Bitcoin broke the key psychological level of $100,000, taking the rest of the crypto market with it.

Summary

- Bitcoin fell below the key psychological level of $100,000

- This is the lowest point in the BTC price since June.

- Strategy shares fell 6%, reflecting the price of BTC

For what? Fear once again reigns in the cryptocurrency markets. Amid government paralysis, traders are fleeing risky assets.

For the first time since July, Bitcoin plunged below $100,000, triggering a massive sell-off in the crypto market. The decline came after deteriorating macroeconomic conditions triggered a wave of liquidations and ETF flows.

On Tuesday, November 4, the BTC price hit a daily low of $99,954, the lowest in several months. The price has since rebounded to $100,269, with Bitcoin seeing a 6% daily decline. The drop triggered a significant decline, with the crypto market cap losing 6.4%, worth over $300 billion.

$100,000 was a key psychological level for BTC, especially since the token remained above it for months. The last time BTC price was below $100,000 was on June 23, when it hit a daily low of $99,705.

Why did Bitcoin fall?

This decline occurred after a deterioration in macroeconomic conditions, reducing appetite for risky assets. Threats of new tariffs, as well as the likely pause in further rate cuts from the Federal Reserve, have made crypto assets less attractive to investors.

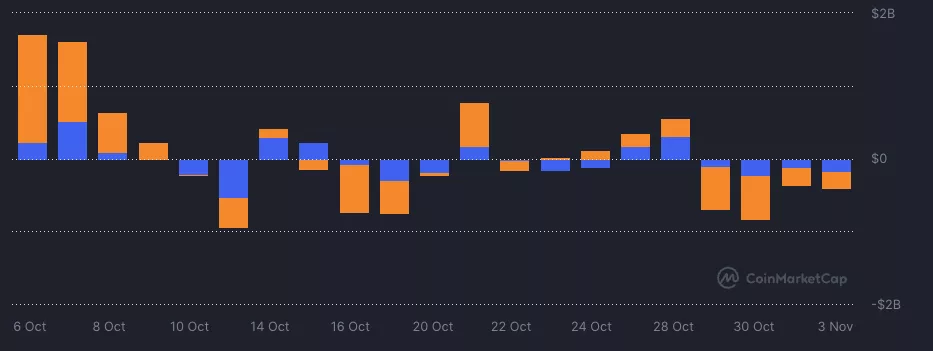

This outlook then caused a cascade of effects that resulted in continued ETF outflows and increased liquidations.

On the one hand, the Bitcoin (BTC) and Ethereum (ETH) ETFs are on track to record their fifth consecutive day of negative flows. Meanwhile, 24-hour liquidations reached $1.4 billion on November 4, with long positions dominating at $1 billion.

Once Bitcoin price falls below this key level, a further breakout is possible. Traders will be looking at the $98,000 support level, which is both the low end and a high liquidity zone.

At the same time, the US dollar has rebounded slightly since the Fed cut interest rates in September.