- The manufacturer’s price extends its earnings on Wednesday after joining almost 12% so far this week.

- Channel metrics paint a bullish table as an active daily active MKR, income collection and increase in trading volume.

- The technical perspectives suggest a continuation of rally targeting additional two -digit gains.

Maker (MKR) Price extends his earnings, a merchant about $ 1,680 on Wednesday after joining almost 12% despite the overall correction of the cryptography market so far this week. Channel metrics paint a bullish table as an active daily active MKR, income collection and increase in trading volume. The technical perspectives suggest a continuation of rally targeting additional two -digit gains.

The manufacturer’s chain metrics show bull signs

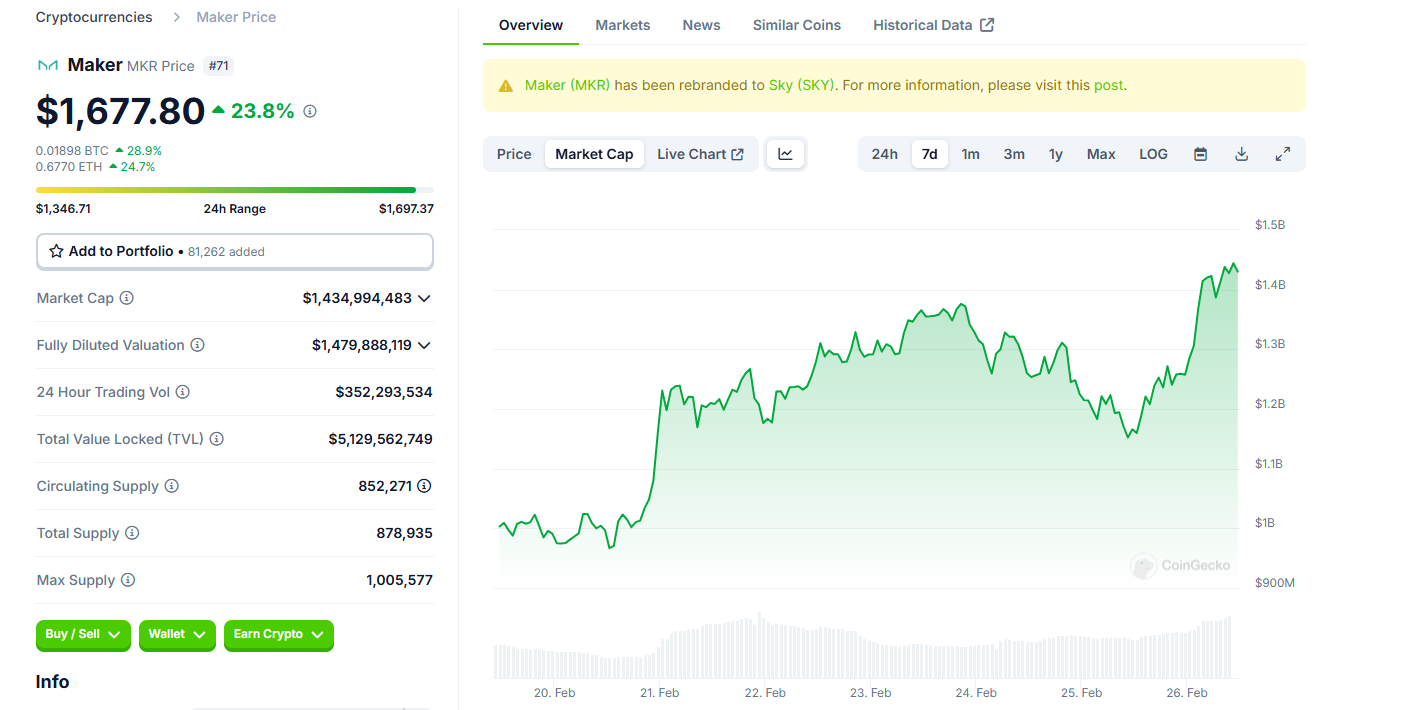

Maker Price continues to be negotiated in green, reaching a summit of $ 1,715 during the Asian negotiation session on Wednesday after joining almost 17% the day before. This upward trend has increased from MKR market capitalization to $ 1.43 billion, according to Coigecko data.

Market capitalization graph of manufacturers. Source: Coingecko

Diving deep into the measures on Maker’s chain still supports its upward perspectives. The daily index of active santly addresses helps follow the activity of the network over time. An increase in metric signals is greater use of blockchain, while the drop in addresses indicates a lower demand for the network.

In the case of MKR, daily active addresses increased by 37% this week. This increase has been the highest since the end of November and indicates that the demand for the use of MKR blockchain is increasing, which could propel a rally in the manufacturer’s price.

%20(09.53.16,%2026%20Feb,%202025)-638761466218343759.png)

GART Active Maker ADDRESS. Source: Santiment

Another aspect strengthening the bullish perspectives of the platform is a recent increase in the interest and liquidity of traders in the MKR channel. Santiment data show that the volume of Maker Chain transactions increased from 109,790 on February 18 to 936,740 Friday, the highest annual transaction.

%20(09.52.19,%2026%20Feb,%202025)-638761466642374848.png)

Manufacturers’ transaction volume graph. Source: Santiment

Defillama data shows that Maker generated $ 734,640 in income on Monday, the highest daily income since January 2, 2025, further strengthening upward prospects.

Maker Daily Revenue Chart. Source: Defillama

Manufacturer’s price forecasts: MKR Bulls aimed at two -digit gains

The manufacturer’s price was interrupted and closed above the descending trend line on February 12 and rallied at 9.28%, closing above $ 1,023 on February 17. MKR continued its rally of almost 59% in the next 8 days. At the time of writing the Wednesday writing moment, he continues to negotiate herself above, of around $ 1,680.

If the MKR continues its upward trend and closes above the resistance level of $ 1,700, it could extend the 28% rally compared to the current levels to retest the weekly resistance of $ 2,175.

The relative resistance index (RSI) on the daily graph reads 74, above its surachat levels, indicating a strong dynamic of purchase and could be due to withdrawal or correction. However, it is possible that the RSI remains above its surachat levels and continue its rally.

MKR / USDT daily graphics