A massive decision: 77K ETH strikes derivatives

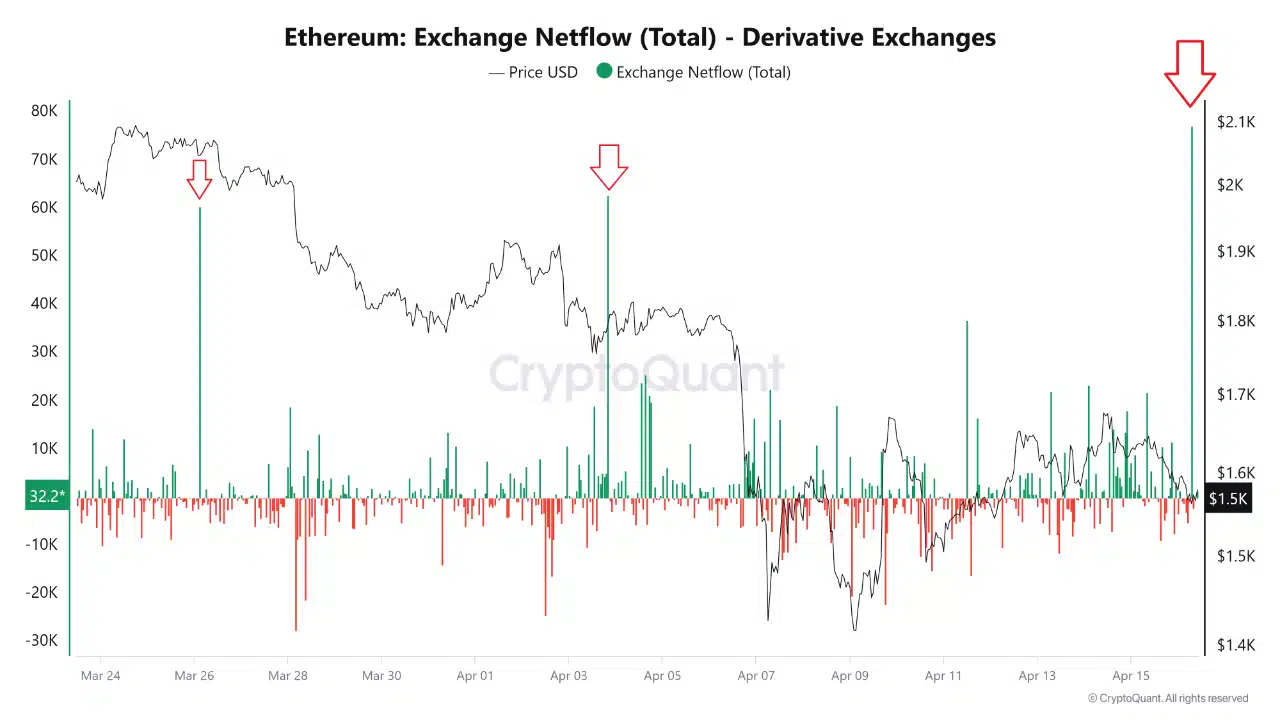

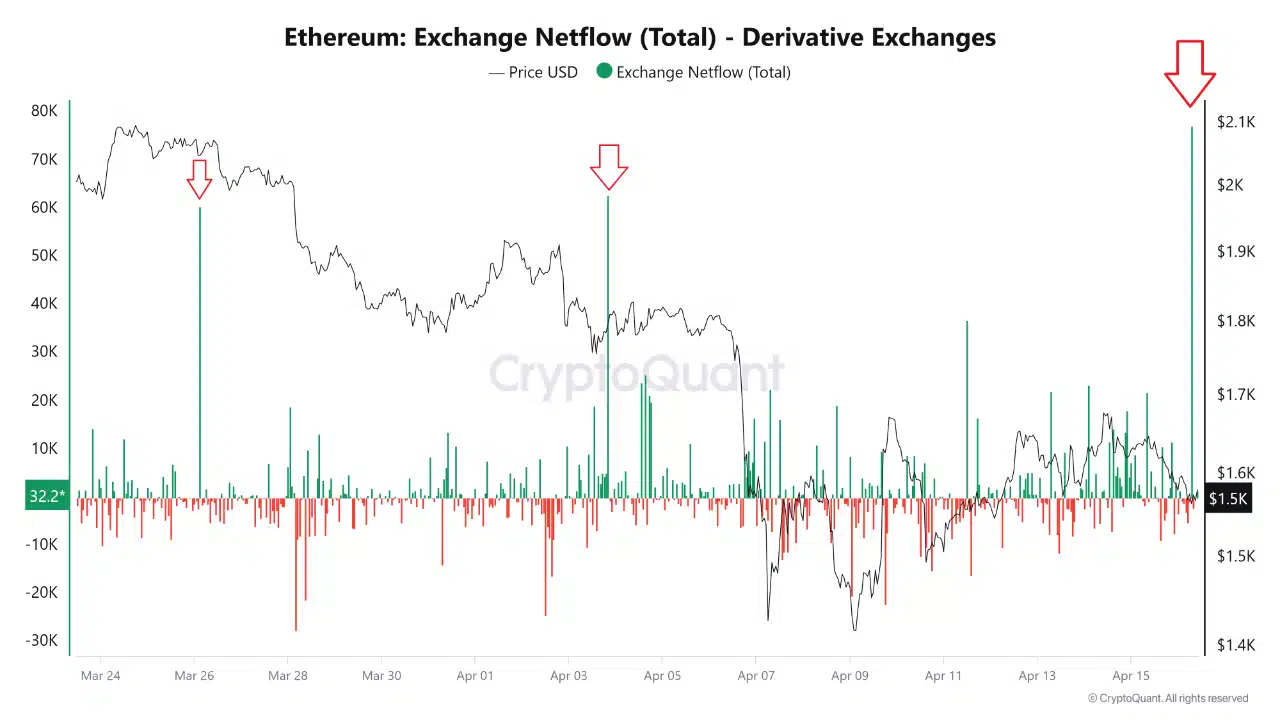

On April 16, more than 77,000 ETH were flooded in derivative exchanges – the largest net entrance in a day of Ethereum for months.

This means that the previous peaks of 65K ETH on March 26 and 60 km on April 3 resemble a change of chump.

Source: cryptocurrency

The sudden push, clearly indicated in the graph, represents a significant increase in the market entry markets generally used for leverage, coverage or speculation.

Above all, the price of Ethereum hovered around $ 1.5,000 during the influx – its lowest level since the end of 2023 – indicating that this movement is not motivated by euphoria, but probably caution.

The markets still shaken by uncertainty, such an entry scale suggests that institutional players reposition themselves – and potentially prepare for more inconvenience.

Lowering rehearsals

The last peak of Ethereum in the derivatives, Afflux reflects two previous events – March 26 and April 3 – which both preceded significant price reductions.

These entries are in correlation with the increase in lowering feeling, because the traders move the ETH to the derived platforms to open shorts or protective hedges.

The scheme is clear: important Ethics entries cause market pensions. What is different now is the scale and the context.

This week’s thrust follows the prices for reprisal from China, which have sparked a broader feeling of risk on the world markets.

If history is repeated, the ETH could see more weakness; But if the macro-conditions stabilize, this influx could mark the capitulation at the bottom, not a prelude to more pain.