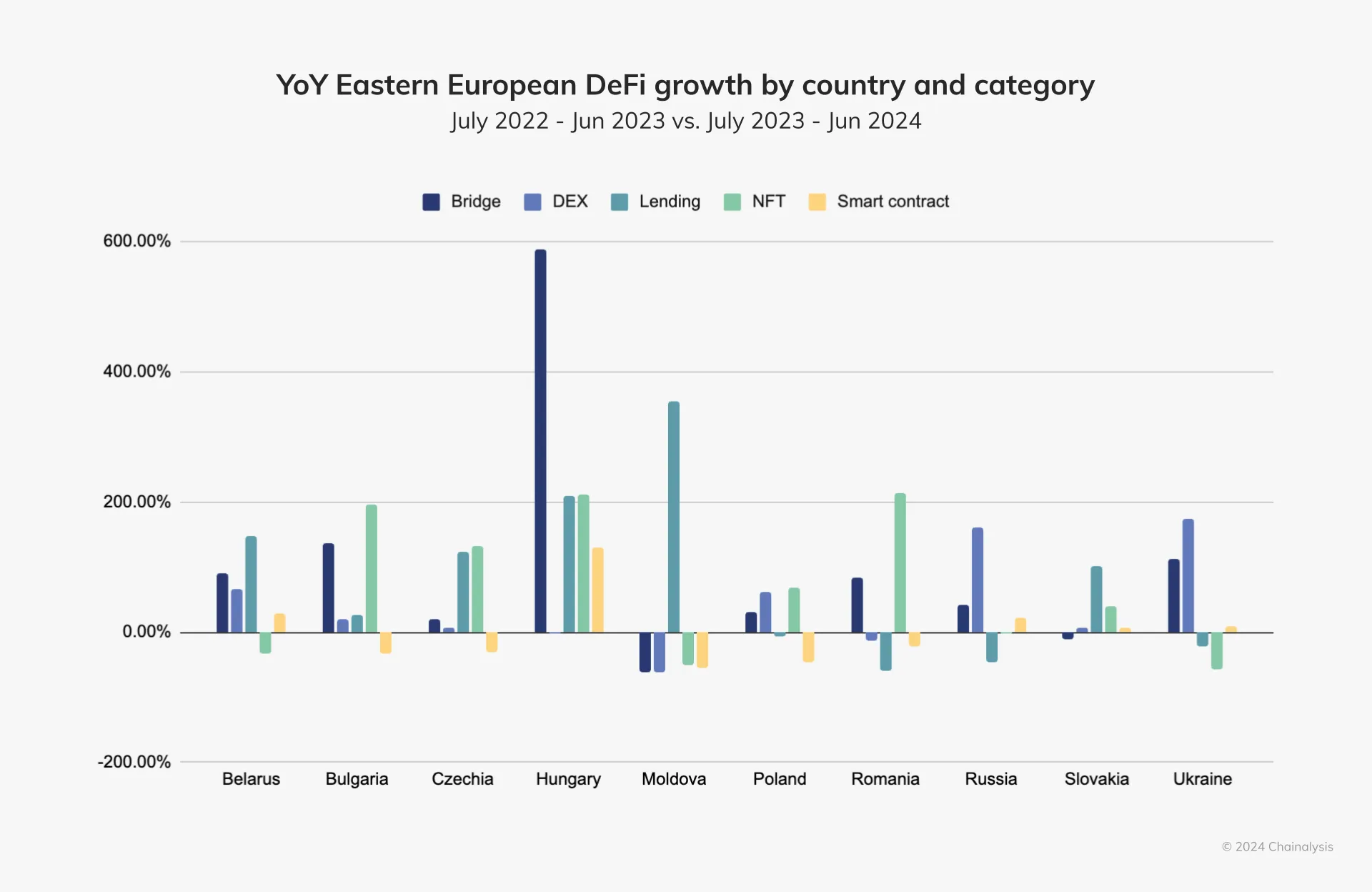

A recent study from blockchain analytics firm Chainalysis shows that crypto adoption is accelerating in Eastern Europe, with Ukraine and Russia leading the way. This push is fueled by emerging DeFi applications and growing institutional support.

The ongoing Russo-Ukrainian war has also led to a shift towards alternative financial systems, as monetary instability and sanctions increase the reliance on non-traditional financing.

The crypto trend in Eastern Europe

A new report from blockchain analytics firm Chainalysis reveals significant growth in cryptocurrencies in Eastern Europe, driven by DeFi activity and institutional adoption, even amid political unrest. DeFi transactions accounted for more than a third of all crypto activity in the region last year, positioning Eastern Europe as one of the fastest-growing DeFi markets in the world.

Previously, Chainalysis observed an increase in centralized FX transactions in Russia and Ukraine; However, decentralized exchanges are now gaining ground as the preferred platform for regional users.

Read more: DeFi Community Building: A Step-by-Step Guide

To explain this change, Ivo Georgiev, CEO and co-founder of Ambire Wallet, based in Bulgaria, gave an exclusive interview to BeInCrypto. As he said, the main attraction of these decentralized institutions is their availability. In the United States or Western Europe, for example, banks are easily accessible and even offer tax advantages for certain wealth-creating activities.

“In Eastern Europe, such services are not only rare, but they are also very difficult to access, requiring a lot of paperwork and often connections. DeFi offers a simple and accessible permissionless alternative, where you can tap your liquidity and take out loans without paperwork or permission from anyone,” Georgiev explained.

The other main pillar of crypto adoption in Eastern Europe is through institutions. This includes private companies like banks or other businesses, which seek to protect themselves against inflation in a tumultuous political climate. However, cross-border payments without sanctions, which the Russian government increasingly supports, is also a major sector.

In other words, Ukraine and Russia are both at the forefront of crypto adoption in Eastern Europe, and the war between them is helping fuel this trend. The conflict is destabilizing both currency and financial institutions in Ukraine, promoting crypto as an inflation hedge and alternative DeFi options. On the other hand, new sanctions against Russia also make cryptocurrencies more attractive.

Read more: Crypto regulations: what are the advantages and disadvantages?

Overall, Chainalysis’ report was optimistic about future crypto growth opportunities in the region. He concludes by describing some of Ukraine’s efforts to comply with MiCA, the EU’s new cryptographic standard. The country hopes to attract new waves of foreign business and investment by adopting similar regulations, even though it is not eligible to be part of MiCA directly.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent reporting. This news article aims to provide accurate and current information. Readers are, however, advised to independently verify the facts and seek professional advice before making any decision based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.