More than $700 million was withdrawn from U.S. spot Bitcoin ETFs in a single day this week, marking the largest pullback in two months. Let’s see why does crypto crash?

According to Bloomberg latest report On January 21, investors withdrew approximately $709 million from U.S.-listed spot Bitcoin ETFs. This is the largest daily release since November 20.

This release follows a period of market tensions triggered by President Donald Trump’s decision. renewed tariff threats against Europe.

His comments sparked new fears of a broader trade conflict and caused investors to abandon risky assets in global markets.

DISCOVER: Next 1000X Crypto – Here are 10+ crypto tokens that can hit 1000x this year

What does the decline in cryptocurrency market capitalization say about investor sentiment?

Bitcoin fell below $88,000 during Tuesday’s sell-off before stabilizing in the upper $89,000 range.

The total crypto market cap fell around 2-3% over 24 hours, remaining just above the $3 trillion mark.

The flow pattern contrasts sharply with early January, when Bitcoin spot ETFs generated about $1.4 billion in net inflows in a single week.

The sudden reversal shows how quickly sentiment has changed as business headlines and rising bond yields dominate the macro picture.

Derivatives data suggests risk reduction rather than complete unwinding. CoinGlass data shows Bitcoin futures open interest near $58.5 billion, with around $63.5 billion traded in the last 24 hours.

Liquidations total around $110 million, while Bitcoin trades at nearly $89,500.

Across the entire crypto market, futures open interest stands at nearly $132 billion, compared to $260 billion in daily volume.

Around $600 million in positions were liquidated over the past day, suggesting cautious repositioning rather than panic.

