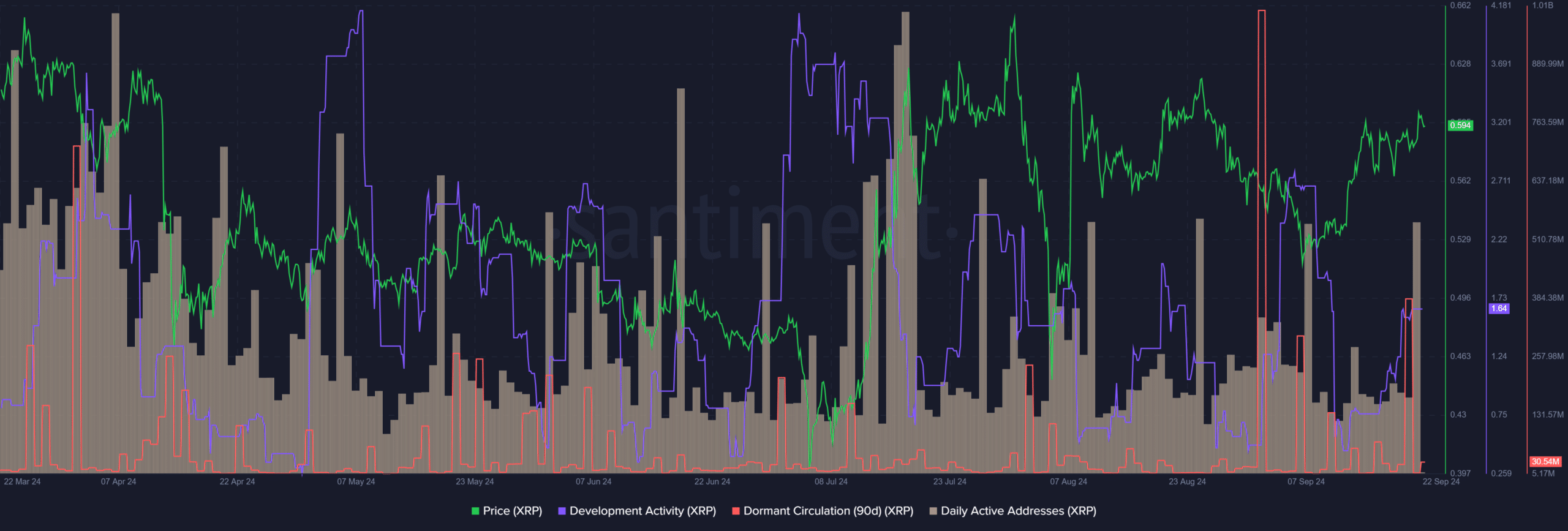

On September 2nd, dormant circulation saw a huge spike. This showed a huge storm of activity among XRP addresses. A surge of activity that eclipsed this was observed in June 2023.

Usually, an increase in this metric precedes a major price correction. XRP experienced such a correction over the next four days, dropping 12.18% from $0.572 to $0.502.

XRP development activity continued at a brisk pace, but its value was surprisingly low compared to large-cap industry leaders such as Cardano (ADA). Meanwhile, daily active addresses have remained relatively stable over the past six weeks.

