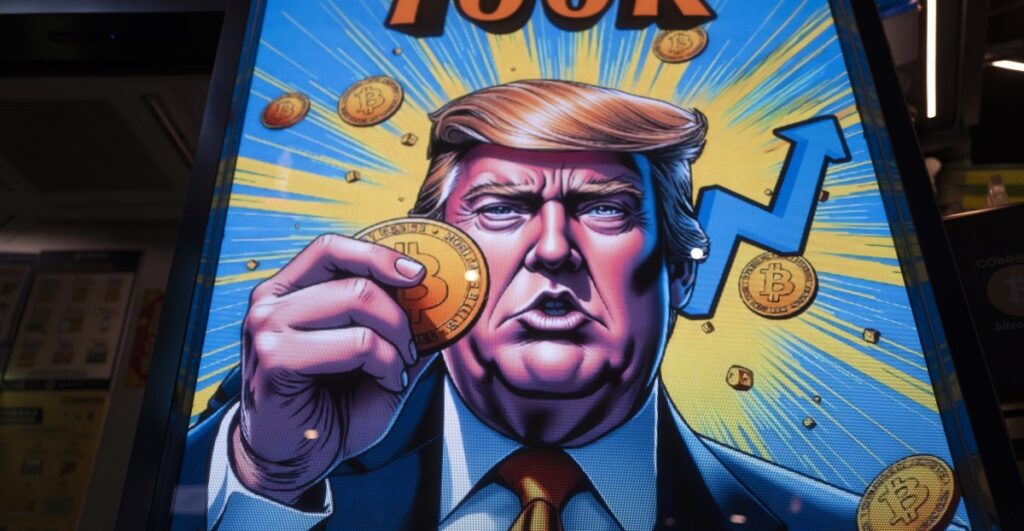

The price of bitcoin surpassed $100,000 for the first time on Thursday, continuing a post-election campaign buoyed by the new Trump administration’s pro-crypto promise.

On Election Day, bitcoin — one of the most popular decentralized digital assets available — was worth $69,374, according to cryptocurrency trading platform Coinbase. Within a month, it had increased by more than 44 percent. Other cryptocurrencies like Ethereum and XRP have also skyrocketed during this period.

The sudden rise in the value of cryptocurrencies is a sign of investor optimism about President-elect Donald Trump’s policies and those of his picks to lead several key regulatory agencies, some of which have explicitly promised deregulation of the cryptocurrency industry.

“The fact that bitcoin has reached the $100,000 mark reflects expectations of both policy support and regulatory latitude under the new administration,” said Ramaa Vasudevan, professor of economics at the State University of Colorado, which has criticized crypto. “The appointment of crypto enthusiasts to administrative positions is a clear signal of the adoption of bitcoin and crypto, triggering an influx of money into these markets.”

Bitcoin’s rally is also a product of its increased legitimacy. Trump’s election may have sparked its rally, but the financial establishment’s embrace of the asset in recent months provided the trigger. While bitcoin was once a niche curiosity, it is now a mainstream digital currency that Americans can now purchase on a daily basis through reputable retail investment accounts. Even if Bitcoin ultimately turns out to be a bubble, as many economists have argued, these investment vehicles have given it some longevity.

New Trump administration’s policies fuel optimism

Trump was an ardent supporter of cryptocurrency throughout his last presidential campaign, and his choices to lead key government agencies related to its regulation reflect that enthusiasm.

Bitcoin reached its highest valuation ever after Paul Atkins was appointed head of the Securities and Exchange Commission (SEC), which regulates tradable securities like stocks, on Wednesday. Atkins served as SEC commissioner for six years during the administration of former President George W. Bush.

Atkins is “not necessarily the kind of do-it-all candidate that Trump has chosen for other offices,” Molly White, a cryptocurrency researcher and critic, told Vox. “It’s pretty established; he has SEC experience, but he was also a strong advocate for deregulation when he was in the SEC and certainly since then. Atkins is also co-chair of the Chamber of Digital Commerce’s Token Alliance, an industry lobbying group that advocates for lax regulation of cryptocurrencies.

