Since earlier this year, investors have been waiting for the Fed to finally reduce rates. The American labor market has refreshed, and many estimated that it was only a matter of time before the central bank moved.

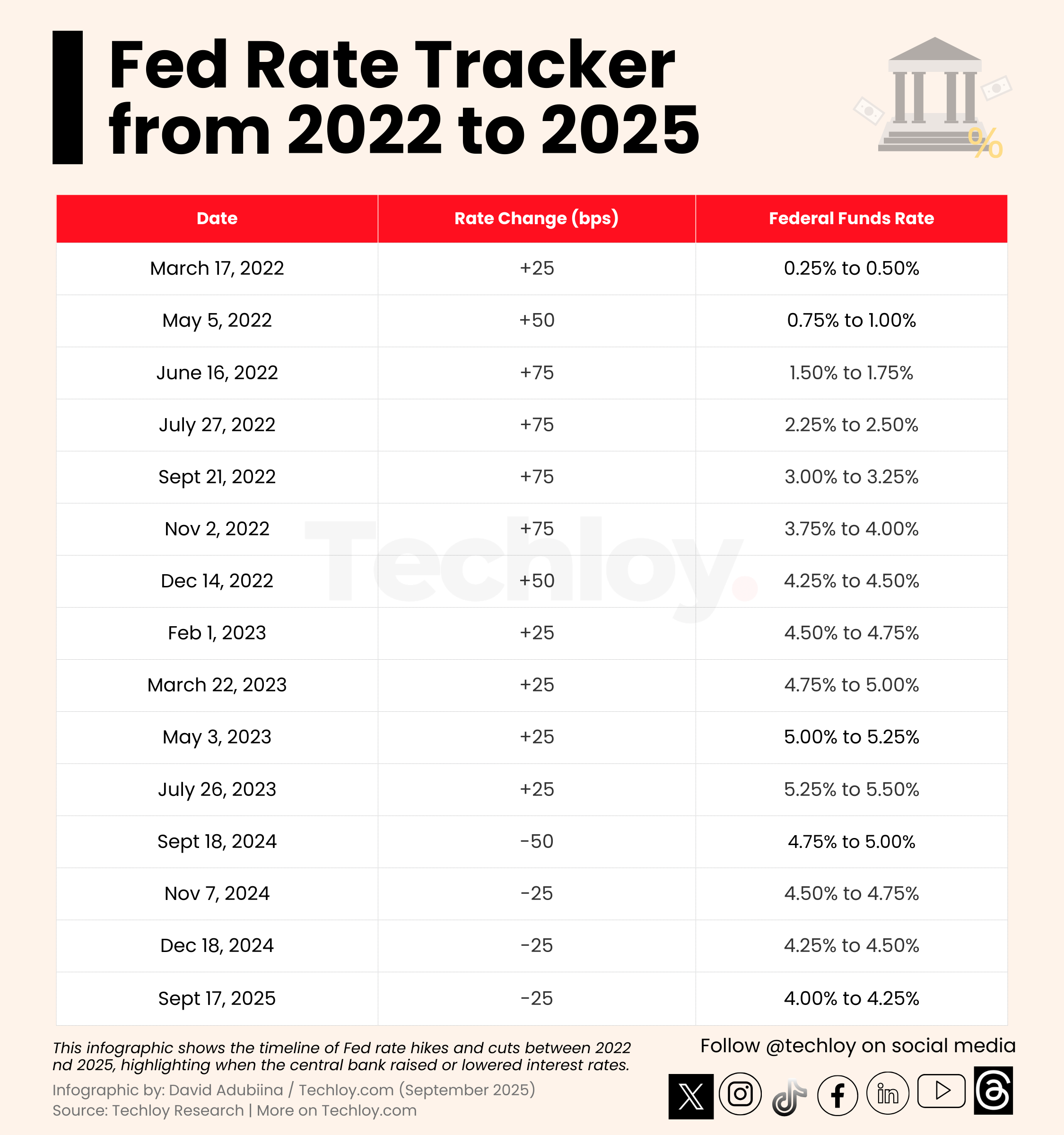

This has happened recently: for the first time since December 2024, the Fed has dropped its target interest rate to a range of 4% to 4.25%. The objective is to stimulate the economy and avoid a recession. It also turns out that President Trump’s push for cheaper loans.