Assess the chances of capital inflows into the network

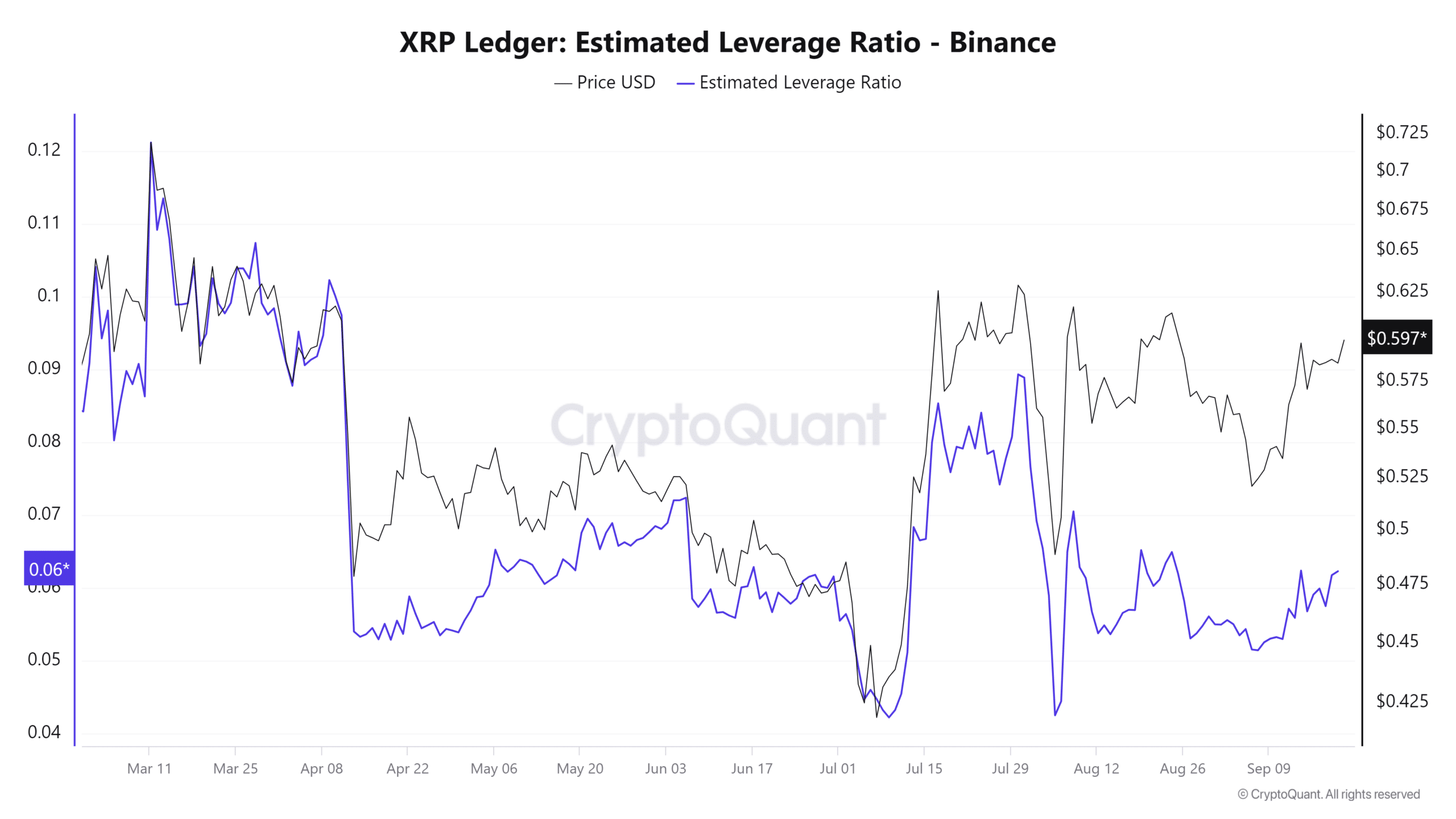

Source: CryptoQuant

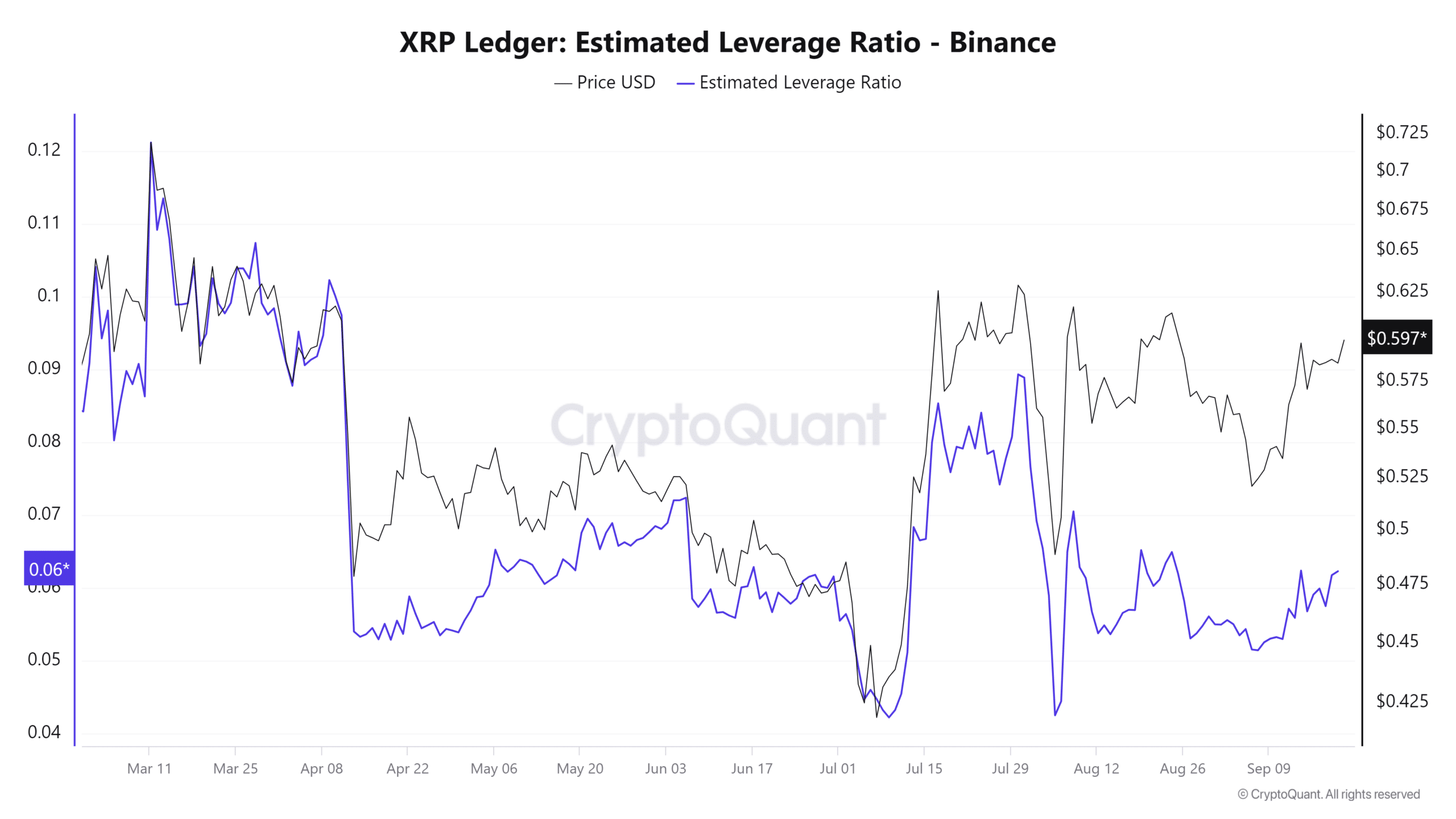

The estimated leverage ratio rose in line with prices in mid-July, but has since calmed down. This lack of movement over the past month showed that speculators were not keen to enter margin positions.

This discovery reinforced the idea that XRP is consolidating.

Source: Santiment

In September, the average age of coins dropped, corroborating the results of dormant circulation. This increase in distribution has slowed over the last two weeks, and the average age of coins has attempted to increase.

Realistic or not, here is the market capitalization of XRP in terms of BTC

Even more significant is the rapid decline in the average age of invested dollars (MDIA). When the average age of invested dollars (MDIA) increases, it means that investments are stagnating and old coins are sitting in the same wallets.

A downtrend usually indicates that the token is ready to see its price increase. This implies that investments are coming back into circulation and suggests an increase in network activity.