Chamber of Digital Commerce CEO Perianne Boring is rumored to be one of Trump’s top picks for another key job: head of the Commodity Futures Trading Commission (CFTC), which sets rules for trade futures and commodities. Currently, cryptocurrency falls under the jurisdiction of the SEC, but the Trump administration is reportedly considering regulating it as a commodity instead. If this change were made, cryptocurrency would fall under the jurisdiction of the CFTC, which is often considered more hands-off in its approach to regulation.

Billionaire crypto enthusiast David Sacks, whom Trump named his crypto and AI czar on Thursday, will be tasked with helping formulate the White House’s crypto and AI policy. In this role, Trump said in an article on Truth Social, Sacks will work closely with the SEC and CTFC to develop a legal framework to regulate crypto.

Trump himself is also connected to cryptocurrency through his family’s cryptocurrency and trading business World Liberty Financial. Pro-cryptocurrency groups spent $245 million in this year’s elections, more than any other sector, to support candidates across the country seen as more pro-cryptocurrency.

All of this likely means that the regulatory landscape under a Trump administration will be much more crypto-friendly following heavier regulations and a series of lawsuits against crypto companies during the tenure of current SEC Chairman Gary Gensler.

“The recent wave of investment in the crypto space is largely driven by the growing belief that years of regulatory uncertainty and legislation may finally give way to clarity,” said Christian Catalini, founder of MIT Cryptonomics Lab.

Gensler’s SEC has cracked down on trading platforms like Coinbase, Binance and Kraken, arguing that buying and selling cryptocurrency should receive the same oversight as something like a stock or bond, and that investors should have access to the same types of information about crypto. Crypto trading platforms and associated companies, however, argue that crypto tokens are not the same as stocks and therefore should not be subject to the same regulations.

The SEC has filed lawsuits against several major crypto platforms, including Coinbase, which are ongoing. But they could be abandoned under the Trump administration, and regulations around bitcoin and other cryptocurrencies are likely to change significantly under Trump.

Under Trump’s regulatory regime, cryptocurrency exchanges like Binance and Coinbase could operate with less risk of litigation, making it easier to trade on their platforms. Enthusiasts say this will spur innovation in the sector, but it could also mean that individual traders using such platforms will be more exposed to fraud, theft and the volatile nature of the currency.

Bitcoin has become an established digital asset

Over the past five years, and especially after the collapse of cryptocurrency trading platform FTX in 2022, the conversation around the usefulness of cryptocurrency has changed. Today, it’s presented more as an investment instrument rather than a form of currency that can be used like cash, White said. And this pivot also contributes to its valuation.

In January, the SEC gave the green light to the first Bitcoin exchange-traded funds (or ETFs) in the United States. ETFs are baskets of financial instruments (such as stocks, bonds, commodities or, in this case, cryptocurrencies like Bitcoin or Ethereum) that are bought and sold on a regulated exchange.

ETFs offer anyone indirect access to cryptocurrency, should they choose to invest. Simply put, if the value of bitcoin increases, so does the value of these ETFs – but due to the pooled nature of ETFs and their presence on a regulated exchange, investors are better protected against losses if the value of bitcoin decreases. Companies such as BlackRock, Invesco, Fidelity, Grayscale and Ark Invest have rolled out Bitcoin funds, which provide new investors, particularly those who might be more risk-averse, with easy ways to purchase or gain exposure to cryptocurrency.

Previously, investors had limited options for trading bitcoin. They could go to a cryptocurrency exchange to buy bitcoin directly, but then would have to figure out how to store it safely and conveniently for the long term. (Cryptocurrency held on an exchange may be vulnerable to theft, while cryptocurrency stored offline is safer but difficult to trade.) They could also invest in risky Bitcoin futures, agreeing to buy or sell the currency at a later date at a certain price. Now, ETFs offer an institution-backed option.

“While no one can predict the exact inflection point or when the price will stabilize, the long-term driver of bitcoin’s rise is its evolution – not just as digital gold, but as a layer fundamental to the global financial infrastructure,” Catalini said.

However, Vasudevan said there is still reason to believe that crypto’s rise will not last forever. Bitcoin once soared, only to collapse precipitously. In November 2022, the value of bitcoin fell by 20%, falling below $16,000, days after crypto exchange FTX fell dramatically. The concern remains that the price of crypto is based solely on speculation, rather than inherent value.

“This has all the elements of another bubble, fueled by the prospect of a more favorable regulatory environment and the possibilities it opens up for new products and funds that could attract more and more people to these markets” , Vasudevan said. .