SUP (SUP) has increased by 34% in the last 30 days while the project’s DEFI ecosystem has increased rapidly this year. This promotes a priced prediction of a bullish because it indicates an increased adoption by the developers.

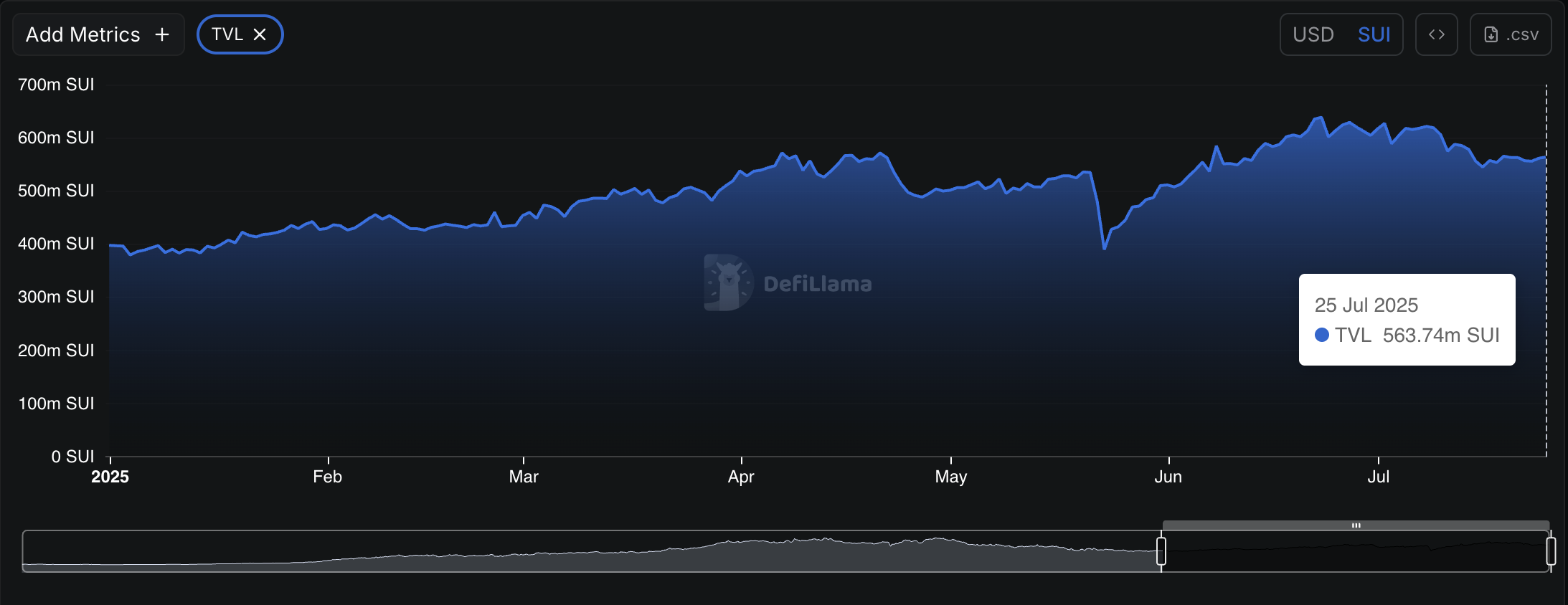

The data from DEFI LLAMA show that the total locked value (TVL) within the Blockchain Suis has increased by 42% since the start of the year.

Measured in Suit, a better way to capture growth and trends, the number of tokens locked in DEFI amounts to 564 million or 16% of the supply in circulation.

TVL analysis in SUI eliminates the distortion created by price increases and captures a more precise image of how the network ecosystem progresses.

The project made efforts to become the home of the main BTCFI applications. These are decentralized applications that exploit the scalability of the SU network in the Bitcoin ecosystem via bridges.

If SUP can capture even a small part of the BTC offer, this can lead to an exponential increase in the Blockchain TVL and promote a priced prediction in the middle of the point which results from the demand for a usefulness token.