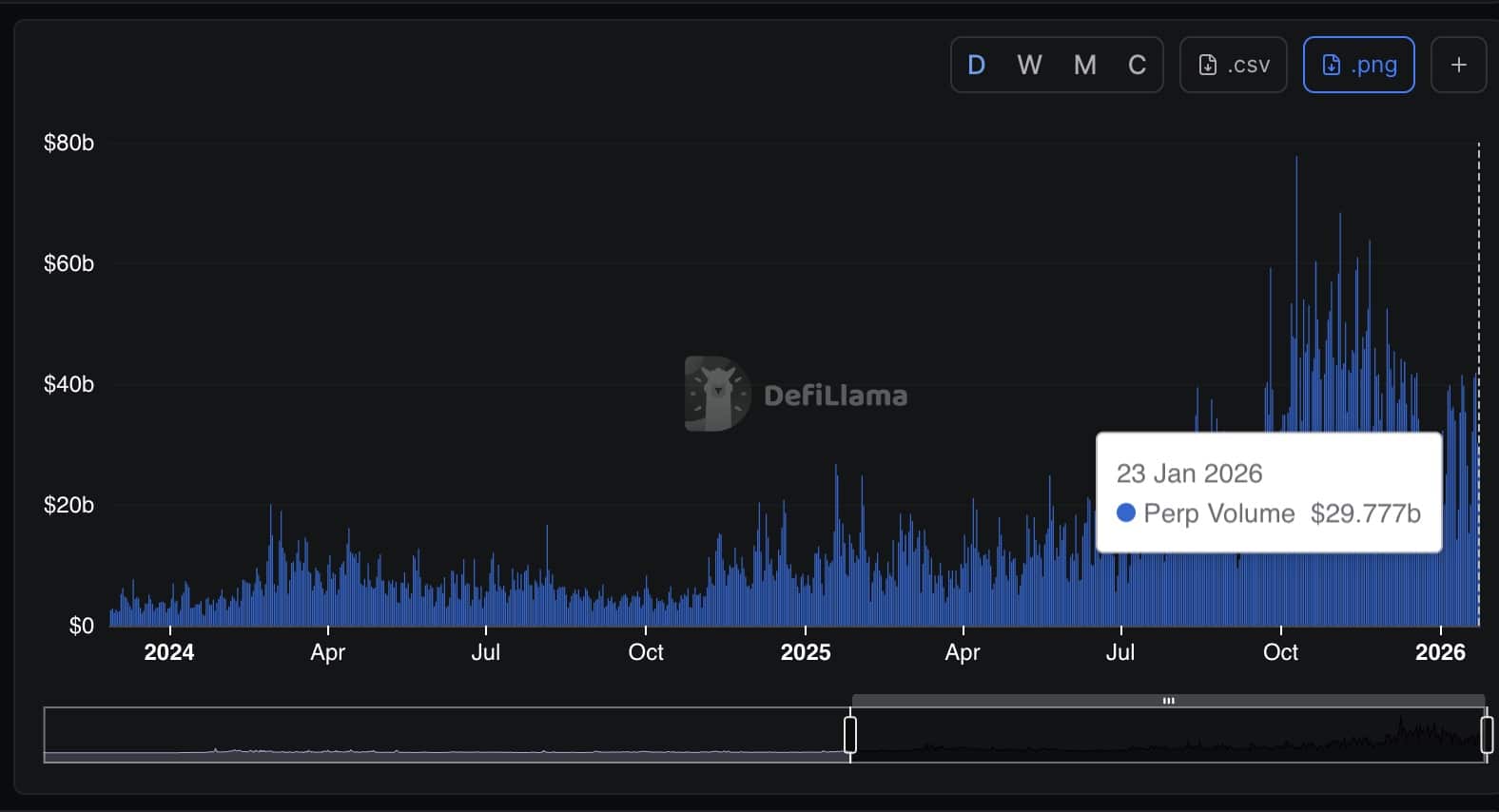

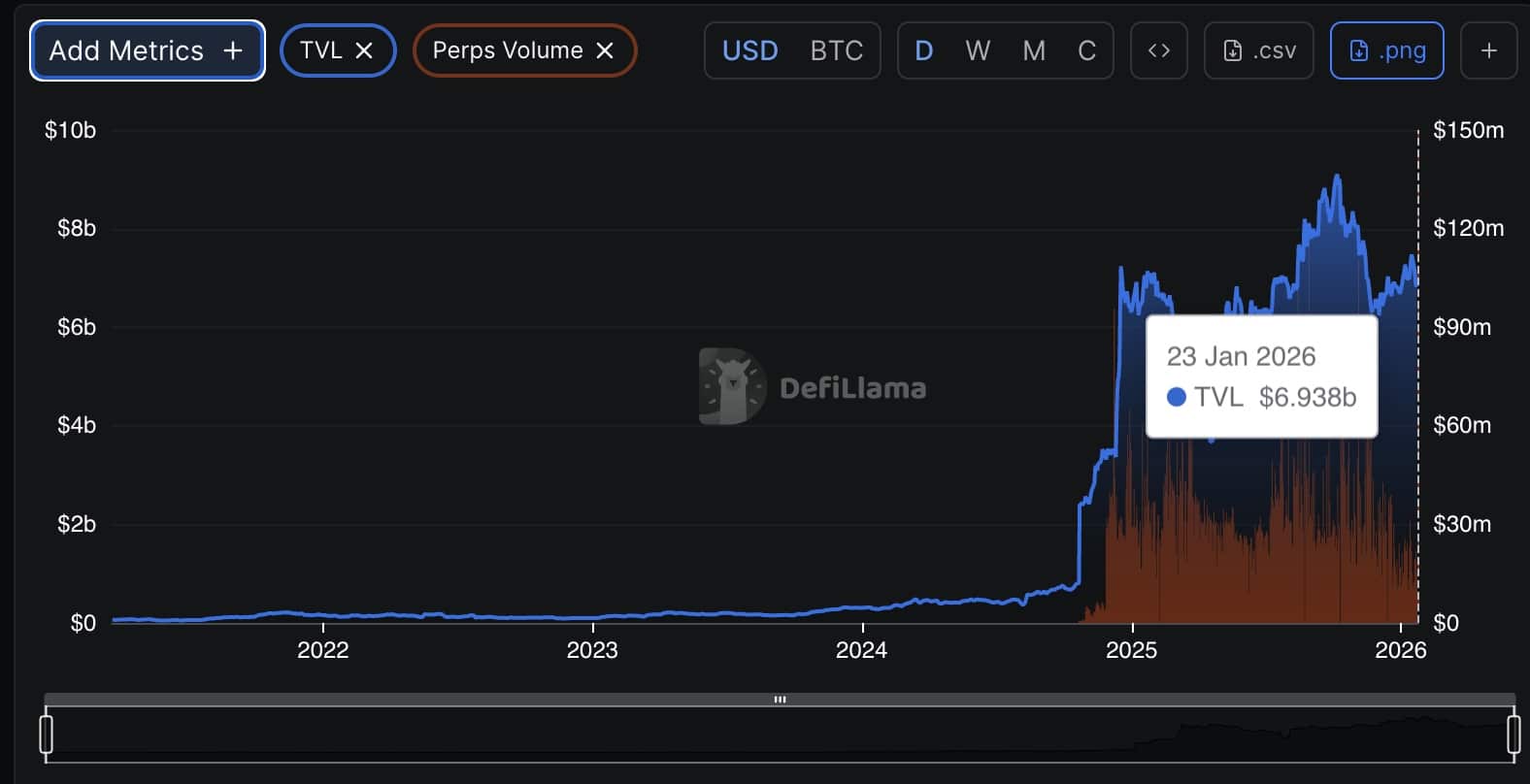

DefiLlama’s dashboard puts perpetual open interest just above $19 billion, with $30.2 billion in 24-hour volume, down slightly from last week.

The share of Bitcoin in on-chain exchanges remains low. Its native chain saw approximately $0.7 million in spot DEX volume and $15 million in perp flows, compared to nearly $14.4 billion in spot transactions on global DEXs.

DISCOVER: 16+ New and Upcoming Binance Announcements in 2026

Does Rising Bitcoin Trading Flows Signal Short-Term Selling Pressure?

Bitcoin’s on-chain flows changed this week as more coins made their way to selling locations.

Data cited by Ali Charts shows that around 15,000 BTC have flowed into centralized exchanges over the past seven days. At current prices, this reserve is worth approximately $1.35 billion.

15,000 Bitcoins $BTCworth around $1.35 billion, was sent to crypto exchanges over the past week, according to data from @nodedeverre. pic.twitter.com/hxiXb6q8wY

– Ali Charts (@alicharts) January 23, 2026

On-chain data from Glassnode shows that exchange balances are increasing again after a brief period of regular outflows at the start of the month.

Traders typically monitor these flows closely because they can signal new selling pressure or short-term positioning.

This change comes as Bitcoin trades near important technical levels, which keeps sentiment cautious at the moment.

Ethereum’s performance relative to Bitcoin has weakened.

