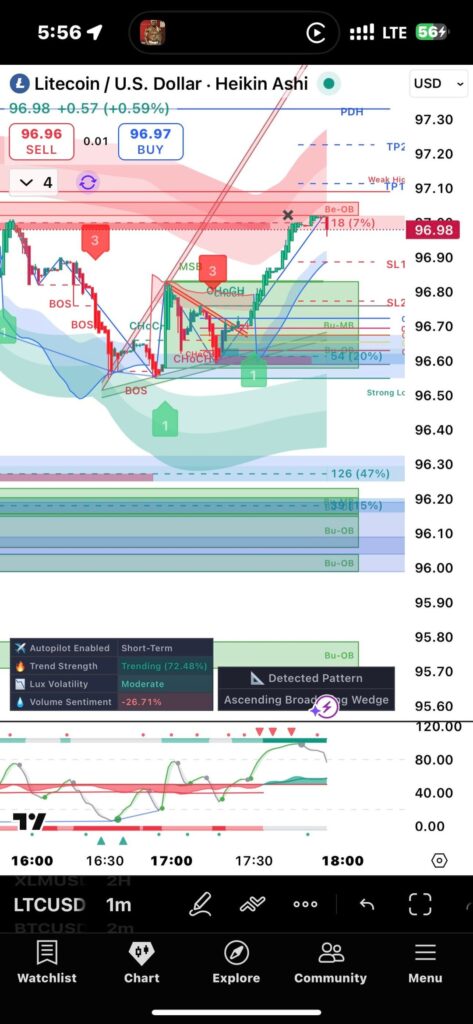

Exactly what the title says. Checkout the candles here, they’re producing “dead candles” which the term might be different but essentially it’s a candle stick with no wick which isn’t a good sign for the markets at all, last time this happened was a week ago before 50% dump.

2H timeframes show bear signals.

1H timeframes show bear signals.

30m timeframes show bear signals.

15m & 5m entries impossible to read right now.

1m timeframes producing dead candles.

RSI is maxed out on 2H, 3H & 4H charts.

1D RSI is about 50% which is a risk zone for correction.

Short contracts exceed long positions as of 4 days ago. Hyperliquidity maps are becoming bearish as hell. So at this point the only thing we can do is hope for the best.

Personally I’ve pulled my funds for right now, I don’t trust the candles being produced. Trump denied a meeting with China which was a macro analysis type of deal that would have switched the market around.

We are looking at $98,000 – $90,000 as our next correction & it’s hard telling if we are going anywhere from here for a while unless tariffs or something with the global economy becomes different.