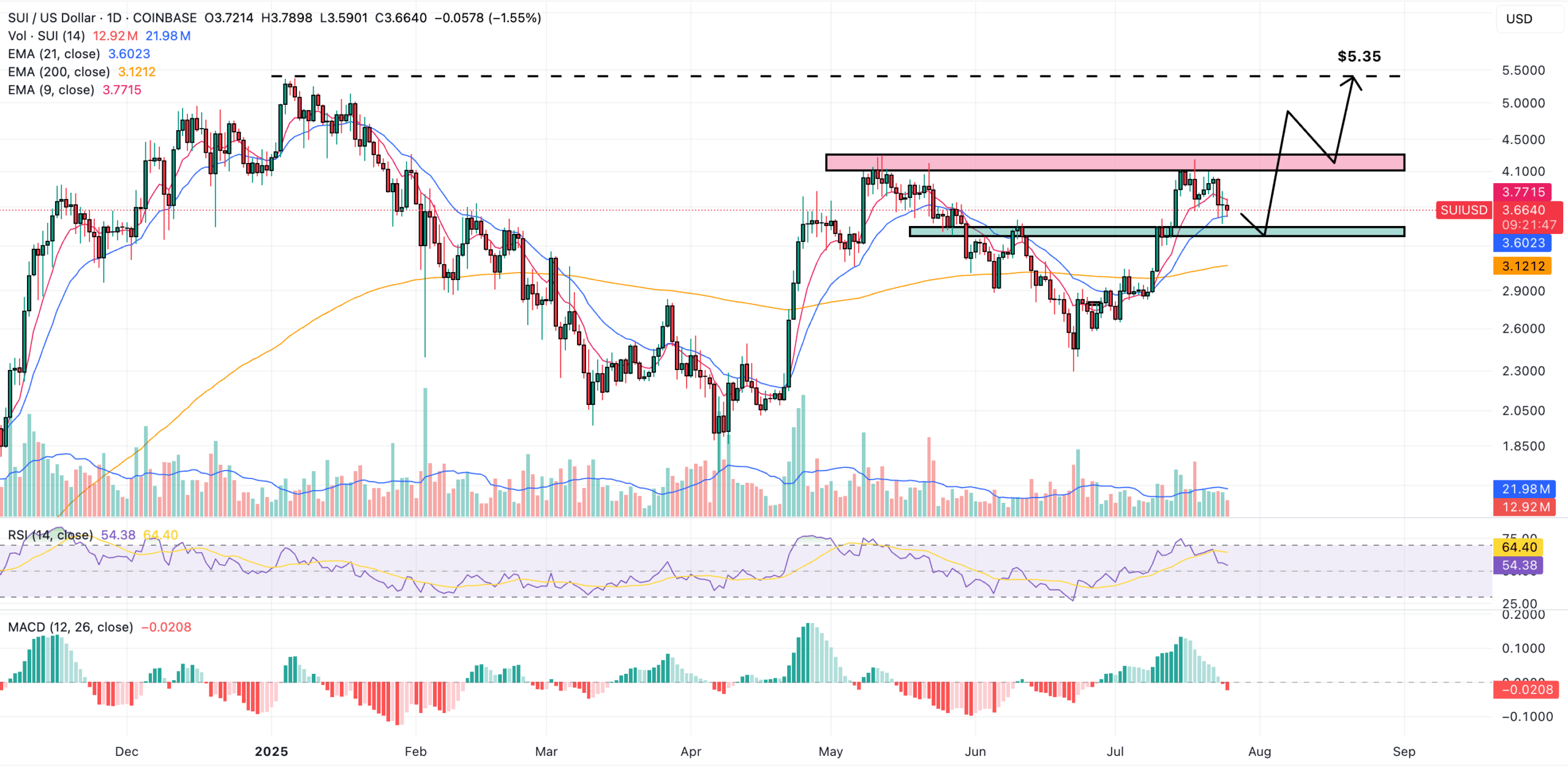

PRICE PRODUCTION SUP: an upper evasion greater than $ 4.2 will confirm the relevant retain

Looking at the daily graphic, SU has encountered high sales pressure at $ 4.2 and prices have now been trapped in what seems to be potential consolidation.

The key support to monitor at this stage is the level of $ 3.45, which has acted as a resistance in the past. The positive impulse that the SUP network has favors an upward prediction of suis prices.

The closest and most logical objective would be the top of all time of the token of $ 5.35 if the bullish momentum continues to push the higher price after a minor withdrawal. A confirmed break would come if the price exceeds this resistance of $ 4.2 and holds it from above.

Several projects have sought alternatives to unlock the unexploited potential of the Bitcoin network.

Bitcoin hyper (hyper), one of the warmest cryptographic presales of the year, has chosen to take advantage of the Solana virtual machine (SVM) to create a bridge that allows BTC holders to transfer their assets safely so that they can earn passive income from their investment.

Bitcoin Hyper (Hyper) collects nearly $ 5 million to launch its Bitcoin L2 fueled by Solana

Bitcoin hyper (hyper) is a side chain created to promote a new era for Bitcoin Defi. BTC holders will be able to win the performance, play and lend their assets without leaving the Bitcoin network via this L2.

So far, the project has raised $ 4.8 million to complete the first step in the roadmap which consists in raising funds to launch the hyper bridge. Once the bridge is operational, users will be able to land the BTC tokens in the Bitcoin Hyper L2 to invest in DEFI applications while their BTC tokens will remain locked in an designated Bitcoin portfolio.

Once portfolios and superior exchanges are starting to adopt this solution, the demand for a project’s utility token, $ hyper, will explode.

You can now buy $ hyper at a priced price at reduced prices to collect the highest yields once this happens. Simply go to the Bitcoin Hyper website and connect your wallet (for example, the best wallet) to exchange USDT or ETH for this token.

You can also invest using a bank card and you will receive $ hyper on the Solana or Ethereum network once the presale is completed.