It’s not every day that a giant like Coinbase leaves a promising market, especially one as dynamic as Turkey. Yet just three months after announcing ambitious plans for the country, the stock market suddenly did an about-face. What went wrong?

The answer lies in Turkey’s increasingly strict crypto regulations, which are shaking up the industry. But Coinbase isn’t the only one feeling the pressure: other major players are also grappling with difficult choices.

So why did Coinbase pull out while others stay? Let’s dive into the story behind this unexpected decision.

Turkey’s Strict Crypto Regulations

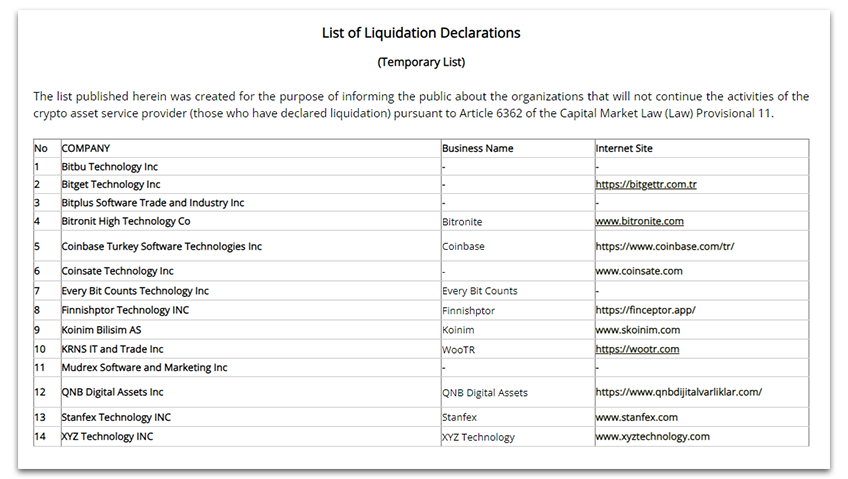

Turkish regulators have tightened rules for cryptocurrency companies, creating major challenges for businesses operating in the country. Recently, the Capital Markets Council listed Coinbase as one of 14 companies that have shut down operations. Despite this, larger players like Binance and KuCoin are still trying to stay in the game, even though they have had to make significant compromises.

Binance and KuCoin scaled back their operations by removing Turkish language support and reducing marketing aimed at local users. These changes highlight the difficulties of operating in a region with increasingly restrictive regulations.

For Coinbase, leaving Turkey appears to be a strategic move to avoid these obstacles.

Coinbase has other problems to solve

Turkey is not the only market presenting challenges for Coinbase. In Europe, the company recently stopped offering USDC yield programs, citing new, stricter European regulations. In addition to the list of changes, Coinbase announced plans to delist Wrapped Bitcoin (WBTC) by December 19, 2024. The move surprised many, especially given the success of its other token, cbBTC, which holds a strong market cap of $1.44 billion in DeFi. space.

Focus on the United States

Back in the United States, Coinbase CEO Brian Armstrong is focusing on politics. He has reportedly spoken with politicians about appointing crypto-friendly executives, including suggesting Hester Peirce as a replacement for SEC Chairman Gary Gensler. Nobody knows if this will change anything, but it shows that the stock market is playing a long-term game.

A positive point for Coinbase

Here’s the problem: Bitcoin’s rally is bringing retail investors back in droves. In November, Coinbase’s app rankings rose to ninth place globally. This is a big win for the exchange, even if it faces regulatory challenges.

For Coinbase, leaving Turkey may be more about focusing its resources on easier markets than abandoning it. But will this strategy allow the company to stay ahead of its competitors? Or will persistent regulatory hurdles slow its momentum?

One thing is clear: the crypto world is still unpredictable and Coinbase remains at the center of the action.