The ETH/BTC pair has fallen below its 200-day moving average and 200-day exponential moving average on the daily chart, showing a clear decline in long-term momentum.

$ETH Lost the daily 200MA/EMA compared to $BTC but still holding on to that 0.032 level.

Given that the price has barely moved over the past 3 months, I think a strong expansion in volatility is likely.

Big level to defend here for the bulls to ensure this move isn’t against them. pic.twitter.com/ExRRxAaeeo

– Daan Crypto Trading (@DaanCrypto) January 23, 2026

Even with this breakout, Ethereum still maintains the 0.032 level against Bitcoin. Traders treated this area as a key line in the sand.

The pair has moved sideways for almost three months, with little direction and tight price action. This type of squeeze often signals that a larger move is coming.

Market analysts say the 0.032 area remains the level that buyers need to protect. A firm decline below would give Bitcoin more momentum and could pave the way for a sharper change in the trend.

DISCOVER: 10+ Next Cryptos to 100X in 2026

Key takeaways

- According to Bloomberg latest report On January 21, investors withdrew approximately $709 million from U.S.-listed spot Bitcoin ETFs. This is the largest daily release since November 20.

-

The share of Bitcoin in on-chain exchanges remains low. Its native chain saw approximately $0.7 million in spot DEX volume and $15 million in perp flows, compared to nearly $14.4 billion in spot transactions on global DEXs.

The post Why does crypto crash? A Record $700 Million Flows Out of Bitcoin ETFs in a Single Day as Wall Street Reduces Risks Ahead of Trade War appeared first on 99Bitcoins.