You expect things to stabilize instantly, but in the long term, this is generally the case. However, the short -term impact on the crypto is another story with persistent inflation potential. To see why, we have to rewind a little.

The drop in ECB rate increases the pressure on EUR / USD

Stay up to date with Forex market trends; Learn how the recent reduction in the reduction in European central bank rates puts EUR / USD under pressure as the markets adjust.

What is a drop in Fed rate?

In simple terms, a decrease in the Fed rate is when the central bank reduces the short -term rates that banks use with each other. Once it falls, loans become cheaper, and for a long time, you also feel it in the wider economy. Companies can contract loans at lower costs, consumers can spend more and investors generally become a little more courageous with their money.

The Fed does not do this for fun, but to maintain live growth when the economy slows down or seems to have switched into a recession.

What are interest rates in crypto doing?

When the rates go upCrypto tends to suffer. Here is why:

1. Reduction of risk appetite

When rates climb, people are less hungry for risk. Why throw money in Bitcoin if a state obligation pays you 10% without drama? This means that investors withdraw money from risky assets.

2. higher opportunity cost

Holding the crypto suddenly feels expensive when other assets start to pay solid interest. Each dollar Bitcoin is a dollar that does not win elsewhere.

3. Margin calls and take advantage of pain

The crypto thrives on the lever effect. People borrow to buy more, pursuing greater gains. But when rates increase, loans become more difficult to serve. If the prices drop, the margin calls the start. Traders are forced to sell, which lower prices even more.

We saw this game in 2022. The rates climbed, Bitcoin dropped and the training effect led to collapses like Celsius and FTX.

So why are the rate drops large?

If higher rates have an impact on the crypto, which makes assets for packages such as savings accounts and more attractive obligations, lower rates tend to do the opposite. Inexpensive money feeds risk taking. When the prices drop, Bitcoin suddenly looks much better. The money does not pay much, the obligations are not either, so the money begins to return to more risky games. And since the crypto is negotiated 24/7, it generally reacts above all.

Historically, large rallies have aligned themselves with periods of easier monetary policy. Think of 2020: recovery checks, prices close to zero and Bitcoin walking from $ 10,000 to almost $ 70,000.

To what height can the crypto go this time?

This is the big question that everyone is asking. The Fed Cup could be the fuel, but how far this rally takes place on the place where investors decide to park their money.

If the liquidity continues to flow and the FNB continues to pull billions, Bitcoin could do another race after its previous heights. Ethereum and Altcoins would follow, on the same wave. Some analysts argue that a visit to the range of $ 150,000 for Bitcoin is not out of the question in this cycle.

Conversely, if the economy continues to weaken, even cheaper is perhaps sufficient. Investors can remain cautious, holding money instead of chasing crypto. In this case, we would probably see lateral movements rather than real market gatherings.

Then there is also the midfielder, where a progressive rally occurs, the bitcoin moving upwards but without the insane parabolic movements of 2020-2021. This could still mean $ 120,000 + Bitcoin, just with a slower momentum.

The Bitcoin price exceeds $ 112,000 after the largest sale of whales, traders are still cautious

Despite the whales that unload $ 12.7 billion in BTC, the biggest concern for traders is the outlets of FNB spot and the rise in ETH entries.

Conclusion

In any case, the Fed rate movements will continue to play a big role in the place where the crypto then heads. In the short term, the effect may seem negative, but a more stable rate environment could open the door to long -term growth. No one can say with certainty how this back and forth between the Fed and the Crypto will take place, but if you enter this space, it is something that you cannot ignore.

What do you think? Is this the beginning of something bigger, or just noise? Place your thoughts in the comments.