This week has been full of surprises and important changes in the American and cryptocurrency markets. From major economic updates to unexpected changes in market trends, staying up to date is more crucial than ever.

Want to know how these developments are shaping markets? Keep reading as we break it down. Let’s go!

US Market Weekly Update

The S&P 500 index stood at $6,051.08 this week, down slightly from $6,091.35 on December 2. Investors are watching a possible 25 basis point rate cut by the Federal Reserve, which is expected to be announced Dec. 18 after a two-day meeting.

Technological and global developments spark interest

Google’s breakthrough in quantum computing has created market buzz, while the continued growth of AI has also generated excitement. In China, the Politburo’s promise of economic recovery further boosted market confidence.

US economic data: what has been published

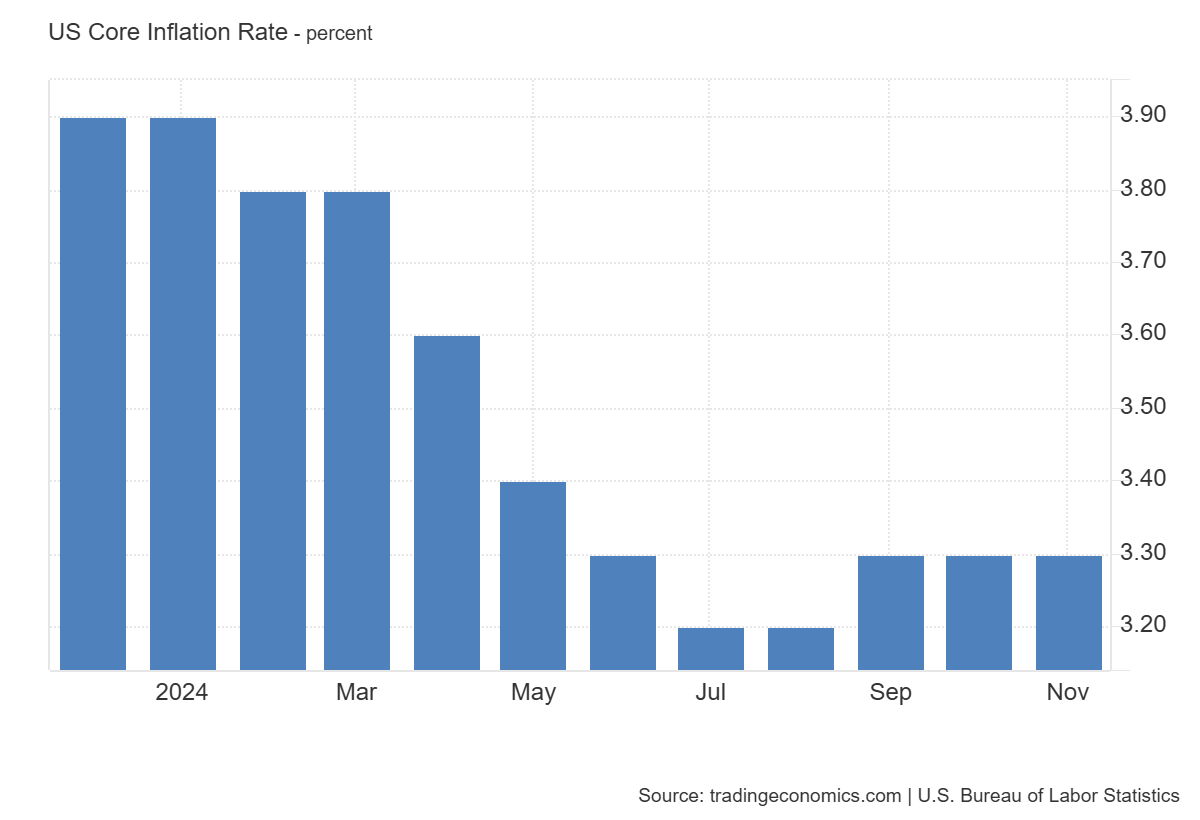

Several key U.S. economic indicators were released this week. The core inflation rate in the United States remained unchanged at 3.3%, while the producer price index (PPI) remained stable at 3.4%. Initial unemployment claims rose sharply, rising to 242,000 from 224,000 the previous week. On the positive side, U.S. export prices rose 0.1% to 0.8% year-over-year and import prices increased 0.6% to 1.3% year-over-year.

The US dollar shows its strength

The US dollar performed strongly against major currencies this week. The euro rose from 0.9461 EUR to 0.9519 EUR, the Chinese yuan from 7.2695 CNY to 7.2751 CNY, the Japanese yen from 149.955 JPY to 153.579 JPY and the Indian rupee from 84.64 INR to 84 .76 INR.

Crypto Market Scenario This Week

The total market cap of cryptocurrencies increased from $3.62 trillion to $3.57 trillion this week, and that of altcoins increased from $1.61 trillion to $1.55 trillion. Excluding Bitcoin (BTC) and Ethereum (ETH), the market capitalization increased from $1.13 trillion to $1.08 trillion.

Bitcoin Market Overview

Over the past seven days, Bitcoin has seen a 2.1% rise. At the start of this week, the price was $97,382.37. On December 11, it climbed to $101,034. On December 12, there was a minor correction. Now the price stands at $101,698.45.

Analysis of Ethereum market scenarios

Over the past seven days, the Ethereum market has seen a decline of 2.2%. At the start of this week, the price was $4,005.27. On December 10, it fell to $3,632.39. Now, with the price sitting at $3,916.22, the market is yet to recover from the said correction.

Main cryptocurrencies and market trends

Outside of Bitcoin and XRP, most of the top ten cryptocurrencies showed negative growth. Cardano fell 8.5% and Dogecoin fell 6.0%. However, XRP rose 2.2%, just ahead of Bitcoin’s 2.1% increase.

Trending this week

Anime-Themed, Impossible Finance Launchpad, Telegram Apps, Terminal of Truths and Morpho Ecosystems are the top five trending categories of the week. Anime-Themed showed a massive growth of 217.9%.

Happy Cat, Velodrome Finance, Hyperliquid, Virtuals Protocol and MAD are the most trending cryptos this week. Happy Cat has seen a gain of 50.8% over the past seven days.

Crypto Overview: Winners and Losers

Over the last seven days, the Smart Contract Platform category fell by 0.5%, Meme Coin by 3.9%, Artificial Intelligence by 7.8%, DePIN by 12.2%, NFT by 9.3%, Layer 2 (L2) by 6.1%, Gaming (GameFi) by 7.9%, Layer 0 (L0) by 14.0%, Real World Assets by 4.9%, Metaverse by 10.1%, Internet of objects by 11.8%,

Meanwhile, the Layer 1 (L1) category jumped 0.1%, Stablecoins by 2.8%, USD Stablecoins by 5.6%, Decentralized Finance by 1.3%, Decentralized Exchanges by 1 .8%, agriculture yield 1.7%, lending/borrowing protocols 9.6%. %, AI Agents by 5.2%, Perpetuals by 23.6%, AI Meme by 17.35 and Telegram Apps by 105.9%.

In conclusion, this week has been eventful for both the US market and the crypto market. While the FOMC rate cut is expected to be announced on December 18, next week could bring even more surprises.

Never miss a beat in the crypto world!

Stay ahead of the curve with breaking news, expert analysis and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs and more.