Bitcoin and cryptographic markets were in crisis yesterday after President Donald Trump announced new prices on China, Mexico and Canada.

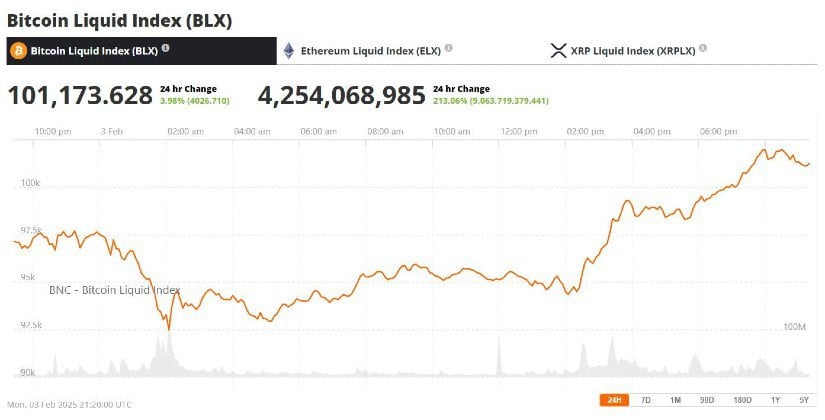

At one point, the largest cryptocurrency in the world by market capitalization was observed at around $ 91,000 – alarmingly decreasing its recent $ 109,000 summit in December.

The Bitcoin Prize crashed and recovered on Monday. Source: Bitcoin Liquid Index (BLX) via Brave new room

Other cryptographic active ingredients, including Ethereum, Cardano and Ripple de Ripple, experienced even worse drops on Monday. Dogey, Shib and Trump coins have also landed strongly on the new prices.

While most of these cryptographic assets have since recovered after the news that Mexico has signed an agreement with the United States which delays new prices to enter into force for another month – it is important for investors to understand Why the market crashed after the price announcement.

After all, it was only the first prize for President Trump, more expected for the weeks and months to come. It is therefore crucial that investors include the intrinsic link between prices and cryptographic markets.

Why are Trump’s prices bad news for cryptographic assets?

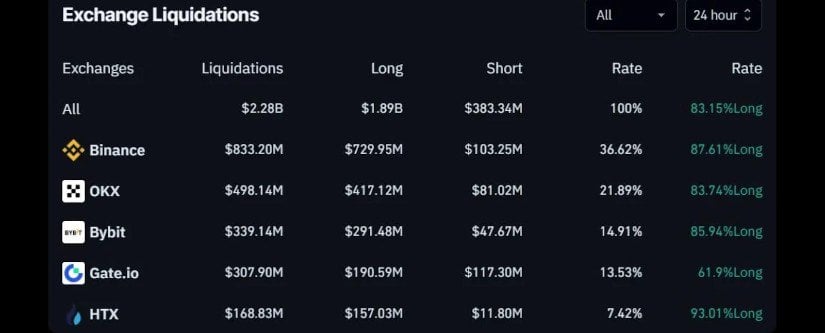

President Trump increased 10% prices on all imports from China and about 25% each of Mexico and Canada during the weekend, which led to just over 2.0 billion dollars on Monday over 2.0 billion on Monday over $ 2.0 billion on the cryptography market.

The crypto-y accident has wiped over $ 2.0 billion in hours: Source: Currency

Sale in cryptocurrencies, including bitcoin, has taken a lot by surprise because Trump prices have nothing to do with digital assets. So why did the cryptography market crash on Monday? In an answer in a word, it is “uncertainty”. The markets like certainty and they do not like uncertainty. Trump is unpredictable, which makes financial markets unpredictable.

Canada has already announced a 25% rate on American products in a reprisal demonstration – China, Mexico, the European Union, and perhaps any other trading partner than the Trump administration targeted in 2025.

In simple terms, the new American government leads the world to a world trade war, and trade wars are known to be an inflationary and, therefore, they result in pressure on consumption expenditure that tends to weigh on business results .

Gathered, it is a recipe for economic uncertainty. When this is knocking on your door, your initial reaction as an investor is to make profits and build a cash reserve.

So, “taking advantage” after an incredible race for cryptography prices and in the midst of more difficult time fears to come – this is the first reason why digital assets took a big blow as a result of the Trump’s decision to raise prices against China, Mexico and Canada.

Investors bange up cryptocurrencies on Monday because digital assets are considered to be volatile, and volatility is what investors avoid such as the plague in the concerns of uncertainty. This is what led to the crash of the cryptography market on Monday.

What is the next step for the crypto in the middle of the fears of a world trade war?

Investors should however note that the subsequent recovery in cryptography prices today suggests that bulls are still controlled.

This is why the director general of Binance, Richard Teng, remains positive and sees the prices of cryptography regain their trajectory upwards in the coming days.

“This too will pass … The slowdown is only temporary,” he wrote on X today.

The CEO of Binance claims that the prices led to the sale in crypto are temporary. Source: X

Teng’s optimism suggests that it is time to consider taking care of cryptocurrencies on weakness-and what the crash of the cryptography market and its subsequent recovery may be established on Monday, it is How lucrative it can be for investors interested in earning fast money.

After all, Bitcoin is comfortably above $ 101,000 in writing. This results in a gain of more than 10% compared to its low intraday. How many financial assets can such yields make in a few hours?